Zinger Key Points

- Chinese AI developers access advanced Nvidia chips via overseas data centers, bypassing U.S. sanctions with blockchain technology.

- Chinese tech giants boosted AI spending to $7B in H1 2024, focusing on processors and infrastructure for AI models.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

Chinese artificial intelligence developers have made a breakthrough in gaining access to sophisticated advanced AI chips as U.S. semiconductor sanctions on China erode their AI ambitions.

The Chinese AI developers are acquiring advanced Nvidia Corp NVDA chips without importing them into China by leveraging computing power abroad through brokers.

The developers are resorting to cryptocurrency-world methods, like using blockchain technology for anonymity, to bypass U.S. semiconductor sanctions, the Wall Street Journal reports.

AI developers rent the computing power needed to run AI algorithms, working with overseas data centers and decentralized platforms, bypassing the cumbersome effort of importing the chips into China.

Derek Aw's company, a former Bitcoin miner, loaded over 300 servers with the chips into a data center in Brisbane, Australia, after which they began processing AI algorithms for a company in Beijing, the WSJ noted.

Joseph Tse is a former employee of a Shanghai-based AI startup that, according to WSJ, arranged for over 400 servers at a data center in California with Nvidia's H100 chips to train its AI model.

The WSJ said Edge Matrix Computing connected over 3,000 GPUs in its decentralized network, including Nvidia chips, for AI training.

Alibaba Group Holding BABA, Tencent Holding TCEHY, and Baidu Inc BIDU collectively spent 50 billion Chinese Yuan ($7 billion) on capital expenditures in the first half of this year, compared to 23 billion Chinese Yuan a year ago, focusing on processors and infrastructure for training AI models, the Financial Times reports.

Chinese tech companies are purchasing lower-performance processors like Nvidia's H20, priced between $12,000 and $13,000 each.

Previously, Alibaba Co-founder and chairman Joe Tsai stated that China trailed behind the U.S. in the AI race due to the U.S. sanctions, which also took a toll on Alibaba's cloud business.

Analysts predict Nvidia will ship over a million units of these processors to Chinese firms in the coming months.

Despite these investments, China's Big Tech capex still trails far behind that of their American counterparts, with Alphabet Inc GOOG GOOGL, Amazon.Com Inc AMZN, Meta Platforms Inc META, and Microsoft Corp MSFT spending $106 billion in the same period.

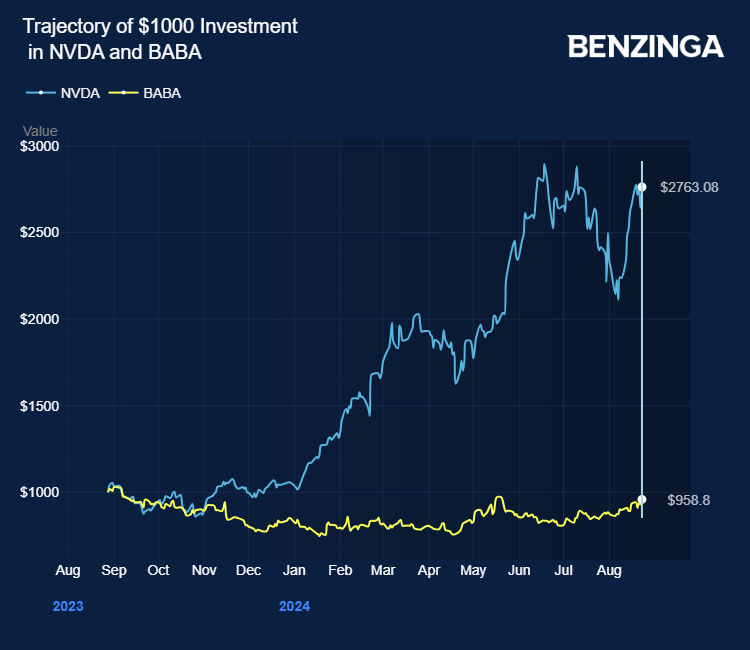

Thanks to the AI frenzy, Nvidia stock has risen over 176% in the last 12 months. Alibaba is down over 7.4% due to the weak Chinese economy, escalating domestic re-commerce rivalry, and U.S. semiconductor sanctions that have damaged the e-commerce juggernaut.

Price Actions: NVDA stock traded higher by 0.53% at $130.05 premarket at last check Monday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.