Zinger Key Points

- Nvidia takes a 3.6% stake in Applied Digital, boosting market confidence.

- Revenue jumped to $60.7 million, driven by Cloud Services gains after launch last fiscal year.

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

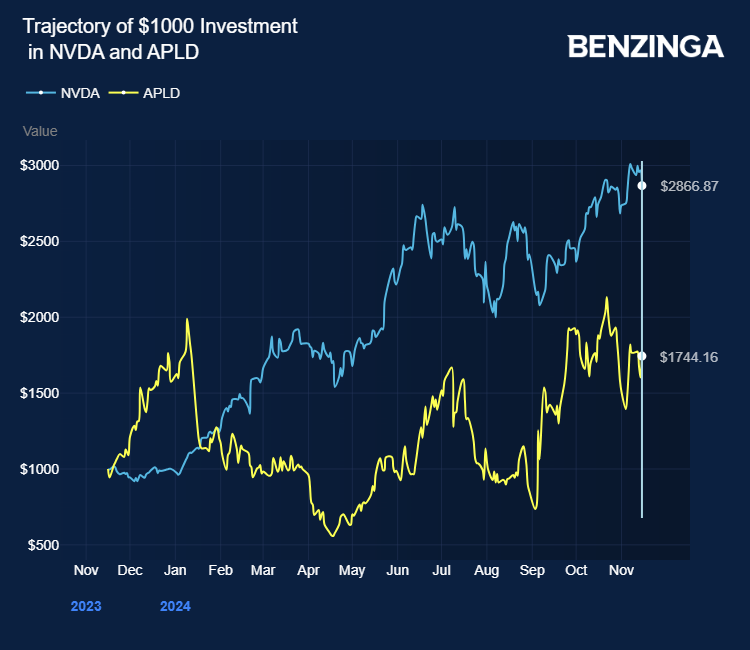

Applied Digital Corp APLD stock is trading higher Friday as Nvidia Corp NVDA gained exposure to the stock.

Nvidia’s 13F fling shows it purchased 7.72 million Applied Digital shares worth $63.66 million as of September 30, 2024, which translates into close to a 3.6% stake in Applied Digital, which had 215.36 million outstanding shares as of October 8, 2024,

Applied Digital, a U.S. company, delivers cutting-edge digital infrastructure tailored for high-performance computing and AI applications.

Also Read: Salesforce Loses AI Chief Amid Major Push for Autonomous Agents

Applied Digital reported a first-quarter EPS loss of 15 cents, outperforming the analyst loss estimate of 29 cents. Revenue for the quarter reached $60.7 million, surpassing the expected $54.85 million.

The company attributed the revenue boost to recognizing income from its Cloud Services segment following the launch of the service at the end of the prior fiscal year.

Applied Digital had secured $160 million in September through a private placement involving institutional and accredited investors, including Nvidia.

Applied Digital planned to allocate the proceeds toward expanding its data centers and developing AI cloud infrastructure, strengthening its position in the AI and high-performance computing (HPC) markets.

The company is advancing a large-scale data center project in North Dakota while scaling up its cloud-computing operations.

Also, on November 4, Applied Digital completed raising $450 million via an upsized private convertible notes offering to fund share repurchases of the company’s common stock.

The filing shows Nvidia retained its stake in Arm Holdings Plc ARM, Nano-X Imaging Ltd NNOX, Recursion Pharmaceuticals, Inc RXRX, Serve Robotics Inc SERV and SoundHound AI, Inc SOUN.

As of September 30, 2024, the U.S. chip designer held 1.96 million Arm shares worth $280.41 million, 0.06 million shares of Nano-X Imaging worth $0.36 million, 7.71 million Recursion Pharmaceuticals shares worth $50.78 million, 3.73 million Serve Robotics shares worth $29.63 million, and 1.73 million SoundHound AI shares worth $8.07 million.

Oppenheimer’s Rick Schafer reaffirmed his Outperform rating for Nvidia, raising the price target from $150 to $175.

He maintains a bullish long-term outlook, emphasizing Nvidia’s leadership in AI hardware, robust margins, and strong data center ecosystem as key growth drivers.

Schafer expects Nvidia’s third-quarter results and January guidance to surpass estimates due to strong demand for AI products from cloud providers and enterprise clients.

He revised his projections upward, driven by high traction for Hopper AI accelerators and the initial ramp-up of Nvidia’s Blackwell chips in the fourth quarter.

Schafer forecasts Blackwell to generate several billion dollars in revenue in the January quarter despite supply constraints from CoWoS-L capacity.

Price Actions: At last check on Friday, APLD stock was up 7.73% at $7.39. NVDA stock is down 3.24%.

Also Read:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.