The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

GBP/USD Current price: 1.4124

- China has become the UK’s biggest single import market on record.

- The British Pound gave up to renewed dollar’s demand and hit fresh weekly lows.

- GBP/USD holds above 1.4100 and is at risk of falling further in the near-term.

The GBP/USD pair remained under selling pressure and bottomed for the day at 1.4111, a fresh weekly low, consolidating nearby at the end of the American session. There were no fresh news to move the pair one war or the other, solely declining on resurgent dollar’s demand.

Meanwhile, China has become the UK’s biggest single import market for the first time since records began, overtaking Germany. Goods imported from China were up 66% from early 2018, according to the Office for National Statistics. The UK won’t publish relevant macroeconomic data on Thursday, with the focus on a speech from BOE’s Gertjan Vlieghe.

GBP/USD Short Term Technical Outlook

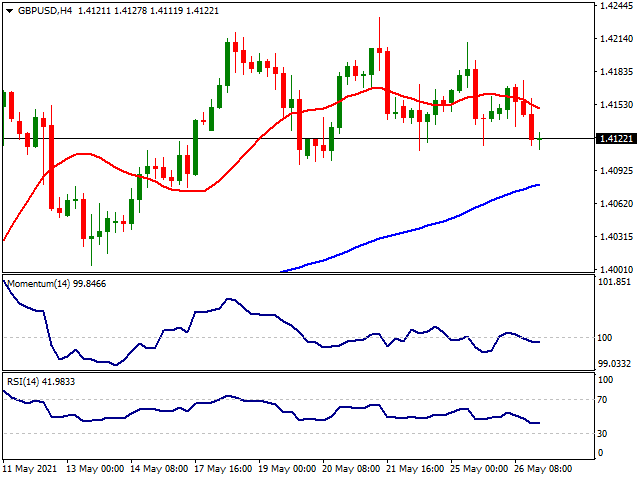

The GBP/USD pair is at risk of extending its decline according to intraday technical readings. The 4-hour chart shows that technical indicators failed to extend their advances above their midlines, now heading south within negative levels. The 20 SMA gains bearish traction above the current level, while the longer ones keep heading north below it. The pair will likely extend its decline on a clear break below the 1.4100 level.

Support levels:1.4095 1.4065 1.4020

Resistance levels: 1.4130 1.4175 1.4220

Image Sourced from Pixabay

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.