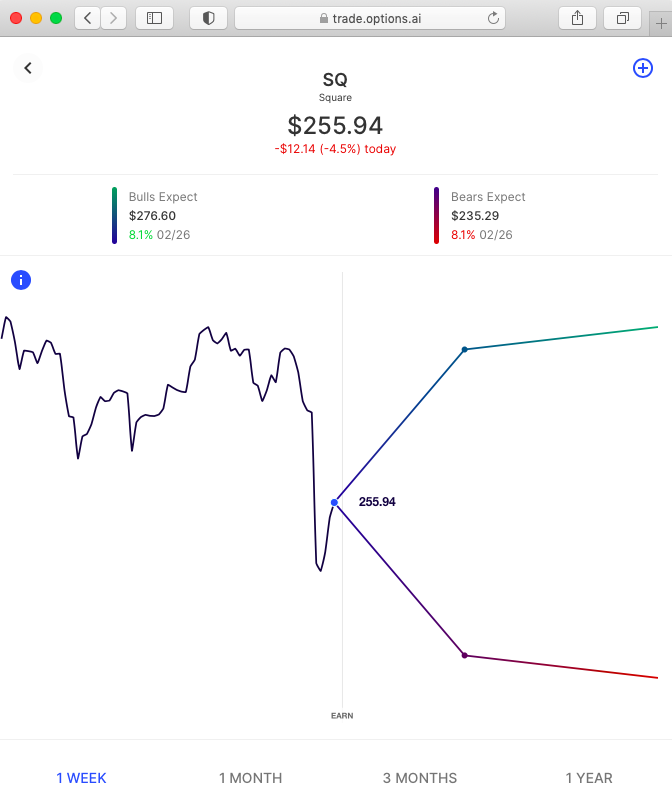

Square SQ and Nvidia NVDA are both set to report earnings in the next couple of days, with Square today after market close and Nvidia tomorrow after the bell. Here's a visualization of how options are pricing expected moves, followed by some examples of spread strategies, incorporating the expected move.

Expected moves and recent earnings moves can be found on the Options AI Earnings Calendar

Expected Moves

SQ 8.0% ( calendar link)

Nvidia 6.0% (calendar link)

Using SQ as an example, we can see how option spreads might be used to reduce capital outlay and potentially improve the probability of profits (versus buying outright calls or puts). We will also look at how the expected move can be used to help guide strike selection on spreads, both debit, and credit.

See also: How to Buy NVIDIA Stock

Please note, any stocks and/or trading strategies referenced are for informational and educational purposes only and should in no way be construed as recommendations. The strategies depicted represent just a few of the many potential ways that options might be used to express any particular view. All prices are approximate at the time of writing. Option spreads involve additional risks that should be fully understood prior to investing.

With Square trading near $250 we can use the 8% expected move (about $20 in the stock) to generate spreads, both debit and credit, and compare those to outright calls. Here's an example with a bullish view:

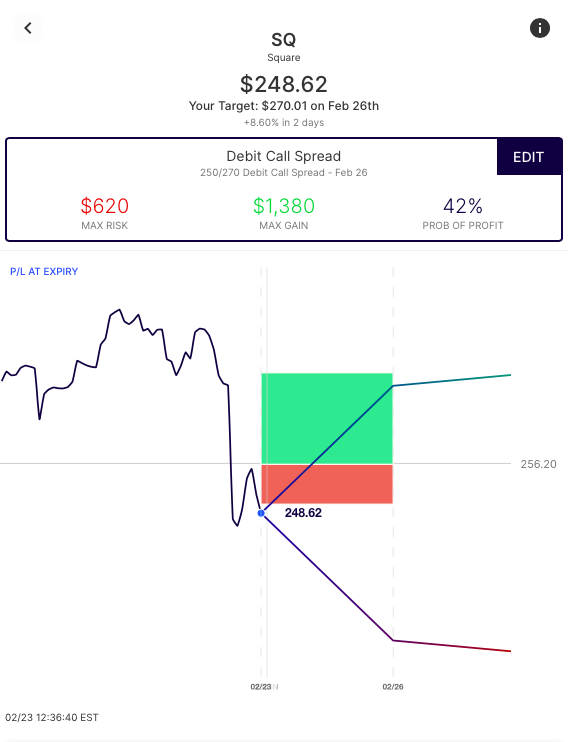

SQ – Debit Spreads

Knowing that the options market is pricing a move of just under $20 in either direction for earnings, we will now look at an example of the bullish spread based on that expected move – the Feb 26th +250/-270 Debit Call Spread. With the stock just under $250, this spread is trading at approximately $6.20. Here's how that trade looks on the Options AI chart:

This is a Debit Call Spread to the bullish consensus. It buys a 250 call and sells a 270 call, creating a breakeven of about $256 in the stock, with profits above that price. It sells the out of the money 270 call at around $4.50.

With this Debit Call Spread a trader is able to position for a move higher at a cost of about $6.20. That is less than the cost of most outright calls near the money and is not much more expensive than the 270 call itself.

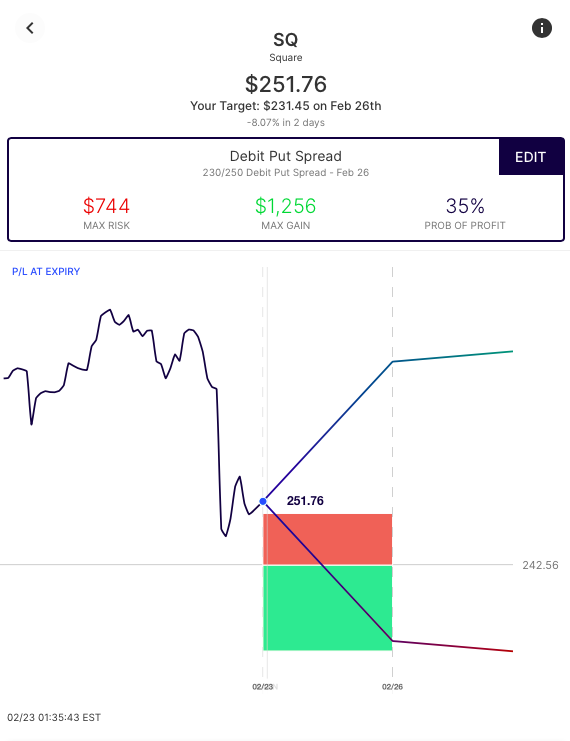

Bearish – The same process can be applied to Bearish Debit Spreads, with the SQ +250p/-230p debit put spread trading at a slightly higher cost:

SQ – Credit Spreads: ‘Selling to the Bulls or Bears'

Again, using Square as an example, a trader can sell spreads at a credit to establish a directional view.

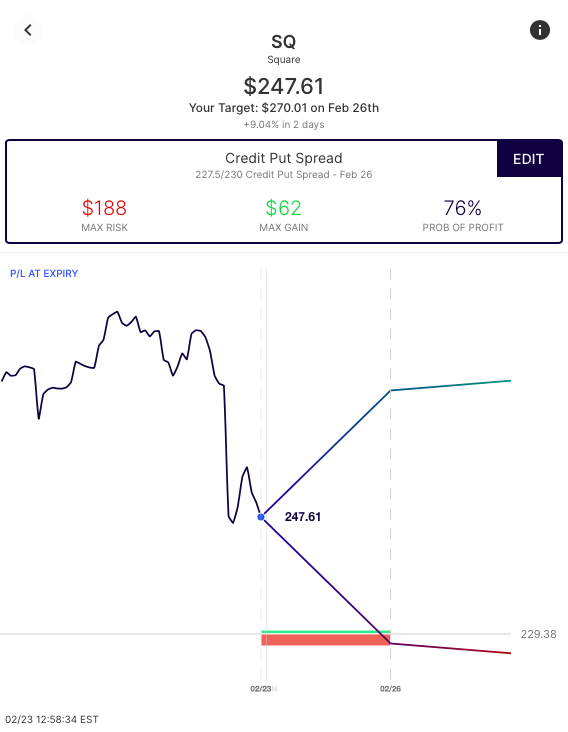

Below is an example of a Credit Put Spread, placed at the bearish expected move for Feb 26th (short the 230 put, long the 227.50 put). This is a bullish trade, that sells a spread to the bears:

In this example, the credit spread collects about $60, as long as the stock is above $230 on expiry. With this credit spread, more has to be risked ($190) than the potential reward ($60). But, because the trade only needs the stock to be above $230 on expiry, it carries a high probability of profit.

This "bullish by not being bearish" stance is one way traders can express a view in a 250 dollar stock without the high costs associated with trading options nearer to the current stock price. On a credit spread, the defined ‘risk', can be thought of similarly to the ‘cost' one would associate with a long option or a debit spread.

Remember, this should be balanced with an understanding of other risks specific to spreads (such as assignment and execution risk).

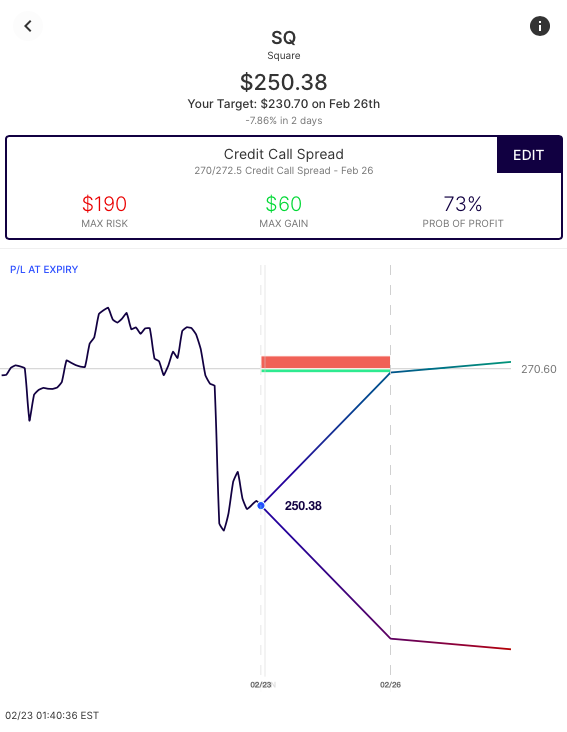

Bearish – The same view can be expressed for bearish positioning, in this case with the -270c/+272.50c credit call spread:

NVDA – Selling a credit to both the Bulls and the Bears

Finally, let's consider the scenario where a trader believes that the options market is overpricing the move in both directions and believe that a stock will stay within the expected move on a given timeframe. Rather than "not bearish" or "not bullish" like the Credit Spread above, this is a trade that ‘sells the move' to both the bulls and the bears – the Iron Condor. Here's an example in Nvidia, using the stock's expected move to initially set strikes:

The Iron condor, which involves simultaneously selling an out-the-money Credit Call Spread and Credit Put Spread seeks to collect the premium (income) received if NVDA stays within its expected move.

On the chart above one can see the max gain range in the stock, (if the stock remains within the expected move) and the points at which the trade becomes max loss (if the stock has a larger than expected move in either direction).

This is a strategy some traders place when they expected implied volatility to go lower. But in this case, with so little time to expiration, the best way to think of this strategy is that if the stock stays within the expected move, it is profitable, if the stock moves beyond the expected move, it is unprofitable.

Summary

Remember, the above are just examples of the many ways a trader might express a view using options. They are based on where the stock is trading at the time of writing and are intended solely to demonstrate how the expected move can help provide actionable insight to consider before making any trade – particularly into an uncertain event – and how it might be used for more informed strike selection. Learn / Options AI has a couple of free tools, including an earnings calendar with expected moves, as well as education on expected moves and spread trading. The concepts shown in Square and Nvidia can apply to any stock and are simply used here for illustrative purposes.

The post Square and Nvidia – Earnings moves and spread trading. appeared first on Options AI: Learn.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.