The geopolitical waiting game is on.

With the Fed meeting out of the way and rates unchanged, the countdown toward UK parliamentary results and a U.S. decision whether to impose promised new tariffs on China stand front and center as trading begins Thursday.

The UK election could help determine how quickly and even whether Brexit happens. Results are likely to start filtering in by early this afternoon U.S. time, with the market still open. The decision on new tariffs determines whether the U.S. imposes levies on around $160 billion worth of Chinese goods starting Sunday. The goods in question are mainly consumer items, which means prices might rise for U.S. shoppers, who’ve really been the power behind recent healthy economic data.

With all these geopolitical chestnuts roasting on the fire, markets had a mixed tone approaching the opening bell. Overseas action also looked mixed, with Europe mostly higher but some Asian markets lower. Over in Europe, the European Central Bank (ECB) elected to hold rates steady at its meeting that ends today, which was the expected outcome. It’s the first meeting for new ECB President Christine Lagarde, who debuts with rates at negative 0.5% and a big bond-buying stimulus program underway.

The focus in Washington is on a reported meeting between the president and top advisers to discuss next steps with China. As we’ve said over and over, when it comes to trade deals and tariff threats, unless you see pen hit paper, it’s probably best not to get caught up in it. Rumors are likely to fly around today and tomorrow, which could make the market a bit choppy. Beware of the noise and remember the importance of sticking to your long-term investment plan.

On the data front, there was a bit of a surprise early Thursday as U.S. first-time unemployment claims jumped to 252,000. That was 40,000 above analyst expectations. Stay tuned next week to see if that was some sort of static in the data or something more worrisome. We haven’t seen a claims number that high since 2017.

Meanwhile, producer prices for November were flat, a below-expectations result. The core producer price index (PPI) actually fell 0.2%. It’s probably fair to say few expected this after PPI rose 0.4% in October, and it’s a soft result pointing toward weakness in the economy. Again, no single data point is a trend.

Market Soothed By Fed, Worried by China Tariff Picture

Stocks didn’t make a big move late Wednesday to the Fed’s decision to stand still on rates, and that’s not really much of a shock. Investors basically got just what they expected, and the market had a prudent reaction to the Fed, taking a breath. Major indices gained a little ground, maybe because Fed Chairman Jerome Powell made pretty clear in his post-meeting remarks that the Fed isn’t in a hurry to raise rates anytime soon. The 10-year Treasury yield fell below 1.8%.

As one analyst noted, the Fed sounds like the bar isn’t very high for a possible rate cut, but would be very high for a rate hike. Powell emphasized again and again at his press conference that the Fed just hasn’t seen inflation developing as quickly as it had expected, and that it would take a much stronger inflation showing for any upward movement in rates. This potentially allows the Fed to keep rates lower for longer, possibly helping the jobs picture. However, Powell pointed to slow productivity growth holding back wage gains.

Sector performance wasn’t too dramatic in any direction yesterday, but Industrials, Materials, and Technology had the best sessions. Those happen to be three sectors that are among the most sensitive to any news on trade with China, so maybe their strong showing indicates hope that the new U.S. tariffs scheduled for Sunday might get pushed back.

Volatility hasn’t gotten back to where it was in late November when it sank below 12. Instead, the Cboe Volatility Index (VIX) is hanging around near 15. This could reflect nerves about the trade situation, as well as the parliamentary election in the U.K. today and its potential implications for Brexit (see more below).

In corporate news (yep, there was something happening this week besides the Fed meeting and trade), Lululemon Athletica Inc. LULU shares got sent to the corner late Wednesday, falling 6% in post-market trading when its outlook apparently failed to impress investors. That despite the company beating Street estimates for earnings and revenue.

Keeping things in perspective, LULU noted that its holiday season projections got clamped by having six fewer holiday shopping days on the calendar this year due to Thanksgiving being so late in November. In a nutshell, the company’s quarter looked quite good, especially same-store and online sales growth, so maybe the decline after hours reflected some profit taking. Shares were up 92% year-to-date heading into earnings.

In other news Wednesday, Home Depot Inc HD provided preliminary fiscal-year 2020 sales guidance that was below expectations, while Chevron Corporation CVX announced an $11 billion write-down of its gas assets in Q4. Shares of both companies finished lower, but neither really got hammered too hard. Investors seem to have a long leash right now for any negative news, kind of a 180 from how things were a year ago.

Stay tuned for more earnings this afternoon. Though the bulk of earnings season is in the rearview mirror, today is arguably a big day. The last of the big retailers, Costco Wholesale Corporation COST, is set to report this afternoon. Business infrastructure staples Oracle Corporation ORCL and Adobe Inc ADBE, as well as semiconductor leader Broadcom Inc AVGO, also report after the close. These three releases and conference calls could offer one final snapshot of consumer and business sentiment as we head into the holidays.

Fed Keeps Things Simple

After three rate cuts in a row, the Fed decided to leave things alone Wednesday and take a little time to see how things play out heading into the new year. That doesn’t necessarily mean this rate-cutting cycle is necessarily over, however, because the futures market still indicates decent chances of one more cut in the first half of 2020.

The Fed’s decision to keep its benchmark Fed funds rate at a steady 1.5% to 1.75% likely didn’t come as a big surprise to anyone following the market lately. Futures prices had odds of a policy change at around 2% going into this week’s meeting.

While chances of another cut in 2020 remain out there, the Fed kind of squelched that a little in its statement Wednesday, saying economic conditions show current rates at appropriate levels and likely to remain that way for a while.

When the Fed talks about “sustained expansion” at current rate levels, that might be an indication it doesn’t feel much need to change anytime soon. However, the statement added that the Fed continues to watch labor market conditions, international developments, and inflation.

Also, the decision to keep rates unchanged was unanimous this time after a couple of meetings where there were dissenters both on the hawkish and dovish sides. Now it looks like hawks and doves are flocking together with rates at current levels. Maybe three cuts, totaling 75 basis points, were enough to make FOMC members feel like they’re at a comfortable place.

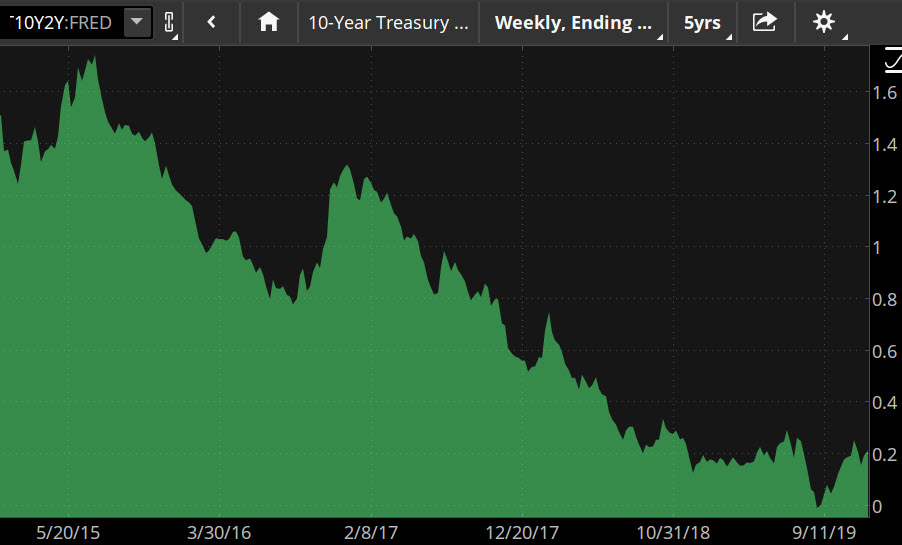

CHART OF THE AFTERNOON: EYE ON THE CURVE. Over the past five years, the trend in the spread between 10-year Treasuries and 2-year Treasuries has been toward narrowing. And it wasn't too long ago—a little over three months ago—that if flipped negative for a brief period. In recent days, it's pushed past 20 basis points a couple times, but seems to have stalled. With the Fed on a rate pause and inflation apparently muted, perhaps the 2-10 spread has found its comfort zone. Data source: Federal Reserve's FRED database. Image source: The thinkorswim platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results. FRED is a registered trademark of the Federal Reserve Bank of St. Louis. The Federal Reserve Bank of St. Louis does not sponsor or endorse and is not affiliated with TD Ameritrade.

Rates Seen Lower, Longer: The updated “dot plot” from Federal Open Market Committee (FOMC) members, maps out where each of them sees rates going in the years ahead. For 2020, every member projects rates to stay below 2%. About half expect rates to top that level in 2021, with chances that they could rise to around 2.5% by mid-2022. This seems to indicate the Fed thinks the economy will remain relatively stable, with slow but steady growth the next few years.

Looking out toward the next Fed meeting at the end of January, investors price in about a 91% chance of rates staying in place, according to CME Group futures. Chances of a rate cut rise to around 14% at the March meeting, and to 35% by June. Some analysts have said if the Fed does make another rate move in 2020, it’s likely to come sooner rather than later so the Fed won’t be accused of having influence on the November presidential election.

Brexit Back in the Mix as Election Looms: One thing that might be a concern for Powell and for investors is the possibility that Brexit could come back into the news right after the new year. British voters elect a new parliament today, which media reports say could help determine whether and how the U.K. exits from the European Union. Polls show the Conservatives leading. If that party wins enough seats, it could support a plan by its leaders to leave the EU by Jan. 31. If it loses, the country might face another referendum on the issue later next year.

Between the parliamentary election and this week’s ECB meeting, investors might want to keep a sharper eye than normal on the pound and euro. The pound has climbed vs. the dollar over the last three months and was up again on Wednesday, but the euro’s been kind of flat and fell vs. the dollar Wednesday. That changed Thursday as the euro and pound made early gains vs. the dollar based in part on the Fed’s dovish forecast.

Growth Factors: The Atlanta Fed’s GDP Now indicator, which not so long ago projected very slim growth below 0.5% in Q4, has now climbed to 2%. The jobs report and wholesale trade numbers played into the sharp hike in the metric, one of the quickest bounces in GDP Now seen in awhile. However, 2% growth isn’t necessarily the kind of muscle many investors had hoped for. It’s down from readings that hit 3% last year, and may be getting smacked around by the trade war with China.

If a Phase One deal is reached and some of the tariffs either don’t go into effect or get rolled back, it might be interesting to see if growth picks up. A more solid economic growth profile accompanied by low inflation and continued strong jobs gains would likely make a nice stocking stuffer for any stock market bulls in your family.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Image by Adam Derewecki from Pixabay

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.