Zinger Key Points

- Mobileye Global stock rises after Intel confirms it will retain its majority stake, easing previous divestment concerns.

- Mobileye faces challenges with weak China demand and lowered 2024 revenue guidance, but stock is up 7.67% premarket.

- Wall Street veteran Chris Capre is going live April 9 at 6 PM ET to reveal a short-term strategy that just returned 195%—in the middle of a crashing market.

Mobileye Global Inc MBLY stock was trading higher Thursday after Intel Corp INTC said it does not plan to divest its majority interest in the company. U.S. Fed rate cut also had a bearing on the stock price movement.

Intel made the statement after winning a multi-year, multi-billion-dollar U.S. chipmaking deal from existing customer Amazon.com Inc AMZN cloud unit and U.S. semiconductor grant.

Intel also won up to $3 billion in CHIPS and Science Act funding, in addition to the $8.5 billion in grants and $11 billion in loans the struggling chipmaker previously won under the act.

Also Read: Intel Missed Out on PlayStation 6 Chip Deal to AMD: Report

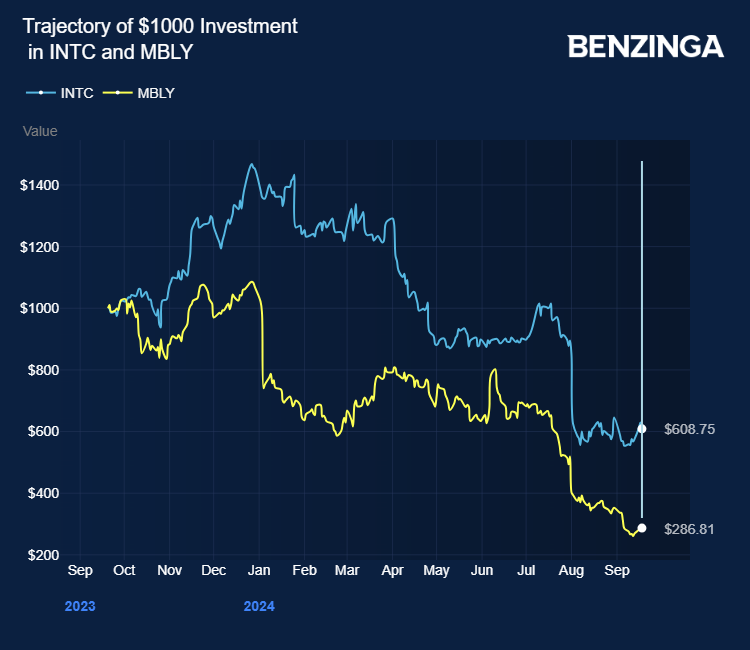

Intel stock is down 43% in the last 12 months as its foundry unit failed to capitalize on the AI shift.

Prior reports indicated Intel’s plans to divest up to 88% of its stake in the Israeli autonomous driving company.

Mobileye Global stock is down 70% in the last 12 months as it slashed revenue guidance after posting a topline decline in the second quarter. The company also flagged impending challenges due to China's weak demand.

It expects fiscal 2024 revenue of $1.60 billion–$1.68 billion below the $1.87 billion analyst estimate.

Price Action: MBLY stock is up 14.4% at $13.28 at last check Thursday.

Also Read:

Photo courtesy of Mobileye.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.