Zinger Key Points

- Taiwan Semiconductor leads with 62% market share, plans price hikes on 3nm, 5nm tech.

- Taiwan Semiconductor to double CoWoS capacity by 2024, boosting AI chip production.

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Taiwan Semiconductor Manufacturing Co TSM continues to lead the global foundry market, holding a 62% share in the second quarter of 2024. Samsung Electronics SSNLF, which has a 3% market share, follows suit.

Taiwan Semiconductor’s $877 billion market cap reflects a strong demand for artificial intelligence (AI) and a robust semiconductor ecosystem.

Also Read: Taiwan Semiconductor Ramps Up Overseas Investments with $1.95B in Subsidies, Eyes Long-Term Growth

It also looks to double its production capacity for Chip on Wafer on Substrate (CoWoS) technology by 2024.

Additionally, Taiwan Semiconductor intends to raise prices for its 3-nanometer and 5-nanometer process products by up to 8%, a strategic move that could further solidify its market position and enhance profitability.

Taiwan Semiconductor clocked a second-quarter topline growth of 40.1% year-over-year, quashing the analyst consensus backed by strong demand for 3-nanometer and 5-nm technologies.

Samsung Electronics also makes strategic advancements, particularly in AI and high-performance computing (HPC) applications. The company is focusing on advancing its 2nm process to meet future technologies’ high-performance, low-power, and high-bandwidth requirements.

Intel Corp INTC announced plans to introduce 1.4nm ultra-fine processes by 2027. It clocked a second-quarter topline growth of 0.9% year-on-year, trailing the analyst estimate. It shared plans to downsize its workforce by over 15%.

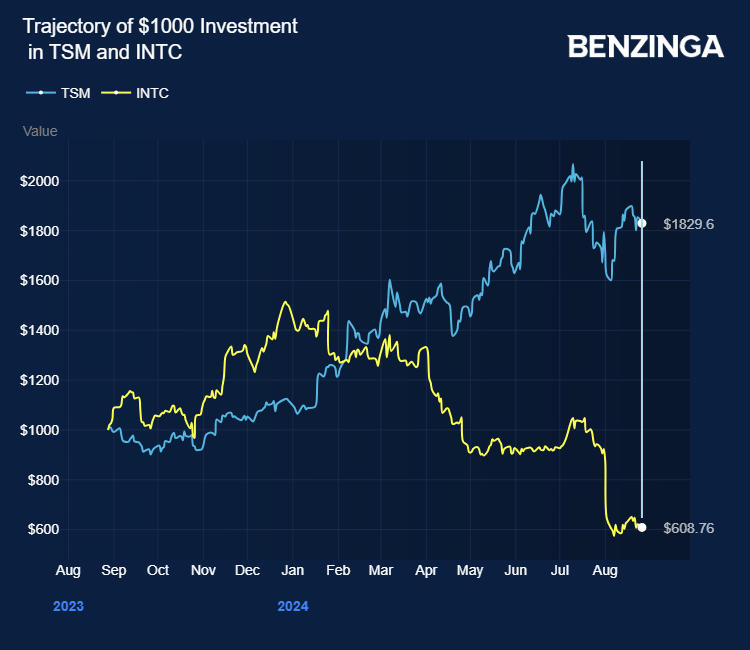

Taiwan Semiconductor stock gained 80% in the last 12 months. Intel plunged over 40%.

Investors can gain exposure to the semiconductor sector through SPDR S&P Semiconductor ETF XSD and ProShares Ultra Semiconductors USD.

Price Action: TSM stock traded lower by 0.81% at $167.70 premarket at the last check Tuesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Jack Hong via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.