Zinger Key Points

- Boeing faces over $1 billion in monthly losses from a prolonged labor strike.

- FAA oversight report highlights production quality and safety concerns with Boeing's 737 and 787 models.

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

Boeing Company BA shares are trading higher today. Here’s what you need to know.

What To Know: A report from the U.S. Transportation Department's Office of Inspector General raised serious concerns about the FAA's oversight of Boeing's production processes. The report, commissioned by Congress, highlighted that the FAA's monitoring of Boeing's manufacturing, particularly for the 737 and 787 models, is ineffective and often reactive rather than proactive. The Office of Inspector General criticized the FAA for failing to implement a more data-driven oversight approach and pointed out unresolved safety issues. It also raised concerns about Boeing employees acting on behalf of the FAA in certain cases.

Following a fuselage panel incident on a 737 Max aircraft in January 2024, Boeing addressed safety concerns and revamped its manufacturing processes. These include internal safety reforms and new leadership, with a new CEO taking over to rebuild trust with regulators and the public. The report provided 16 recommendations for improving Boeing's compliance with FAA standards, which are set to be implemented between 2025 and 2028.

Senator Tammy Duckworth, chair of the Senate’s aviation safety subcommittee, criticized the FAA for not holding Boeing accountable and emphasized the need for stronger oversight. She pledged continued Congressional monitoring to ensure that Boeing and the FAA prioritize public safety.

Meanwhile, Boeing faces additional challenges with a four-week strike by the International Association of Machinists and Aerospace Workers, which has halted production at key facilities. The strike, involving about 33,000 workers, is expected to cost the company over $1 billion per month. Boeing has filed an unfair labor practice charge against the union, accusing it of bad faith bargaining, while the union claims Boeing is unwilling to negotiate on key issues related to wages and working conditions. The conflict remains unresolved.

Financial Metrics: The company reported a net income loss of $1.439 billion for the year, with loss EPS of $2.33. Despite revenue growth of 16.79%, Boeing continues to operate at a loss and its EBITDA margin stands at -2.40%, indicating ongoing operational difficulties. Boeing’s long-term debt is substantial at $53.162 billion and the company's enterprise value is $135.657 billion.

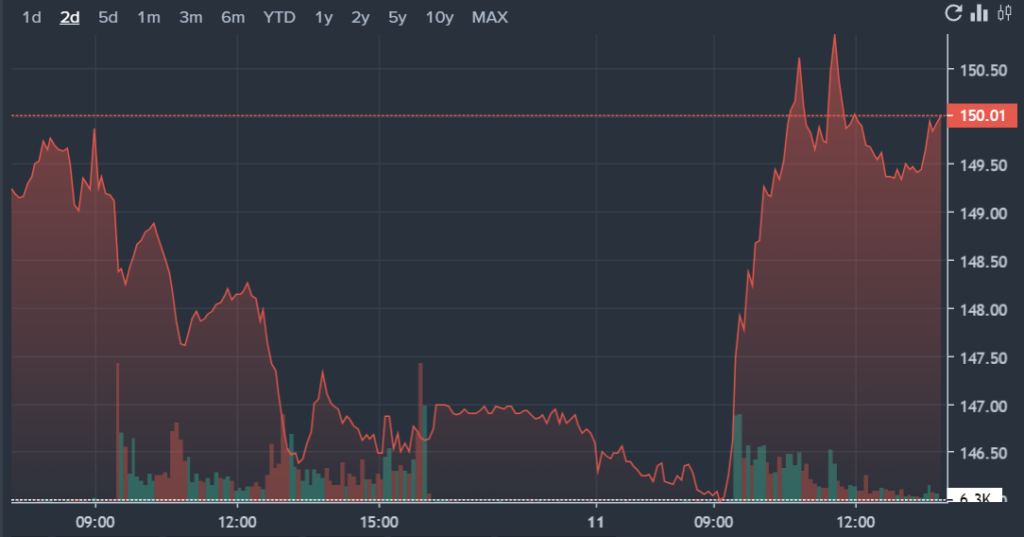

BA Price Action: Boeing shares were up by 2.35% at $150.04 at the time of writing, according to Benzinga Pro.

See Also:

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.