Zinger Key Points

- AMD shares rise, buoyed by Nvidia's strong Q4 results and optimistic Q1 revenue forecast.

- U.S. tightens grip on SMIC, impacting chip sector; Nvidia sees no harm from sanctions as tech investment in AI grows.

- Find out which stock just claimed the top spot in the new Benzinga Rankings. Updated daily— discover the market’s highest-rated stocks now.

Advanced Micro Devices, Inc AMD stock traded higher Thursday in sympathy with Nvidia Corp NVDA after the latter’s upbeat quarterly results and guidance.

Nvidia reported fourth-quarter revenue of $22.10 billion, up 265% year-over-year, above the Street estimate of $20.62 billion. The adjusted EPS of $5.16 beat the Street consensus estimate of $4.64.

Also Read: Analysts Eye AMD and Nvidia’s AI Rivalry: Who Leads the Tech Race?

Nvidia expects its first-quarter revenue of $24.0 billion, plus or minus 2%, above the Street consensus estimate of $22.16 billion.

Analysts consider AMD as the second most vital artificial intelligence beneficiary after Nvidia.

Meanwhile, a lot has been happening in the industry lately. The U.S. government has intensified its crackdown on China’s leading sanctioned chipmaker, Semiconductor Manufacturing International Corp (SMIC), by restricting additional American imports to its most advanced factory.

This action follows the factory’s production of a high-tech chip for Huawei’s Mate 60 Pro phone, Reuters reports.

The Commerce Department halted shipments from U.S. suppliers to SMIC’s most sophisticated plant, affecting millions of dollars in trade, particularly impacting Entegris, Inc ENTG, a supplier of chipmaking materials and parts.

Entegris, adhering to a valid export license, ceased its shipments upon receiving the Commerce Department’s notification.

The U.S. has already imposed sanctions on China’s access to cutting-edge semiconductor technology, including artificial intelligence.

The move restricted Nvidia and AMD’s access to their primary market.

Nvidia had acknowledged no harm from the U.S. sanctions as Big Tech keeps splurging on their AI ambitions.

However, the U.S. chipmakers have been pressing the government to go softer on the China policy.

Analysts remain divided over the impact of the restrictions on Nvidia.

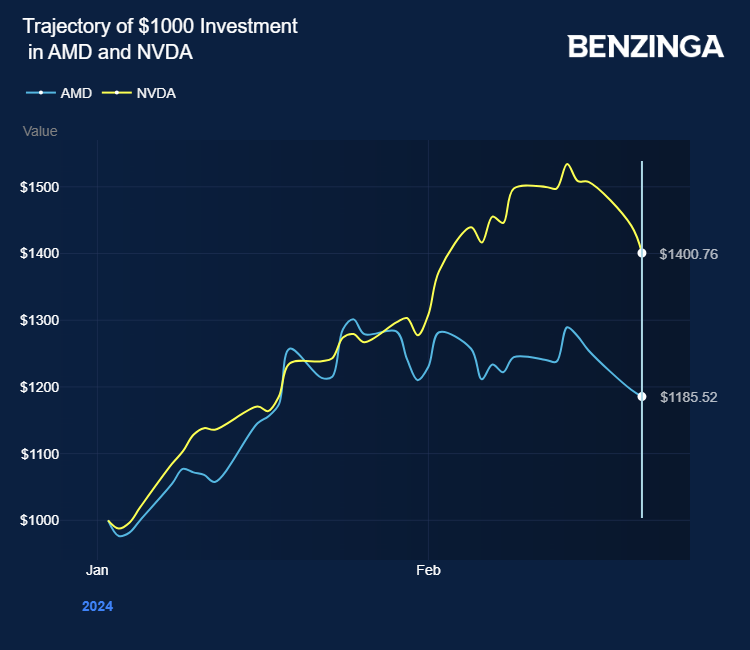

AMD stock gained 19% year-to-date versus Nvidia at 40%.

Price Actions: AMD shares traded higher by 8.76% at $178.69 on the last check Thursday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by cebbi from Pixabay

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.