Zinger Key Points

- Airline companies, American Airlines and Alaska Air, are both reported earnings on Jan. 25 pre-market.

- We compare these 2 companies on various metrics, as investors would be keen to know which is the better buy?

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

American Airlines Group Inc AAL and Alaska Air Group Inc ALK are among the popular airlines in the U.S.

Both airline companies are reporting their fourth-quarter (Q4) earnings on Jan. 25 before market hours.

American Airlines shares are down about 12% over the past year. Wall Street expects the company to report 10 cent in EPS and $13.02 billion in revenues. The stock commands a $9.19 billion in market cap on the U.S. stock market.

Commanding market cap of $4.64 billion currently, Alaska Air stock is down about 28% over the past year. The stock is down over 8.5% YTD, post the incident on Jan. 5, where a panel on the aircraft blew out in mid-air, led to the grounding of over 170 Boeing 737 Max 9s. The passengers were on board an Alaska Airlines flight, causing reputational damage to both Alaska Air and Boeing Co BA.

Consensus estimates for Alaska Air’s Q4 financial results stand at an $18 cents in EPS and $2.55 billion in revenues.

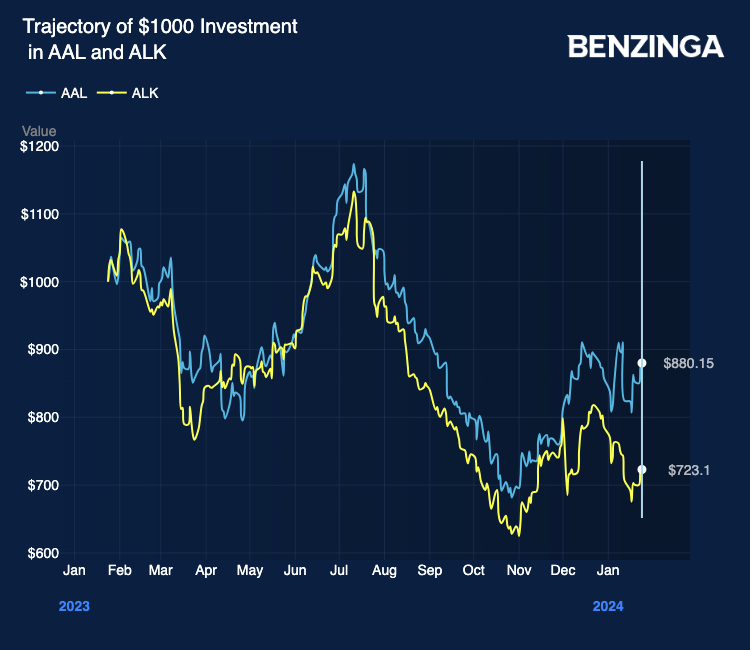

In terms of stock performance, Alaska Air has largely lagged American Airlines stock over the past year. While, the former is down 28%, the latter is down 12%.

Investors would be keen to know which is the better buy? Let’s take a quick look at how these companies compare. While both being airline operators, they have distinct strategies and strengths.

Market Presence and Network

American Airlines is a global aviation giant, renowned for its extensive route network connecting passengers to international destinations. American Airlines flies to more than 350 destinations in more than 60 countries.

In contrast, Alaska Airlines, together with its regional partners Horizon Air and SkyWest Airlines SKYW, strategically dominates the West Coast market, excelling in regional connectivity.

Financial Resilience and Debt Levels

American Airlines grapples with a substantial debt load, impacting its financial flexibility. For the past four years, the company’s total debt has been reported at over $40 billion and net debt over $30 billion, both highest among peers. It’s long-term debt/total capital ratio stands at a whopping 99.95%.

Conversely, Alaska Air maintains a healthier balance sheet, positioning it as a more stable player in the airline industry. The company has a long-term debt/total capital ratio of 39.43%.

Operational Focus and Efficiency

American Airlines has a broad operational focus and invests in fleet modernization for improved efficiency. Its robust loyalty program, AAdvantage, adds a competitive edge. However, frequent labor disputes pose a challenge.

In contrast, Alaska Air stands out for its historical commitment to operational excellence. Alaska Air sports a healthier balance sheet compared to many competitors. Nevertheless, the airline faces limitations in terms of international exposure, relying heavily on its domestic operations. Alaska Air maintains a young operational fleet of Boeing 737 aircrafts and Embraer 175 aircrafts.

Valuation Differences

Chart compiled using Yahoo Finance data.

Looking at stock valuations, American Airlines stock comes with a more favorable trailing earnings multiple, as well as forward earnings multiple. Valuations clearly appear to side with American. While the difference is wide enough to aid decision-making, let's just look further on at analyst consensus ratings for validation.

Chart compiled using Yahoo Finance data.

And the tables have turned! Per consensus analyst estimates, Alaska Air stock appears to offer more upside potential than American Airlines stock. Analysts see a good 43.21% upside associated with Alaska Air stock. American Airlines stock, on the other hand, comes with a 9.72% upside per analysts.

Investors need to consider their risk tolerance, market preferences, and the specific strengths and challenges presented by each airline when evaluating these investment opportunities in the dynamic airline sector.

Read Next: United Airlines Vs. Southwest Airlines: Which Stock Offers More Upside?

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.