Zinger Key Points

- Nvidia's compensation packages, including stock grants, have significantly reduced employee churn.

- Nvidia's stock surge has made many employees millionaires, further boosting retention.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Nvidia Corp NVDA has succeeded in containing its employee churn rate through its compensation packages.

The chip designer is known for its demanding work environment, where employees slog up to seven days a week, with work hours stretching until 2 a.m.

CEO Jensen Huang has said he prefers to “torture them into greatness,” marking a stark contrast with his rivals keen on hiring and firing, Bloomberg reports.

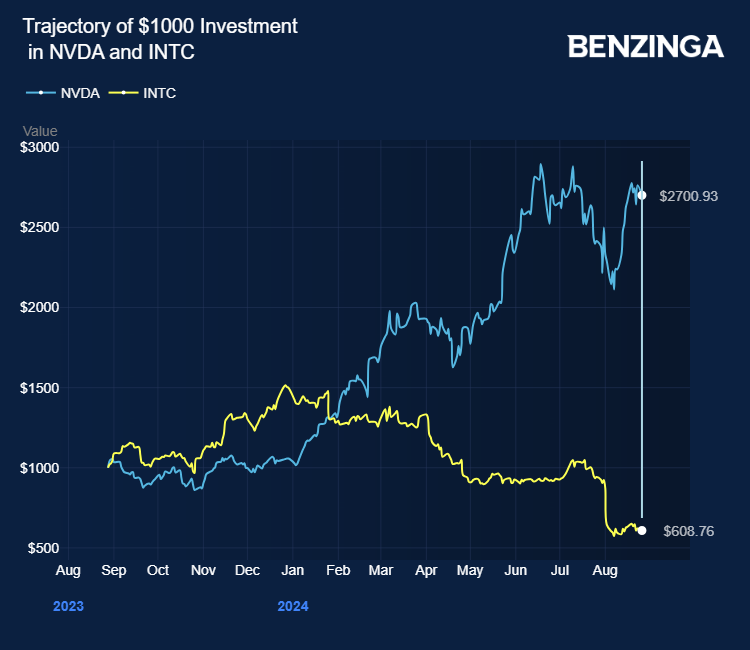

At the same time, Intel Corp INTC looks to downsize in thousands or over 15% of its workforce to accomplish a business turnaround. The company had slashed 5% of its workforce in 2023.

Also Read: Nvidia Tech Fuels Chinese AI Growth Overseas, Alibaba Ramps Up $7B Investment

Nvidia’s stock grants, which typically vest over four years, have been pivotal to its success with its employees, the New York Post reports. The stock’s 3,776% surge since 2019, courtesy of Big Tech’s splurge on their artificial intelligence ambitions, has made its employees millionaires.

Nvidia’s 2023 employee churn rate of 5.3% dipped to 2.7% after its market capitalization surpassed $1 trillion, compared to the industry average of 17.7%.

Nvidia’s artificial intelligence moat has enabled employees to indulge in luxury cars, high-end real estate, and sporting events like the Super Bowl and the NBA Finals.

According to Bloomberg, Nvidia CFO Colette Kress, who assumed office 11 years ago, owns stock valued at $758.7 million, versus Advanced Micro Devices Inc AMD CFO Jean Hu, who joined in 2023, who owns stock valued at $6.43 million.

Nvidia stock surged 170% in the last 12 months. Investors can gain exposure to the stock through Vanguard Information Tech ETF VGT and iShares S&P 500 Growth ETF IVW.

Price Actions: NVDA stock traded higher by 0.58% at $127.19 premarket at last check Tuesday.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.