Zinger Key Points

- BofA analyst maintains Buy rating on Amazon, sets price target at $210.

- AWS and Oracle partnership enhances database access, fueling growth opportunities.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-Day free trial now.

BofA Securities analyst Justin Post maintained a Buy rating on Amazon.Com Inc AMZN with a price target of $210.

The re-rating followed Oracle Corp ORCL and Amazon Web Services’ new partnership, which connects Oracle’s Autonomous Database & Exadata Database and AWS applications.

AWS customers would benefit from more seamless access to their data, simplified database administration, billing, and unified customer support, Post noted.

Also Read: Amazon Targets Walmart’s Grocery Market with Expanded Prime Discounts

Post said that Oracle and Amazon were competitive with database customers. Hence, the new partnership suggests that cloud providers have a sizable opportunity to unlock demand for infrastructure and applications using data housed within Oracle’s databases.

According to Oracle, partnerships with leading Cloud providers are already driving growth. AWS CEO Matt Garman also spoke at an investor conference, outlining optimism for artificial intelligence demand and AWS’ differentiated infrastructure.

Despite concerns about AI-related disruption to AWS’ strong Cloud industry position, Post said the CEO commentary suggests optimism on AI-related demand and differentiated AWS AI infrastructure to drive client wins.

Also, Amazon is walking a fine line between promoting its cost-efficient infrastructure and featuring Nvidia Corp’s NVDA strong GPU capabilities. Still, he flagged customer choice as a differentiated and compelling offering.

The price target reflects Post’s Sum Of The Parts (SOTP) analysis, which values the 1P retail business at 1.2 times 2025E Revenue (including subscription and Prime membership fees), the 3P retail business at 3.0 times 2025E Revenue, AWS at 8.0 times 2025 Sales, and the advertising business at 5.0 times 2025 Sales.

For 2025E, Post’s 8.0 times AWS multiple is relatively below the analyst’s SaaS comps at 8.5 times, his 1.2 times GMV multiple is a discount to his retail comps at 1.3 times, and his 5.0 times advertising multiple is a discount to his digital advertising comps at 5.2 times, which are warranted given growth rates in excess of peers.

Oracle Stock Prediction For 2024

Equity research analysts on and off Wall Street typically use earnings growth and fundamental research as a form of valuation and forecasting. But many in trading turn to technical analysis as a way to form predictive models for share price trajectory.

Some investors look to trends to help forecast where they believe a stock could trade at a certain point in the future. Looking at Oracle, an investor could make an assessment about a stock's long term prospects using a moving average and trend line. If they believe a stock will remain above the moving average, which many believe is a bullish signal, they can extrapolate that trend into the future using a trend line. For Oracle, the 200-day moving average sits at $123.04, according to Benzinga Pro, which is below the current price of $156.09. For more on charts and trend lines, see a description here.

Traders believe that when a stock is above its moving average, it is a generally bullish signal, and when it crosses below, it is a more negative signal. Investors could use trend lines to make an educated guess about where a stock could trade at a later date if conditions remain stable.

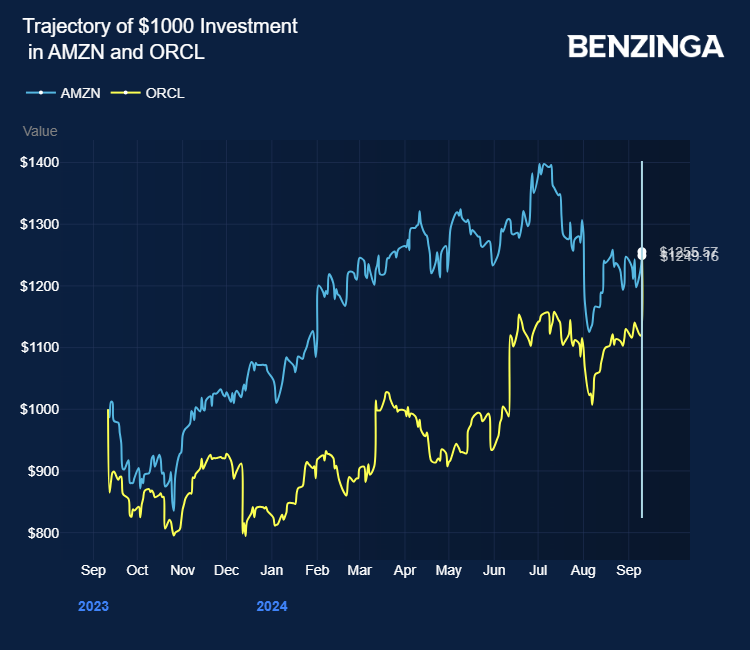

Price Action: AMZN stock is up 2.54% at $179.86 at the last check on Tuesday.

Photo via Company

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.