Zinger Key Points

- Taiwan Semiconductor struggles with a severe workforce shortage, despite a 45% sales surge driven by AI chip demand.

- The U.S. chip industry faces a shrinking workforce, with only 1,500 engineers joining annually, risking bottlenecks for TSM.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Taiwan Semiconductor Manufacturing Co TSM is grappling with a severe workforce crisis that threatens to undermine its recent successes.

Despite a 45% surge in July sales, reaching $7.9 billion thanks to the booming demand for AI chips, the company faces significant difficulties securing the highly skilled workers needed to maintain and expand its operations, the Financial Times reports.

The U.S. chip manufacturing workforce has shrunk by 43% since its peak in 2000, and only about 1,500 engineers and 1,000 technicians join the field each year, the FT report says.

With the demand for these specialized workers expected to rise to 75,000 within the next five years, the shortage could become a significant bottleneck for Taiwan Semiconductor and the broader industry.

By 2029, the U.S. could face a shortage of up to 146,000 workers in the sector, according to FT.

Geopolitical tensions and demographic challenges further complicate this labor shortage. In Taiwan and South Korea, where most of the world's chip production occurs, declining populations and lower student enrollment in higher education exacerbate the issue.

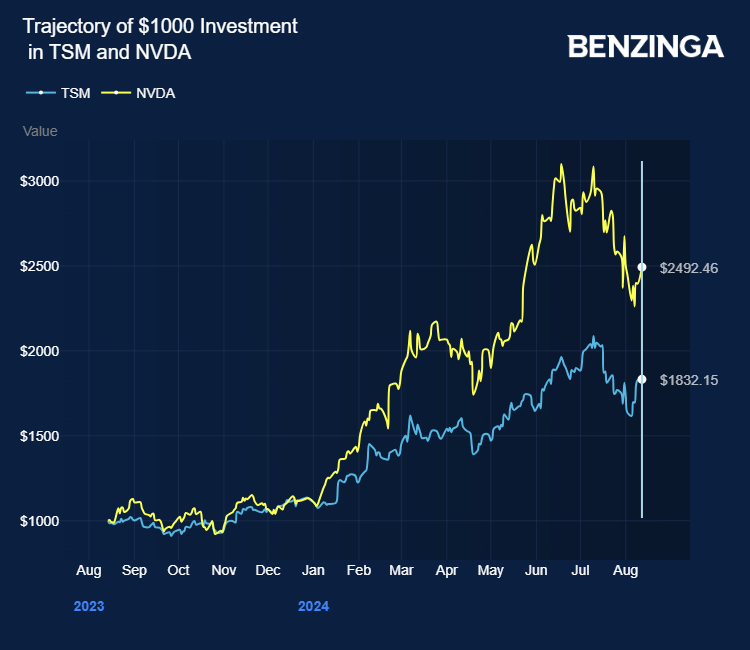

Taiwan Semiconductor, a key supplier of Nvidia Corp NVDA, has gained over 80% in the last 12 months. Investors can gain exposure to the stock through the iShares Semiconductor ETF SOXX and the First Trust NASDAQ Technology Dividend Index Fund TDIV.

Will Taiwan Semiconductor Stock Go Up?

When trying to assess whether or not Taiwan Semiconductor will trade higher from current levels, it's a good idea to take a look at analyst forecasts.

Wall Street analysts have an average 12-month price target of $207.25 on Taiwan Semiconductor. The Street high target is currently at $250.0 and the Street low target is $168.0. Of all the analysts covering Taiwan Semiconductor, 8 have positive ratings, no one has neutral ratings and no one has negative ratings.

In the last month, 3 analysts have adjusted price targets. Here's a look at recent price target changes [Analyst Ratings]. Benzinga also tracks Wall Street's most accurate analysts. Check out how analysts covering Taiwan Semiconductor have performed in recent history.

Stocks don't move in a straight line. The average stock market return is approximately 10% per year. Taiwan Semiconductor is 65.1% up year-to-date. The average analyst price target suggests the stock could have further upside ahead.

For a broad overview of everything you need to know about Taiwan Semiconductor, visit here. If you want to go above and beyond, there's no better tool to help you do just that than Benzinga Pro. Start your free trial today.

Price Action: TSM shares traded lower by 0.17% at $167.34 premarket at the last check on Tuesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Jack Hong via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.