A sharp rise in April consumer prices put stocks under more pressure early Wednesday, but the data really shouldn’t come as much of a surprise.

We’re having an initial reaction now where everything sells off and rates are pushing higher, but we’ve already seen hints of this coming from earnings. Based on what executives said, it would be hard to believe if there wasn’t some inflation pressure developing and showing up in today’s number.

This is one report, so it’s nothing to lose our minds over, but it backs up what we’ve been hearing. To recap, the consumer price index (CPI) rose 0.8% last month, compared with Wall Street’s consensus for 0.2%. The CPI is up 4.2% year-over-year. These are big numbers, but remember that last year set a low bar considering the struggles with Covid at the time.

The S&P 500 Index (SPX) was already lower in pre-market trading before the data hit, and immediately dived when CPI came out. The 10-year Treasury yield also ticked up a couple basis points to just under 1.65%. It was below 1.5% at one point last week, so this is a pretty big move. Volatility also edged up after the news. Higher rates might have a chance of helping the Financial sector today if they can hold the line against what looks like a lot of pressure coming from the rest of the market.

Rising inflation numbers over time might get the Fed worried, but Fed Chairman Jerome Powell has made it clear over and over that we should expect inflation and that it will be temporary. With the easy comparisons to a year ago continuing over the next few months, it might not be until Q4 when we get a true picture of the price situation.

CME Fed funds futures now show a 9% chance of a rate hike by the end of the year, up from 7% earlier this week. Historically, readings like those don’t show much worry about increasing rates. However, if inflation continues to ramp up, it might put more focus on when the Fed might start “tapering” some of its bond-buying.

The intense inflation focus heads into day two tomorrow when the government releases the April producer price index (PPI). Circling back, the March report might have given many investors an unpleasant shock, rising a full 1% month over month. Analysts had expected decent gains, but not that dramatic.

For tomorrow’s April PPI, the Wall Street consensus, according to Briefing.com, is 0.3% for the headline PPI and 0.4% for core, which excludes food and energy. Those aren’t low numbers, but remember the comparison is against the big gain in March. For more on what to watch beyond the headlines in PPI, see below.

Stepping away from prices, the Tech slide that briefly halted late yesterday appears ready to resume this morning following weakness overnight in the FAANG stocks. Semiconductor shares also came under pressure in overnight trading. On the charts, Tech is beginning to show some technical weakness, which may weigh on these stocks as the day continues.

Having said that, yesterday’s rally in the Nasdaq (COMP) was nothing short of incredible. Some of the recovery may have reflected “buy the dip” mentality (see more below). It’s going to be worth checking to see if that happens again on today’s early weakness.

Asian and European markets were mixed overnight, while crude resumed its climb and is now above $66 a barrel.

Inflation? Taxes? A Combination? Struggles Continue

If it seems like the market just can’t get going lately, that’s because it can’t. In general, there’s this thought that inflation may rear its ugly head. We see a little bit higher rates, not significantly, but a bit. And this struggle between value and growth continues at the same time.

It’s really a kind of tale of two cities, if you will, when we saw Industrial names such as Caterpillar CAT and 3M MMM achieve solid gains over the last month (until Tuesday, at least), but large tech names like Amazon AMZN and Facebook FB struggle. That kind of reversed yesterday. So-called cyclicals like Industrials and Financials that tend to do better in a recovering economy got clobbered, and the Tech sector rebounded from recent selling. One day isn’t a trend, however. Tech isn’t out of the woods by any stretch of the imagination, and the cyclical selling might have been profit-taking after a long rally.

Even as the struggles continue on Wall Street, with Tech down about 3% so far this month, the Fed is sticking to accommodative policy and the 10-year Treasury yield has been tame lately, so maybe anticipation of higher inflation alone is enough to keep buyers hesitant. That, and maybe some concerns about whatever changes get worked into the tax picture over the next few months as the administration proposes more spending on infrastructure.

Volatility Reappears After A Short Vacation

As caution grows, so does volatility. You could see that in the dramatic swings of the COMP yesterday. It started off with 2% losses and then clawed back almost all the way to flat. It could mean people chose to “buy the dip” in Tech once again, especially after the Nasdaq-100 (NDX) briefly fell below its 50-day moving average, though it’s well above the 200-day.

As we said yesterday, this dip buying is kind of like running a play that keeps working in football until it doesn’t work any more. The proof is in the pudding. If Tech can recover a bit here and make another move higher, maybe it tells those dip buyers that there’s more room to roll. In some ways it’s a self-fulfilling prophecy.

The Cboe Volatility Index (VIX) climbed above 20 on Tuesday for the first time since late March, going above 23 during parts of the day. Historically, 20 is about average and probably nothing that signals too much choppiness ahead. However, if you look at the futures complex, VIX contracts expiring this summer trade up near 24 or 25. It would probably take a rebound back to 30 in VIX to get more people nervous, but even 25 would make a statement.

Sorry to get technical, but arguably the level to watch in the SPX could be the 50-day moving average. That key point began Tuesday near 4046, meaning the SPX still enjoyed a more than 75-point premium even after falling 1.5% shortly after Tuesday’s open. Continued selling could mean a test of that 50-day level, which has been tested several times so far this year but held tight on each of those occasions.

A drop below the 50-day conceivably could mean acceleration of the selloff as stops get triggered. On the other hand, it could mean buyers come back into the market seeking to take advantage of lower prices, as they appeared to do in Tech yesterday. Nasdaq 100 futures (/NQ) fell below their 50-day moving average of 13,384 yesterday, but remained above the 200-day moving average of 12,462. They haven’t made a test of the 200-day since early March, when the COMP briefly went into a 10% correction.

Reopening Stocks Get Ready To Report, Led by Disney

Whatever happens with the major indices, a couple of important earnings head our way Thursday with Disney DIS and Airbnb ABNB. They’re both ones to watch from a reopening perspective.

With DIS, two outstanding questions are how the theme park business is doing now that Disneyland is welcoming visitors, and whether the same streaming subscriber challenges Netflix NFLX reported in Q1 affected DIS. Some analysts are also wondering if DIS might start to consider bringing back its dividend, one of the victims of Covid. We’ll publish a full preview of DIS earnings later today.

Also, listen on the DIS call if they mention anything about having any trouble finding workers to take care of those resorts and theme parks. Shortages of workers are something a couple of other companies have mentioned and could play into inflation fears.

Besides earnings and inflation, data to watch today and tomorrow include weekly U.S. crude stockpiles later this morning and weekly initial jobless claims tomorrow morning. Yesterday’s Job Openings and Labor Turnover Survey report (JOLTS) showed job openings climbing to 8.123 million in March from a revised 7.526 million in February. These are very big numbers that likely indicate a growing economy—or an economy that would like to grow faster than the supply of labor is currently allowing.

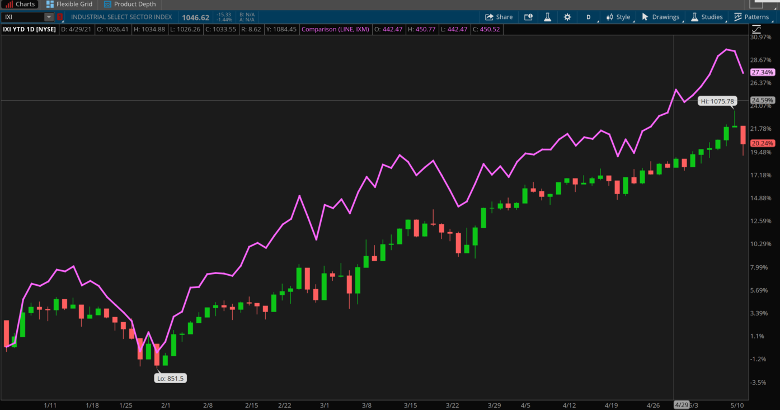

CHART OF THE DAY: UPHILL RIDE PAUSES. So-called “cyclical” sectors Industrials (IXI—candlestick) and Financials (IXM—purple line) have had a very solid start to 2021, as this year-to-date chart shows. Yesterday the brakes slammed on both, along with Energy, another cyclical. Still, it’s just one day, so monitor the sectors over the coming sessions to see if there’s a pattern change taking shape. Data Source: S&P Dow Jones Indices. Chart source: The thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

$3 Gas And The Consumer: One concern when gas prices rise is that they can eat into demand for things people would have bought if they hadn’t bought expensive gas. At times like those, monthly retail sales reports can still look pretty impressive—that is until you check and see how much gasoline costs contributed to the growth. The last time U.S. gas prices were above $3 across much of the country was two years ago in May 2019, but that wasn’t a lasting situation.

For that, you have to go back to the summer of 2018. The last month where prices stayed near $3 was September 2018, and, coincidentally or not, retail sales that month rose just 0.1%, seeing the biggest drop in spending at restaurants and bars in nearly two years.

It’s important to never look at one data point in isolation or try to detect a trend from any one month. Also, remember about correlation not being causation. Having said that, we’re hearing from a couple of big chain restaurants this week, including Wendy’s WEN and Jack in the Box JACK. Let’s see if executives at either company get asked about or bring up gas prices on their calls.

Paying Up For Paper Towels, But How About For Crispy Chicken? Inflation is the current watchword on Wall Street, and when inflation shows up, sometimes so does the Consumer Staples sector. Think about it—if prices rise, who might benefit? The companies that have the most pricing power. So far this earnings season several big Staples names including Kimberly Clark KMB, Coca-Cola KO, and Procter & Gamble PG have talked about raising prices for their products as they deal with post-Covid supply chain tangles and rising commodity prices. For these companies, pricing power may be able to make up for their rising costs on the margins.

On the other hand, Tyson Foods TSN—the big poultry producer—recently warned in its earnings call that it’s seeing “substantial inflation across our supply chain, which will likely create margin pressure during the back half of the year.” In case you haven’t watched TV or driven by a fast-food place recently, almost every one of them seems to be touting a new chicken sandwich, and the competition is fierce. With all the competition, it’s unclear how much pricing power fast-food restaurants have, so chicken is a problem across the board. Will fast-food companies (and maybe ultimately their customers) be willing to pay TSN more for the commodity they all crave? Coming weeks might tell.

Beyond The PPI Headlines: It’s easy to get caught up in the headline numbers of any specific report. However, sometimes the data farther down tell a more important story. It was that way with the March producer price index (PPI) report. It showed growth in intermediate demand for processed and unprocessed goods basically off the charts high in March at 4% and 9.3%. That represented the most dramatic monthly gains for those two categories since August 1974 and November 2006, respectively, and “points to inflation issues that are apt to linger for producers and which could potentially spill over into consumer prices,” Briefing.com noted at the time.

Generally, analysts see core intermediate PPI as a key leading indicator of inflation. Intermediate goods are partially processed ones used as inputs to produce other goods. Think of plastic resins, tires, metal doors, processed fuels and even containers like boxes, barrels, and cans used for production. This is a little in the weeds, but a better understanding of the fine print can help investors have a better sense of what a key report like PPI is telling us.

TD Ameritrade® commentary for educational purposes only. Member SIPC.

Image by Gary Ullah from Pixabay

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.