Good Morning Everyone!

The AI chatbot race takes off with competition heating up between:

- ChatGPT (OpenAI & Microsoft)

- Bard AI (Google)

- Ernie (Baidu)

Who will win?

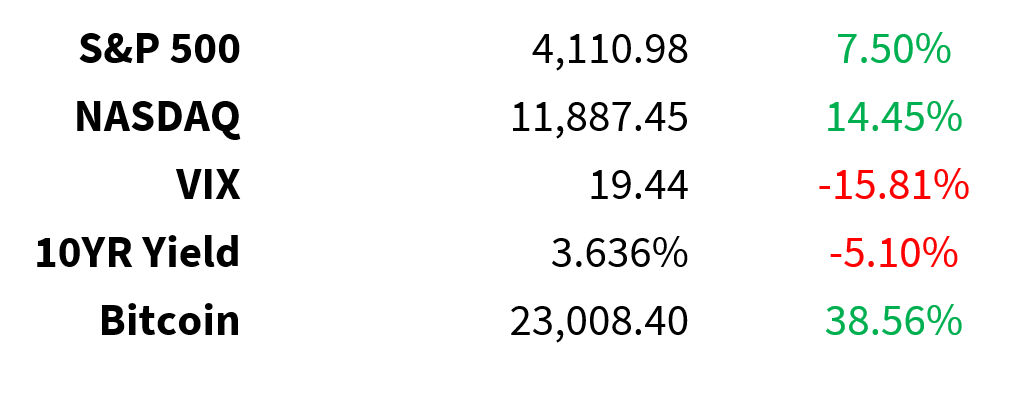

Prices as of 4 pm EST, 2/6/23; % YTD

MARKET UPDATE

Tonight U.S. State of the Union

12 p.m. Fed Jerome Powell speaking

-

February 1 hike 25 basis points 4.50%-4.75%

-

March 22 hike 25 basis points 4.75%-5.0%

-

May 3 hike or pause? 5.0%-5.25%

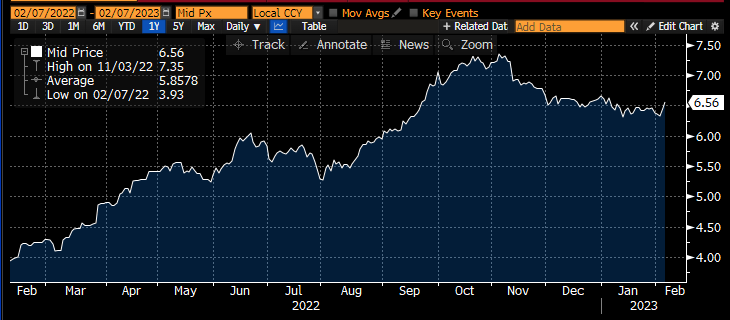

U.S. 30-year mortgage rates

-

Down almost 1% from its high but

-

Well above the 3% range from a year ago

Crude 75 +1.7%

-

Impact of the earthquake in Turkey and Syria & shutdown of Johan Sverdrup

Google GOOGL

-

Testing their new AI service

-

Plans a broader public launch in coming weeks

-

New search engine to combat ChatGPT

-

1 p.m. today Microsoft MSFT to highlight Bing/ChatGPT combo

Earnings

-

Activision Blizzard ATVI +3% will Microsoft get approved to buy ATVI, $95 offer vs. $74 stock

-

Simon Property SPG flat EPS in-line, occupancy rate 94.9%, guide light

-

Pinterest PINS flat Q4 weaker, Q1 guide weaker, focus expense efficiency

-

Take-Two Interactive TTWO flat EPS miss, guide cut, cautionary purchasing behavior

-

BP BP +5% increased dividend and extended the buyback

-

Fiserv FISV +3% EPS in-line, guide better than street

-

KKR KKR +1% $0.92 distributable earnings vs $1.59 year ago, $500B assets

-

Centene CNC flat modest topline beat, guide in-line

-

Carrier CARR -4% in-line, orders down 10% as expected, guide in-line

-

DuPont DD +1% in-line, Q1 guide light similar to other chemical companies

-

Royal Caribbean RCL +4% loss better than expected, structural cost increases

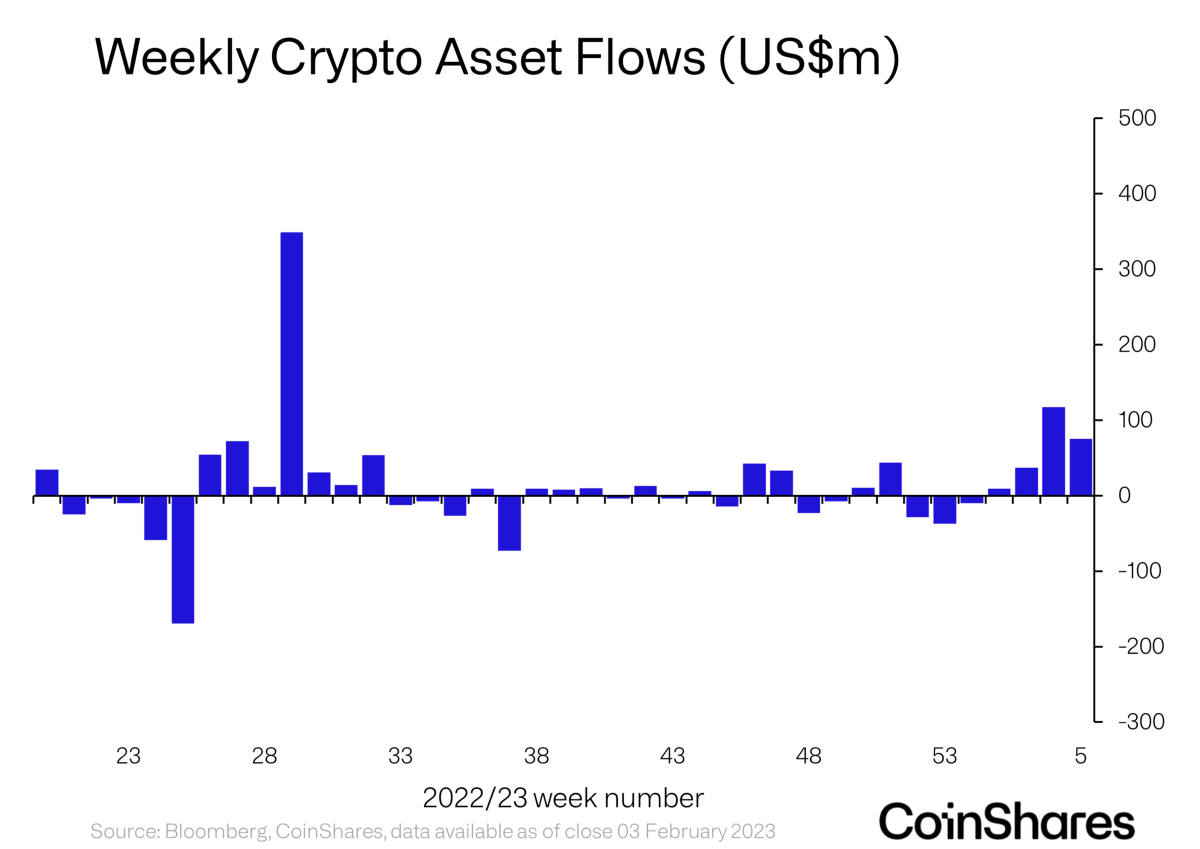

CRYPTO UPDATE

Digital Currency Group (DCG)

-

Selling shares in top funds at steep discounts

-

Including Grayscale (its asset management business)

-

-

Seeking to raise capital to pay Genesis (its lending arm) creditors

-

Owes +$3 billion

-

Digital asset fund flows

-

4th consecutive week of inflows

-

$76 million

-

-

YTD inflows = $230 million

-

Total AUM +39% ($30.3 billion)

-

-

Bitcoin 90% of flows ($69 million)

-

$8.2 million to short-Bitcoin products

-

Rest of flows muted

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.