Zinger Key Points

- Fisker announces 15% workforce cut amid funding concerns; stock drops 40%.

- Fisker shifts to dealership model, ending 2023 with $396M in cash but seeks further investment.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

Electric vehicle startup Fisker Inc FSR is facing significant financial challenges, announcing plans to lay off 15% of its workforce amid concerns it may not have sufficient funds to operate over the next 12 months. The stock plunged close to 47% Friday.

On Thursday, Fisker reported preliminary fourth-quarter revenue of $200.1 million and a net loss of $(1.23) per share. Fisker produced 4,789 vehicles in the fourth quarter and delivered 3,818 vehicles.

The company, which had over 1,300 employees by the end of September 2023, is shifting from direct sales to a dealership model to improve its financial outlook.

Founder and CEO Henrik Fisker revealed the company ended 2023 with $396 million in cash, but $70 million is restricted, and it is seeking additional investment from a lender and potential transactions with a giant automaker for joint development and manufacturing in North America.

This strategic pivot comes as Fisker attempts to adapt to a changing market, indicating it will not invest further in future products without the collaboration of another automaker, putting several of its planned models at risk, TechCrunch reports.

The transition to a wholesale model has negatively impacted sales, with the company sitting on a substantial inventory of vehicles.

Fisker is also addressing issues with its Ocean SUV, including software updates to resolve reported problems and ongoing investigations by the National Highway Traffic Safety Administration.

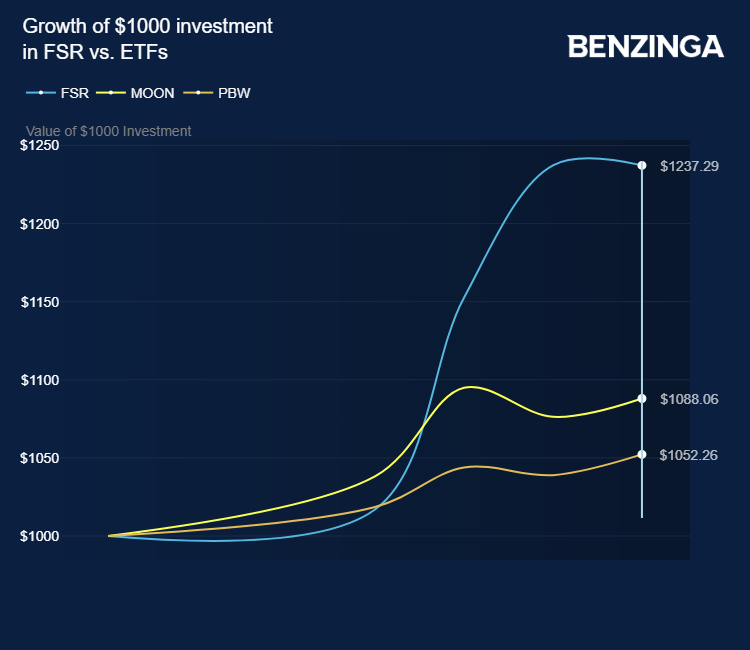

Investors can gain exposure to Fisker via Direxion Moonshot Innovators ETF MOON and Invesco WilderHill Clean Energy ETF PBW, which have gained 3-8% in the last five days.

Price Action: FSR shares traded lower by 47.50% at $0.38 on the last check Friday.

Image Via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.