Zinger Key Points

- Nvidia and AMD stocks surge as TSMC reports strong Q4 results, exceeding expectations with $19.62 billion revenue.

- Meta invests heavily in Nvidia's AI chips, planning to acquire 350,000 H100 cards by 2024, driving Nvidia's stock up.

- Markets are messy—but the right setups can still deliver triple-digit gains. Join Matt Maley live this Wednesday at 6 PM ET to see how he’s trading it.

Nvidia Corp NVDA stock maintained its rally Friday along with peers Advanced Micro Devices, Inc AMD as chief contract chipmaker Taiwan Semiconductor Manufacturing Company Ltd TSM won the Street with its upbeat quarterly results and guidance.

The Taiwanese semiconductor manufacturer reported a revenue of $19.62 billion in the fourth quarter, a slight decrease of 1.5% compared to last year, yet surpassing the expected $19.45 billion Thursday. With earnings per share (EPS) at $1.44, it exceeded the anticipated $1.37.

For the fiscal year 2024, Taiwan Semi anticipates revenue growth ranging from low to mid-20%. The company has set a capital expenditure budget between $28 billion and $32 billion for FY24, compared to the $30.45 billion spent in 2023.

The optimistic outlook from Taiwan Semiconductor Manufacturing Co on capital spending and revenue growth led to a significant increase in semiconductor stock values, with companies like Tokyo Electron Ltd and Nvidia adding over $160 billion in market value, Bloomberg reports.

According to Wedbush analysts, Taiwan Semi’s confidence in near-term fundamentals has significantly improved, buoyed by expectations of AI’s increasing contribution and better prospects for traditional end markets in 2024.

Meanwhile, on Thursday, Meta Platforms Inc META CEO Mark Zuckerberg announced a significant investment in Nvidia’s AI chips, focusing on building a robust computing infrastructure.

This plan includes acquiring 350,000 H100 graphics cards from Nvidia by 2024’s end, with an estimated expenditure of nearly $9 billion, as the H100 cards are priced between $25,000 and $30,000.

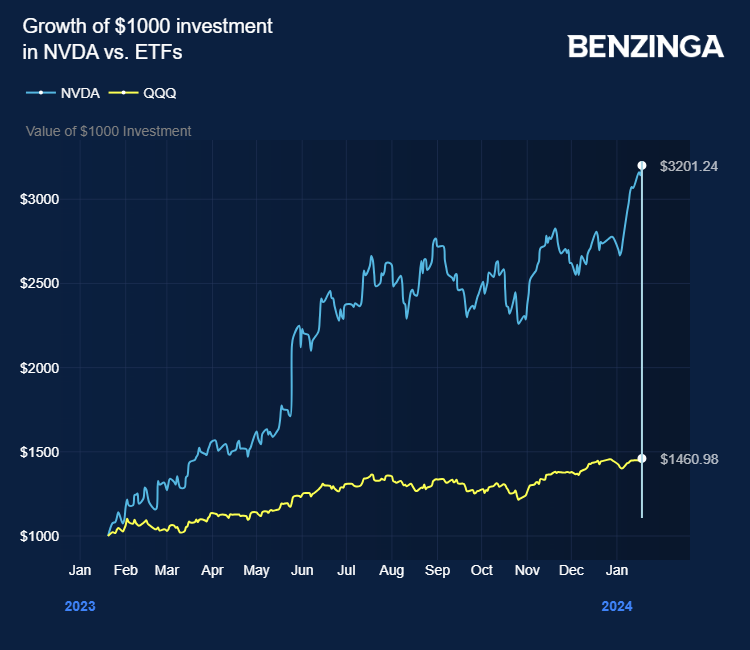

Nvidia stock gained 241% last year versus the broader index Invesco QQQ Trust, Series 1 QQQ at 50%.

Price Actions: NVDA shares traded higher by 1.66% at $580.50 premarket on the last check Friday. AMD shares traded higher by 1.70% at $165.44.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Wikimedia Commons

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.