Jim Cramer, the host of CNBC’s “Mad Money,” has urged investors to maintain their positions in Home Depot Inc. HD despite the company’s underwhelming quarterly performance.

What Happened: Cramer, on Wednesday, highlighted the importance of patience and confidence in Home Depot, despite the company’s recent lackluster quarter. The home improvement retailer reported a nearly 3% drop in quarterly sales compared to the previous year, CNBC reported.

"Sure, the quarter wasn't great, but the conference call commentary I found encouraging, which is why I'm willing to be patient and hold on to Home Depot," Cramer said. "Remember, you can't wait for the actual turn, you have to get in ahead of time or you'll miss the move."

Home Depot’s Chief Financial Officer, Richard McPhail, attributed the decline in sales to falling lumber prices and interest rate hikes. Despite these challenges, the company sees potential for future growth.

Cramer found the company’s outlook to be “appropriately conservative,” indicating that Home Depot is optimistic but not yet ready to declare a definitive turnaround. He was particularly encouraged by CEO Ted Decker‘s candid comments about the company’s inventory issues. Decker expressed confidence in the company’s inventory position for 2024 after a year of progress in inventory management.

Despite the Federal Reserve’s potential reluctance to make as many rate cuts as Wall Street had hoped, Cramer believes that rates will ultimately decrease, which would benefit companies linked to the housing market.

"Home Depot's got a nice catalyst coming in the form of the spring planting season, which is like Christmas for any retailer with a gardening business," Cramer said.

"Besides, I'm betting that management deliberately gave a conservative forecast—they like to under promise and over deliver at Home Depot."

Why It Matters: Home Depot’s Q4 performance was a mixed bag, with a 2.9% year-over-year decline in sales, but a beat on earnings per share (EPS) expectations. This performance led to a decline in the company’s stock price on Tuesday.

Despite the less-than-stellar results, analysts like Kate McShane from Goldman Sachs have maintained a Buy rating for Home Depot, citing the company’s EPS beat and a cautious yet optimistic outlook for 2024.

Home Depot’s performance is particularly noteworthy in light of its recent foray into the smart home market. The company’s expansion into technology indicates a strategic shift that could potentially impact its future performance.

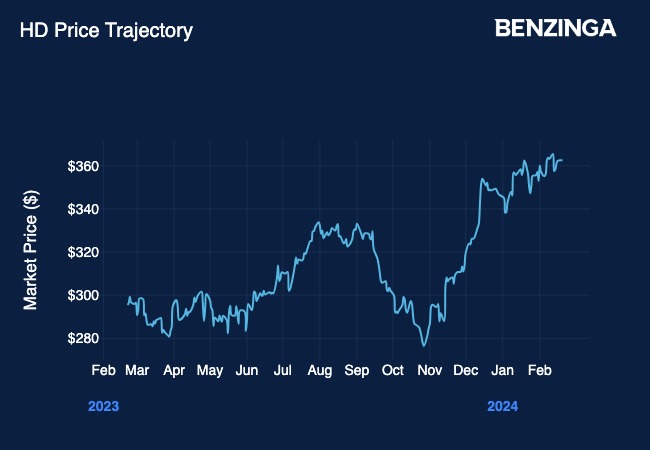

Price Action: HD shares closed 0.43% higher at $364.13 on Wednesday, according to the data from Benzinga Pro.

Image Via Shutterstock

Engineered by Benzinga Neuro, Edited by Kaustubh Bagalkote

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.