Walt Disney Co DIS is reported fiscal fourth-quarter earnings after Thursday's close.

Benzinga took a look back at Disney’s last six fourth-quarter earnings reports to look for any potential patterns in how the stock reacts.

- Q4 2017: shares gained 2 percent the day following the report

- Q4 2016: up 2.8 percent

- Q4 2015: up 2.3 percent

- Q4 2014: down 2.1 percent

- Q4 2013: up 2.1 percent

- Q4 2012: down 5.9 percent

Related Link: Disney Shares Rise After Big Q4 Earnings, Sales Beat

While most initial fourth-quarter earnings reactions have been relatively modest, Disney does have several instances of large earnings moves following other quarterly earnings reports. The stock dropped 9.1 percent following its Q3 2015 earnings report after gaining 7.6 percent following its Q1 earnings report earlier that year.

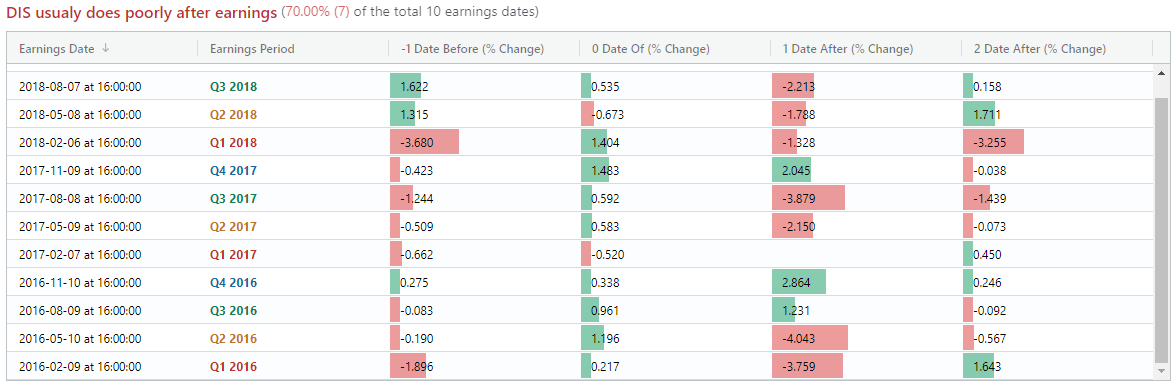

The chart below shows how Disney stock has reacted to its past three years of earnings reports:

Here are some potential takeaways from the information outlined above:

- Disney tends to have relatively modest earnings reactions of less than 4 percent.

- Disney stock has reacted mostly negatively to earnings reports, trading lower the following day more than 80 percent of the time.

- Disney hasn’t had a positive reaction to earnings at all so far in 2018.

- Disney stock has averaged a one-day move of +/- 2.5 percent.

According to Optionslam.com, Disney’s seven-day implied movement based on the weekly options market is 4.3 percent.

Disney's stock closed Wednesday at $117.05 per share. The stock is up 8.6 percent year-to-date.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.