As the day concludes, Vornado Realty VNO is preparing to distribute a dividend payout of $0.30 per share, resulting in an annualized dividend yield of 4.32%. This payout is exclusive to investors who held the stock before the ex-dividend date on December 14, 2023.

Vornado Realty Recent Dividend Payouts

| Ex-Date | Payments per year | Dividend | Yield | Announced | Record | Payable |

|---|---|---|---|---|---|---|

| 2023-12-14 | 4 | $0.3 | 4.32% | 2023-12-05 | 2023-12-15 | 2023-12-27 |

| 2023-01-27 | 4 | $0.38 | 6.44% | 2023-01-18 | 2023-01-30 | 2023-02-10 |

| 2022-11-04 | 4 | $0.53 | 9.07% | 2022-10-27 | 2022-11-07 | 2022-11-18 |

| 2022-08-05 | 4 | $0.53 | 7.24% | 2022-07-28 | 2022-08-08 | 2022-08-19 |

| 2022-05-06 | 4 | $0.53 | 5.2% | 2022-04-27 | 2022-05-09 | 2022-05-20 |

| 2022-01-28 | 4 | $0.53 | 4.68% | 2022-01-19 | 2022-01-31 | 2022-02-11 |

| 2021-11-05 | 4 | $0.53 | 4.94% | 2021-10-28 | 2021-11-08 | 2021-11-19 |

| 2021-08-06 | 4 | $0.53 | 4.8% | 2021-07-29 | 2021-08-09 | 2021-08-20 |

| 2021-05-07 | 4 | $0.53 | 4.62% | 2021-04-28 | 2021-05-10 | 2021-05-21 |

| 2021-01-29 | 4 | $0.53 | 5.62% | 2021-01-20 | 2021-02-01 | 2021-02-12 |

| 2020-11-06 | 4 | $0.53 | 6.98% | 2020-10-29 | 2020-11-09 | 2020-11-20 |

| 2020-08-07 | 4 | $0.53 | 5.85% | 2020-07-30 | 2020-08-10 | 2020-08-21 |

Vornado Realty's dividend yield falls in the middle range when compared to its industry peers, with Office Props IT OPI having the highest annualized dividend yield at 18.08%.

Analyzing Vornado Realty Financial Health

Companies that pay out steady cash dividends are attractive to income-seeking investors, and companies that are financially healthy tend to maintain their dividend payout schedule. For this reason, investors can find it insightful to see if a company has been increasing or decreasing their dividend payout schedule and if their earnings are growing.

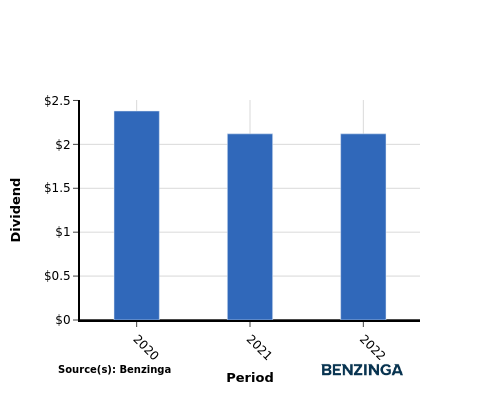

YoY Growth in Dividend Per Share

From 2020 to 2022, there was a decline in the company's dividend per share, dropping from $2.38 in 2020 to $2.12 in 2022. This negative trend suggests a reduction in the company's dividend distribution, which requires careful investigation to identify the underlying causes.

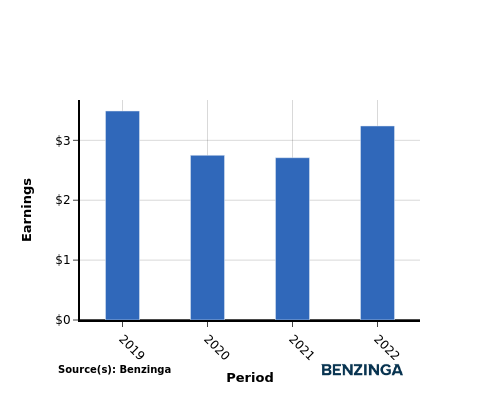

YoY Earnings Growth For Vornado Realty

The earnings chart above reveals a decrease in Vornado Realty's earnings per share, declining from $3.49 in 2020 to $3.24 in 2022. This could raise concerns for income-seeking investors, as it suggests a decline in the company's profitability. It is crucial to closely monitor the situation and assess the factors contributing to this decrease, as it may have implications for future cash dividend payouts.

Recap

This article delves into the recent dividend payout of Vornado Realty and its implications for shareholders. Presently, the company is distributing a dividend of $0.30 per share, leading to an annualized dividend yield of 4.32%.

Vornado Realty's dividend yield falls in the middle range when compared to its industry peers, with Office Props IT having the highest annualized dividend yield at 18.08%.

The decline in dividend per share and earnings per share for Vornado Realty from 2020 to 2022 could signify a challenging financial situation, requiring careful consideration in terms of future profit distributions to shareholders.

Investors are advised to closely monitor the company's performance in the upcoming quarters to stay informed about any fluctuations in financials or dividend disbursements.

[Track real-time stock fluctuations for Vornado Realty on Benzinga.](https://www.benzinga.com/quote/Vornado Realty (NYSE: VNO))

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.