Today, October 26, 2023, marks an important moment for investors of Wabash National WNC. The company will distribute a dividend payout of $0.08 per share, demonstrating an annualized dividend yield of 1.44%. Remember, only shareholders prior to the ex-dividend date on October 04, 2023 are eligible for this payout.

Wabash National Recent Dividend Payouts

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2023-10-04 | 4 | $0.08 | 1.44% | 2023-08-17 | 2023-10-05 | 2023-10-26 |

| 2023-07-05 | 4 | $0.08 | 1.32% | 2023-05-11 | 2023-07-06 | 2023-07-27 |

| 2023-04-05 | 4 | $0.08 | 1.12% | 2023-02-16 | 2023-04-06 | 2023-04-27 |

| 2023-01-04 | 4 | $0.08 | 1.29% | 2022-11-18 | 2023-01-05 | 2023-01-26 |

| 2022-10-05 | 4 | $0.08 | 1.7% | 2022-08-17 | 2022-10-06 | 2022-10-27 |

| 2022-07-06 | 4 | $0.08 | 2.23% | 2022-05-13 | 2022-07-07 | 2022-07-28 |

| 2022-04-06 | 4 | $0.08 | 1.89% | 2022-02-21 | 2022-04-07 | 2022-04-28 |

| 2022-01-05 | 4 | $0.08 | 1.73% | 2021-11-18 | 2022-01-06 | 2022-01-27 |

| 2021-10-06 | 4 | $0.08 | 2.14% | 2021-08-18 | 2021-10-07 | 2021-10-28 |

| 2021-07-07 | 4 | $0.08 | 1.86% | 2021-05-12 | 2021-07-08 | 2021-07-29 |

| 2021-04-07 | 4 | $0.08 | 1.85% | 2021-02-18 | 2021-04-08 | 2021-04-29 |

| 2021-01-06 | 4 | $0.08 | 1.84% | 2020-11-19 | 2021-01-07 | 2021-01-28 |

With a dividend yield that places it neither at the top nor the bottom, Wabash National finds itself in the middle among its industry peers, while Trinity Industries TRN boasts the highest annualized dividend yield at 5.17%.

Analyzing Wabash National Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

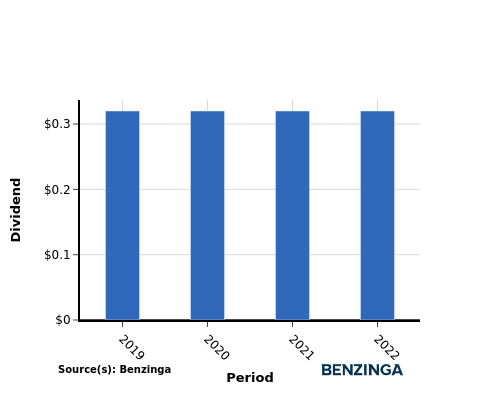

YoY Growth in Dividend Per Share

The company has consistently maintained a dividend per share of $0.32 from 2019 to 2022. This unwavering dividend policy instills confidence in investors, as they can rely on a consistent income stream from the company's dividends.

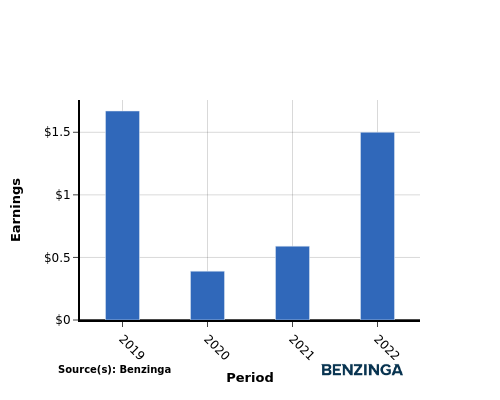

YoY Earnings Growth For Wabash National

The earnings chart highlights a decrease in Wabash National's earnings per share, declining from $1.67 in 2019 to $1.50 in 2022. This decline in earnings raises a red flag for income-seeking investors, as it suggests a potential decrease in the company's ability to generate cash for dividend payouts. It is essential to closely examine the factors behind this decrease and assess the long-term impact on dividend sustainability.

Recap

This article provides an in-depth analysis of Wabash National's recent dividend distribution and the impact it has on shareholders. The company is currently distributing a dividend of $0.08 per share, resulting in an annualized dividend yield of 1.44%.

With a dividend yield that places it neither at the top nor the bottom, Wabash National finds itself in the middle among its industry peers, while Trinity Industries boasts the highest annualized dividend yield at 5.17%.

Despite maintaining an unchanged dividend per share from 2019 to 2022, the decrease in earnings per share for Wabash National suggests a need for caution in the company's financial standing, potentially impacting the distribution of profits to investors.

It is essential for investors to closely track the company's performance in the coming quarters to remain updated regarding any alterations in financials or dividend disbursements.

[Monitor live stock price updates for Wabash National on Benzinga.](https://www.benzinga.com/quote/Wabash National (NYSE: WNC))

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.