Zinger Key Points

- B. Riley Financial shares rise 9.20% after announcing the sale negotiation of a 53% stake in Great American Group at a $380 million.

- Company anticipates $410 million in gross cash proceeds from these two transactions.

- Learn how to trade volatility during Q1 earnings season, live with Matt Maley on Wednesday, April 2 at 6 PM ET. Register for free now.

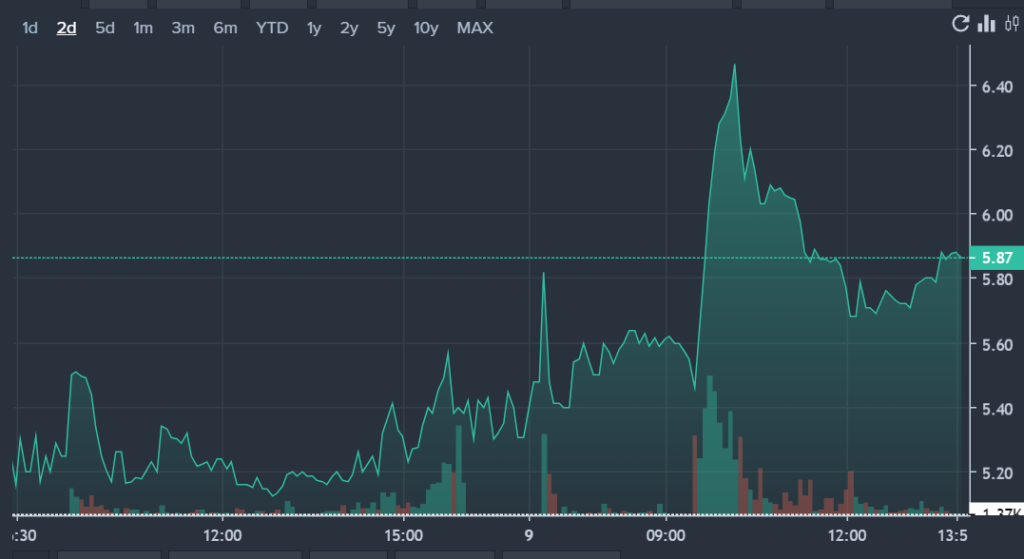

B. Riley Financial RILY shares rose on Monday after the company announced strategic and financing initiatives. Initiaves included negotiating a sale of a majority stake in its Great American Group at a $380 million enterprise value, alongside a $236 million debt financing plan for its brands portfolio.

What To Know: These moves are expected to yield around $410 million in gross cash proceeds, which the company plans to use to reduce its senior secured debt to approximately $125 million by the end of 2024.

Key Initiatives:

- Sale of Majority Stake: B. Riley is negotiating the sale of a 53% stake in its Great American Group business, valued at approximately $380 million.

- Debt Financing Initiative: The company has entered into a non-binding agreement for $236 million in debt financing for its brands portfolio, using the funds to pay down its senior secured debt.

- Debt Repayment: B. Riley intends to use the proceeds to reduce debt, aiming to lower its Nomura Senior Secured Credit Agreement to $125 million by the end of 2024.

- Balance Sheet Strengthening: The cumulative transactions are expected to enhance the company's financial position, allowing for better investment in its core businesses.

Price Action: As of now, B. Riley shares have surged by 11.1%, with the price rising to $5.97 according to Benzinga pro.

See Also:

Image: Shutterstock/ solarseven.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.