Market volatility doesn’t appear to be taking any time off for the holidays.

A day after the Dow Jones Industrial Average ($DJI) posted its largest ever single day points gain, the market appears poised to head in the opposite direction.

The up and down is perhaps not that surprising given that many market participants may be out of their offices during the traditional holiday period between Christmas and the new year. Light volume can exaggerate market moves up or down. On Wednesday, volume was substantially lighter than average for the broad market represented by the S&P 500 (SPX). (The $DJI saw heavier than average volume while the Nasdaq Composite’s (COMP) lighter volume was less marked than that of the SPX.)

While yesterday’s rally may have taken stocks into overbought territory, from a short-term standpoint anyway, it’s also possible that certain underlying worries that haven’t gone away are capping the market’s attempt at a Santa Claus rally. In addition to market volatility, investors may also be worried as the partial U.S. government shutdown continues, European political risk still looms, and trade issues between the U.S. and China haven’t been settled.

A Reuters report saying that the Trump administration is considering banning U.S. companies from purchasing telecommunications equipment from Chinese firms Huawei and ZTE added to the tension between the world’s two largest economies. Meanwhile, data on China’s industrial sector showed profits declined for the first time since late 2015, apparently casting more doubt on global economic growth.

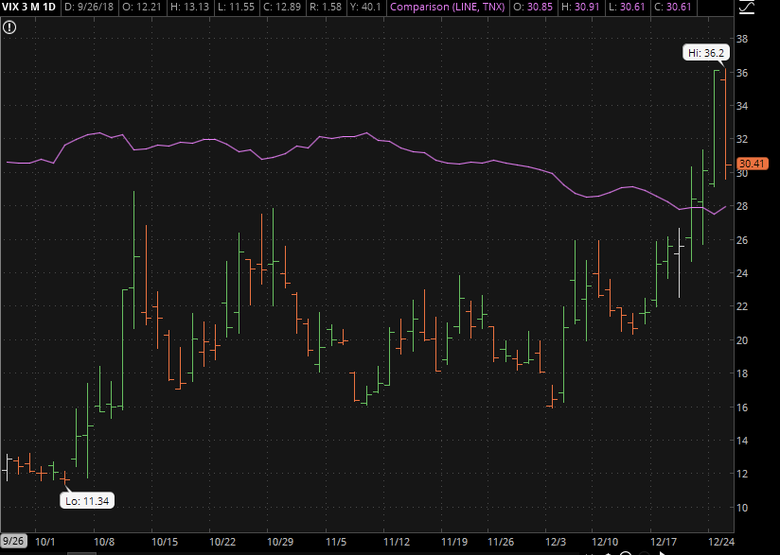

Although Wall Street’s main fear gauge, the Cboe Volatility Index (VIX), fell sharply Wednesday, it still remained above 30 for much of the day, indicating that market participants continued to be uneasy. And, while government debt yields rose on Wednesday, they were up from low levels. The 10-year Treasury remained well below the key 3% level as market participants had likely been buying Treasuries as a perceived safe haven investment recently (although no investment is completely safe.) (See chart below).

Retailers Lead Wednesday Rally

All three major U.S. indices jumped sharply on Wednesday, the first trading day after the worst Christmas Eve session on record. The $DJI posted its best-ever session for points gained, while the SPX and COMP put in their strongest performances since March 2009.

But remember: Prior to Wednesday’s sharp rally, the SPX had fallen 15% in the month of December. In other words, as sharp as the rally may have been, it would take several of them to get the stock market back to where it was on Thanksgiving.

Even as some people on Main Street may have been heading out to the mall to burn off some of that holiday roast, consumer discretionary stocks were the biggest gainers on Wall Street. The sector rose more than 6%, led by Kohl’s Corporation KSS and Amazon.com, Inc. AMZN in percentage terms.

Gains for the sector seem to have been helped on news that holiday sales increased 5.1 percent year over year to more than $850 billion this year. The data came from Mastercard SpendingPulse in a press release aptly datelined Purchase, New York. This year marked the strongest growth over the last six years, Mastercard MA said, adding that online shopping posted a gain of 19.1 percent over 2017. (See more below.)

Speaking of online sales, AMZN finished higher after the internet retailing giant said Wednesday it had a record holiday season as customers ordered more items worldwide than ever before.

The upbeat news from the retail sector shows that the consumer, which accounts for a huge chunk of the U.S. economy, is healthy and optimistic enough to get out and spend–or stay at the keyboard and spend–despite the volatility that the stock market has seen in November and December.

Energy Sector a Close Runner Up

Meanwhile, the energy sector was only slightly behind the consumer discretionary sector, also posting a gain of more than 6% as oil prices climbed sharply. The rally in oil prices, and in stocks for that matter, could be due in part to a bounce from oversold conditions, with market participants wanting to buy the dip.

It also seems like Wednesday’s increased appetite for riskier assets helped oil. And it could be that oil traders and investors are feeling more optimistic about global demand for black gold, taking their cue from stronger sentiment in the equities market.

Still, the oil market is coming off a year of high supply, and we’ll have to see if economic conditions are favorable enough to help soak up a sufficient amount of that supply to move oil prices meaningfully higher. Crude prices were down in early Thursday trading.

Risk Indicators: The VIX, shown as a bar chart, has come down from recent highs, and Treasury yields, as represented by a purple line showing the 10-year Treasury Index, have risen. But, overall, volatility has remained high as investor sentiment has generally been risk-off. Data Source: Cboe Global Markets. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Consumer Discretion: With the consumer discretionary sector the best performer on Wednesday amid bullish news on holiday spending, it could be interesting to delve a little deeper into Mastercard’s Wednesday report detailing retail spending from Nov. 1 through Christmas Eve. Despite pockets of poor weather including a cold Black Friday morning on the East Coast, total apparel sales grew at the fastest rate since 2010, notching a gain of 7.9% over 2017, according to the report. Meanwhile, consumers continued to spend on home improvements, pushing holiday sales in that category up 9%. Home furniture and furnishings sales grew 2.3%. Perhaps unsurprisingly, given the closings at brick-and-mortar stores and competition from internet sales, holiday spending at department stores fell 1.3 percent. This segment isn’t taking the competition from the internet lying down, though, as online sales for department stores grew 10.2%. However, holiday retail sales of electronics and appliances fell 0.7%.

A Cure for High Prices: There’s an old adage that high prices cure high prices. That may be happening in the housing market, which has been facing an affordability crunch amid rising mortgage rates. On Wednesday, the latest S&P CoreLogic Case-Shiller 20-city composite home price index showed a year-over-year gain of 5%, which was in line with expectations and down from the prior month’s annual rate of 5.2%. Apparently, declining demand could be causing housing price growth to moderate a bit. Also, mortgage rates have come down recently, but they still remain higher than they were a couple years ago. “The combination of higher mortgage rates and higher home prices rising faster than incomes and wages means fewer people can afford to buy a house,” said David Blitzer, managing director and chairman of the index committee at S&P Dow Jones Indices. “Reduced affordability is slowing sales of both new and existing single-family homes.”

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.