Twitter Inc TWTR shares made a strong comeback in 2018, ending the year with nearly a 20-percent advance and outperforming social media peers.

The short-messaging platform has built on the gains with a 14.4-percent advance in the first quarter of 2019. That's smaller than Facebook, Inc. FB's 27.16-percent jump and Snapchat parent Snap Inc SNAP's 100-percent rally.

How has Twitter fared fundamentally in the just-finished first quarter?

Twitter is due to release its fiscal first-quarter results Tuesday, April 23 before the market open.

Q1 Expectations

Twitter is widely expected to report earnings per share, or EPS, of 15 cents, a penny less than the year-ago EPS of 16 cents.

Analysts, on average, expect Twitter to post revenue of $775.23 million, up 16.6 percent year-over-year.

Guggenheim Securities analyst Michael Morris estimates GAAP operating income of $42.2 million and revenue of $778.7 million.

KeyBanc Capital Markets Andy Hargreaves expects upside to Twitter's typically conservative guidance in the first quarter, more in-line with his estimates, which call for non-GAAP EPS of 16 cents on revenue of $796.3 million.

In its Feb. 7 fourth-quarter earnings release, the company guided to first-quarter revenue of $715 million to $775 million and GAAP operating income of $5 million to $35 million.

The company reversed to a profit on a GAAP basis in the fourth quarter of 2017 after years' of losses and has been profitable ever since.

In the fourth quarter of 2018, revenue climbed 24 percent to $909 million, with 87 percent of it coming from advertising and the remainder from data licensing and others. The U.S. accounted for about 54 percent of the ad revenue.

Key User Metrics

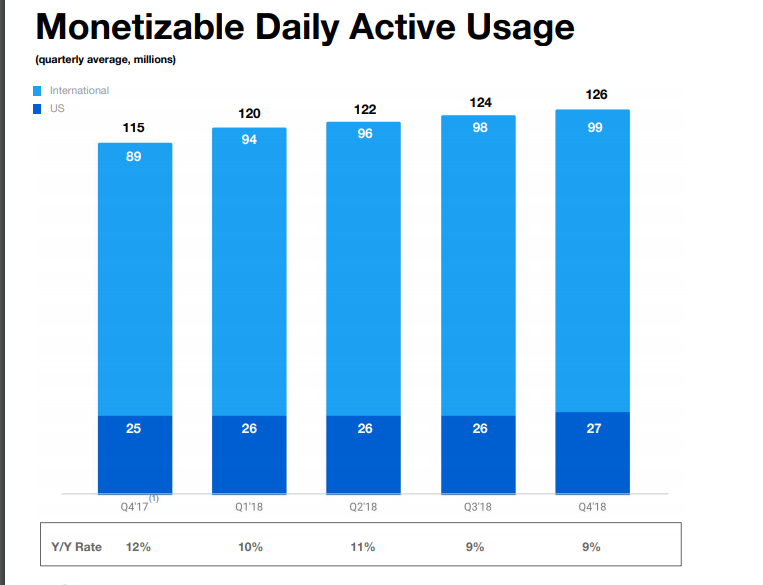

Monetizable daily active usage, or mDAU, was at 126 million in the fourth quarter of 2018, up 9 percent year-over-year. Yet monthly active usage, or MAUs, slid by 9 million to 321 million.

Source: Twitter

Going forward, Twitter said it has discontinued the practice of reporting MAU and will release only mDAU.

KeyBanc's Hargreaves estimates 6-percent year-over-year growth in mDAU to 127 million, although the analyst expects the metric to decelerate slightly throughout 2019.

"The company is focusing efforts on making the service more interest-based and easier to onboard, a correct strategy in our mind, but efficiency going forward will be a question as incremental engagement becomes tougher," Hargreaves said.

Investor Focus

Guggenheim expects Twitter investors to be anxious about the increased investments the company is making in 2019 and whether they will lead to higher sustained value.

The firm believes the investments will benefit both users and the company in the long run.

Even as investors are skeptical of the scalability and the scope for increasing engaged users, Guggenheim's Morris said he believes

Twitter's initiatives to expand content offerings and efforts to improve ad relevance will help accomplish this.

Investors are also worried about whether Twitter can win advertiser confidence.

"We think Twitter's continuous efforts to create a healthy, sustainable ecosystem will lead to stronger conviction from advertisers and increased user engagement, which we believe has yet to be realized in TWTR's valuation," the analyst said.

"We continue to view TWTR as a unique, high utility platform for both advertisers and news-oriented users."

Stock Takes

Analysts, on average, have a Hold rating on Twitter, with an average price target of $33.56, according to the Yahoo Database.

Guggenheim has a Buy rating on Twitter and $41 price target.

KeyBanc has a Sector Weight rating on Twitter.

Twitter shares were trading down slightly at $34.38 at the time of publication Monday.

Related Links:

Facebook Vs. Twitter Vs. Snapchat: How Do Key Statistics Compare?

MKM Partners: Twitter Has Potential For 30-40% Annual Returns

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.