Zinger Key Points

- Visa and Mastercard, a duopoly of the credit card market, are comparable in size and operations.

- As the two report their fourth-quarter earnings, we look at how operations and valuations differ between the two.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

Visa Inc V and Mastercard Inc MA are two of the biggest players in the U.S. credit card space.

While Visa is reporting fourth-quarter (Q4) earnings on Jan. 25, Mastercard is reporting on Jan. 31. The two firms compare well in terms of scale and market performance.

Let's take a quick look at how these companies compare.

Also Read: US Consumer Debt Moves Toward Pre-COVID Levels: Economist Shares Top Takeaways

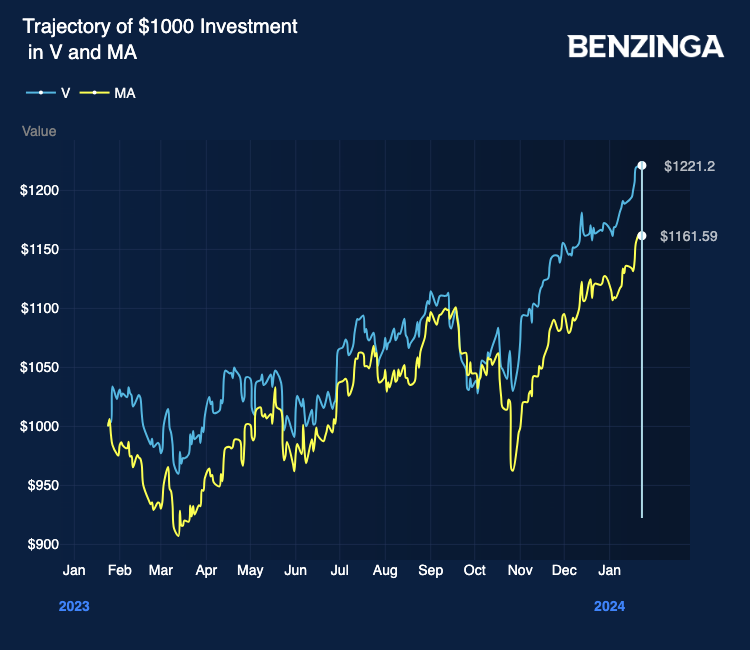

Looking at the trajectories above, while Visa stock is up 22.12% over the past year, Mastercard stock is up 16.16%.

Visa and Mastercard operate as global payment technology companies, facilitating electronic funds transfers and earning revenue through transaction fees. Both companies emphasize digital payments and global expansion, acting as intermediaries connecting financial institutions, merchants, and consumers.

Both entities have proven to be resilient and successful in the rapidly evolving payments industry. They do, however, differ in terms of their financial performance, market share, and technological innovation.

Resilience Vs. Strength

Visa and Mastercard both exhibit robust financial performance, with consistent revenue and profit growth. Visa’s global reach and dominance in electronic payments contribute to its resilience, while Mastercard’s strategic partnerships and innovative approach to payment technology contribute to its sustained financial strength.

Visa Dominates Market Share

Visa and Mastercard are global leaders in the payments industry, each holding a significant market share. Visa’s widespread acceptance and partnerships with financial institutions contributes to its dominance with 52% market share by purchase volume.

Mastercard competes closely, strengthened by its emphasis on technological advancements and strategic acquisitions. Mastercard’s market share by purchase volume stood at 24%.

Technological Innovation – Advancement Vs. Evolution

Both Visa and Mastercard prioritize technological innovation, investing in research and development to stay at the forefront of the digital payments landscape.

Visa’s proactive approach includes continuous advancements in payment technologies, while Mastercard focuses on contactless payments, blockchain technology, and collaborations with fintech companies to enhance user experiences and drive the evolution of payment methods.

Valuation Differences

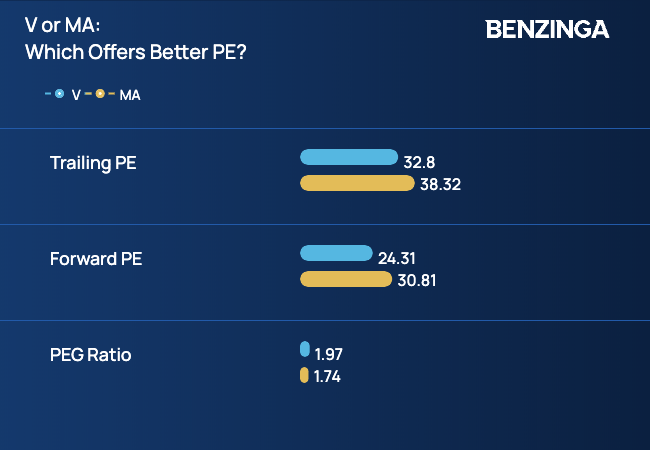

Chart compiled using Yahoo Finance data.

Looking at stock valuations, Visa offers more favorable trailing and forward earnings multiple. However, valuation figures for the two compare very closely, so let's look at analyst consensus ratings for further validation.

Chart compiled using Yahoo Finance data.

Per analyst consensus estimates, both Visa and Mastercard stand to offer investors over 6% upside. While the former has the potential to offer a 6.9% upside, the latter comes with a potential 6.62% upside.

Prima facie, both stocks look well positioned, with Visa stock having just a slight edge over Mastercard stock. But an assessment of the Q4 earnings will be able to give more insight into the outlook for these two stocks as analysts update their reviews and ratings.

Besides the differences discussed above, investors should review each firm's revenue growth, profitability and risk factors when making investment decisions.

Now Read: 6 Netflix Analysts Size Up Earnings, Subscribers, WWE Deal – ‘WWE Raw Changes The Game’

Image: Pixabay

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.