Editor’s Note: The featured image has been updated to correctly show Charlie Munger instead of Warren Buffett.

Charlie Munger, the legendary late chairman of Berkshire Hathaway once said, “I don’t invest in what I don’t understand,” referring to Mark Zuckerberg’s Facebook. His sentiments were later shared by Robert Kiyosaki, author of “Rich Dad Poor Dad.”

What Happened: In 2012, Warren Buffett and Munger chose not to invest in the initial public offering of Meta Platforms, formerly known as Facebook, either for their Berkshire Hathaway portfolio or personally.

Buffett, speaking to CNN at Berkshire’s annual meeting in Omaha, stated, “We never buy into an offering,” adding that the notion of an IPO being the best investment among thousands of options is “mathematically impossible.”

At the same time, Munger, known for his candid approach, stated, “I don’t invest in what I don’t understand. And I don’t want to understand Facebook.” He has never joined the social media platform.

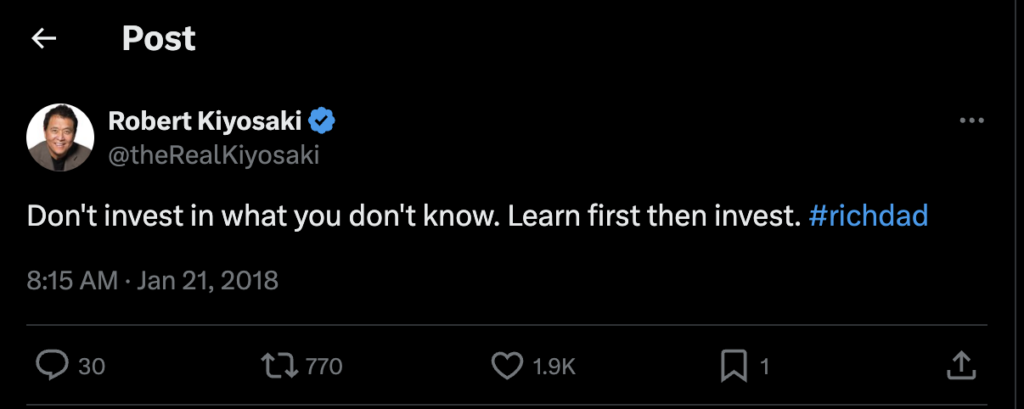

In 2021, another seasoned investor echoed Munger’s sentiments by posting it on a social media platform called Twitter, now rebranded as X. He said, “Don’t invest in what you don’t know. Learn first then invest.”

Why It Matters: In June this year, the Museum of American Finance and the Gabelli School of Business at Fordham University hosted a tribute to Munger, who passed away in November 2023.

The event highlighted Munger’s guiding principles and investment wisdom, including his famous principle, “Invert, always invert,” suggesting that complex problems can be addressed by first identifying what actions to avoid.

Munger once also noted the importance of patience and discipline in investing, saying, “It takes character to sit with all that cash and to do nothing. I didn't get to be where I am by going after mediocre opportunities.”

Zuckerberg’s Meta is currently worth $1.337 trillion, making it the seventh richest company in the world.

Image via Shutterstock

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.