Last week ended with stocks near all time highs and implied volatility near yearly lows.

Looking ahead, SPY options are pricing in just a 1.3% expected move into Friday's expiration, implying a bullish consensus around $388 and a bearish consensus near $377:

With some of the larger tech names set to report earnings this week (including Tesla Inc TSLA, Apple Inc AAPL, Microsoft Corporation MSFT, and Facebook Inc FB), QQQ options are pricing in a 1.9% expected move into Friday's expiration, implying a bullish consensus around $332 and a bearish consensus near $319:

Expected Moves for Companies Reporting Earnings

This week is highlighted by large tech names Microsoft, Apple, Facebook and Tesla. A more complete calendar with expected moves and prior earnings reactions to EPS beats/misses can be found on the Options AI Earnings Calendar.

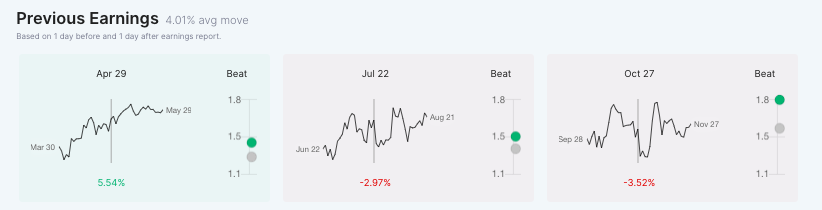

Microsoft / Reporting Tuesday after hours / 3.7% Expected Move / link

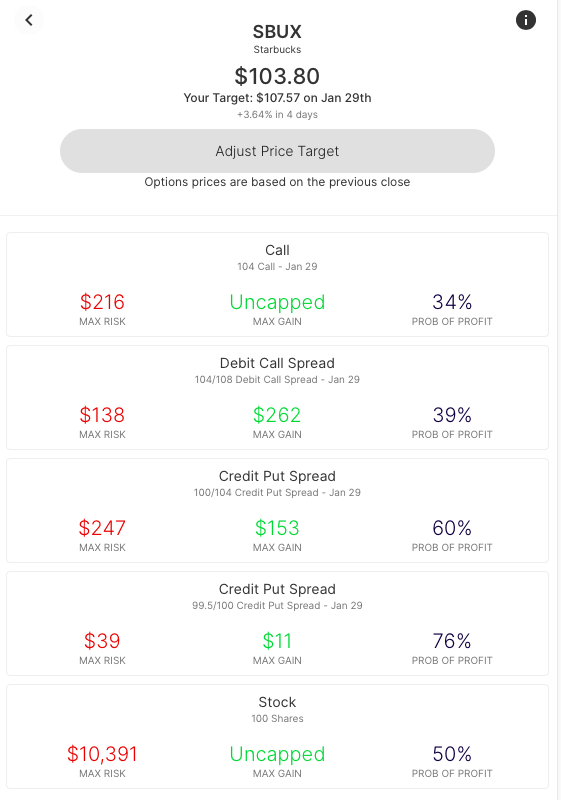

Starbucks Corporation SBUX / Reporting Tuesday after hours / 3.6% Expected Move / link

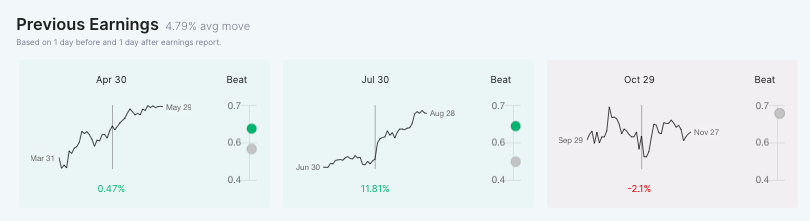

Apple / Reporting Wednesday after hours / 5.3% Expected Move / link

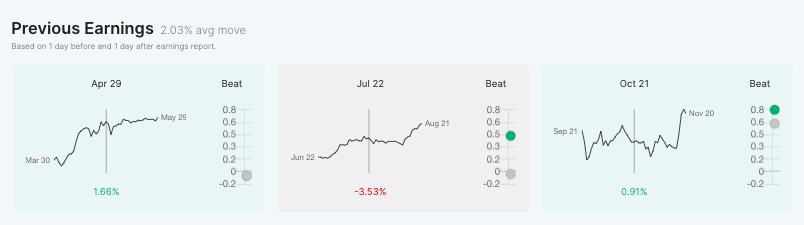

Facebook / Reporting Wednesday after hours / 6.0% Expected Move / link

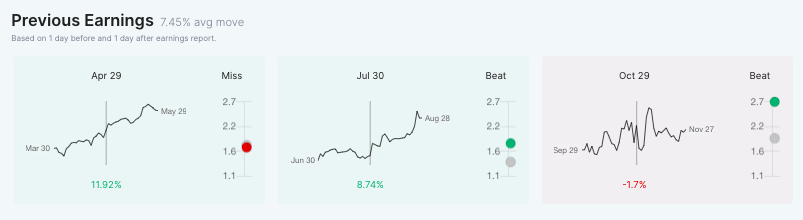

Tesla / Reporting Wednesday after hours / 7.2% Expected Move / link

Using the Expected Move to Help Inform Spread Trading

The expected move is the amount that options traders believe a stock price will move up or down. It can serve as a quick way to cut through the noise and see where real-money option traders are pricing potential stock moves. On Options AI, it is calculated using real-time option prices and displayed on a chart.

Knowing this consensus before making a trade can be incredibly powerful, regardless of whether you're using stock or options to make your trade. A helping hand with setting more informed price targets as well as a useful basis for starting strike selection.

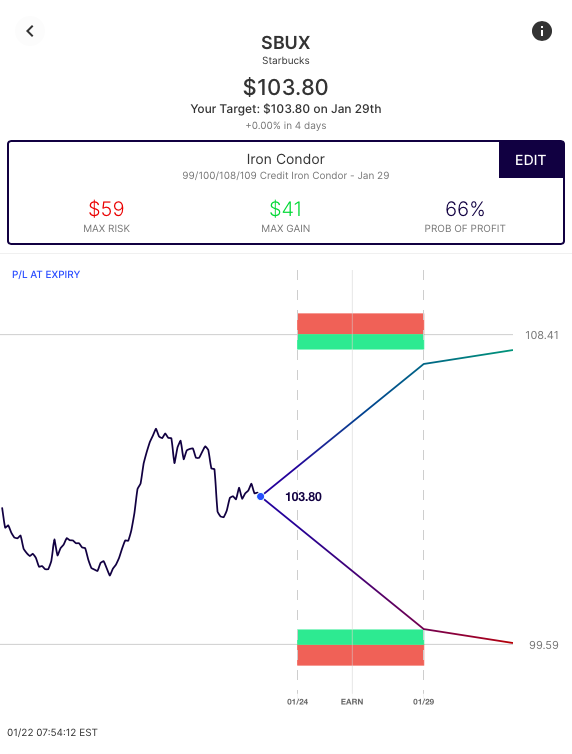

Here's an example, using Starbucks and its expected move. On the Options AI platform, a trader can select the bullish consensus for spread trades to generate debit call spreads and credit put spreads around the move. Or, if a trader believes that the options market is overestimating the move, a trader can select a neutral view to sell to both the bulls and the bears and generate credit/income generating strategies such as an Iron Condor at the expected move – shown here:

A closer look at some spread trades to the bullish consensus, compared to stock and a single call:

And a closer look at the Iron Condor, with strikes set at the expected move:

Summary

Remember, the above are just examples of the many ways a trader might express a view using option spreads. They are intended solely to demonstrate how the expected move can provide actionable insight to consider before making any trade, particularly into an uncertain event. Whether gut-checking your own expectations versus the options crowd, generating trade ideas from option market signals, or for more informed strike selection. That's why Options AI puts the expected move at the heart of its chart-based platform. Learn / Options AI has a couple of free tools as well as education on expected moves and spread trading. The concepts shown in Starbucks can apply to any stock and it is simply used here for illustrative purposes. Expected moves will change slightly into each company's earnings events so be sure to stay up to date via the earnings calendar. We'll be back later this week with previews of Tesla, Facebook and more.

The post What You Need to Know in Options – Week of January 25th appeared first on Options AI: Learn.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.