The drive-in restaurant chain, Sonic (SONC), reports its FQ3 '15 results after the market close today and both Estimize and Wall Street are predicting a good result. SONC shares rallied on high volume on Friday, rising 2.24%. Year-to-date (YTD) the stock has put on 22.51% compared to the S&P 500 which has only increased 2.48%.

Sonic's revenue growth has been exciting investors recently, helping the stock move higher. The gains in revenues are trickling down to the bottom line and ultimately increasing earnings. Unlike competitors like McDonald's, which plans to close more stores than it opens this year, Sonic has demonstrated resilience and will open between 34-44 stores in 2015. The company reported second quarter same-store sales of 11.5% in March.

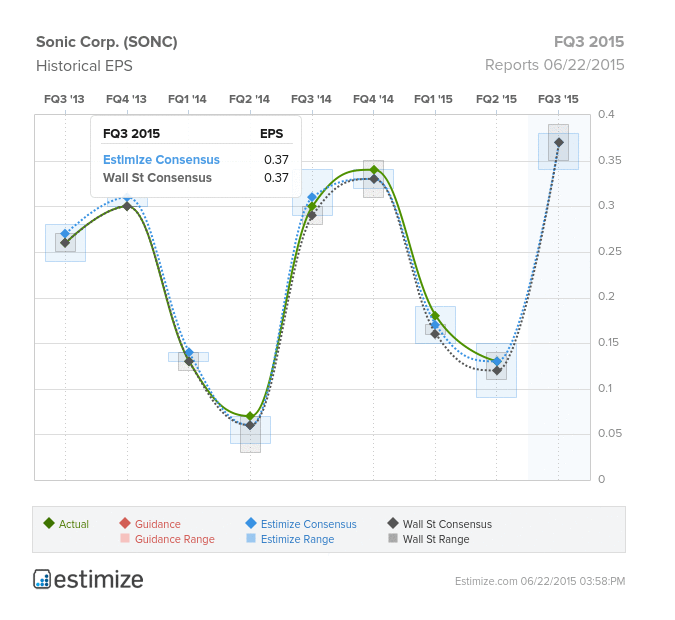

Estimize and Wall Street predict an EPS figure of $0.37. The Estimize community, however, is looking for slightly higher revenues of $163.66M compared to Wall Street's $163.36M.

Despite negative commentary surrounding the health implications of Sonic's menu, the company continues to deliver strong growth rates. If Sonic reports an EPS figure of $0.37 this afternoon, it will mean Sonic's YoY earnings will have experienced a significant 23% rise. Despite having a strong gross profit margin around 36.91%, SONC's net profit margin is only 6.07% which is below the industry average. However, as the firm continues to focus on innovation and growth, profit margins may experience some positive tailwinds moving forward.

Currently trading on a PE Ratio (TTM) of 34.76X relative to its five year historical average of 26.79X. SONC's continued success relies heavily on the next twelve months. Investors will want to see continued growth in revenues and EPS and also a positive outlook from management.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.