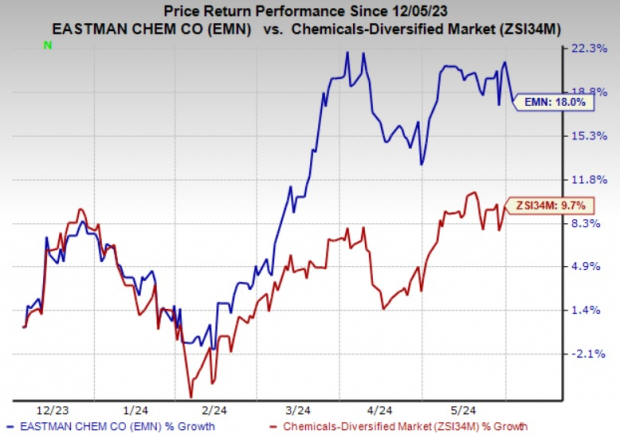

Eastman Chemical Company's EMN shares have shot up 18% over the past six months. The company has also outperformed its industry's rise of 9.7% over the same time frame. Moreover, it has topped the S&P 500's around 15% rise over the same period.

Let's take a look into the factors behind this Zacks Rank #3 (Hold) stock's price appreciation.

Image Source: Zacks Investment Research

What's Working in EMN's Favor?

Strong first-quarter 2024 results and upbeat prospects have contributed to the run-up in the company's shares. EMN's adjusted earnings of $1.61 per share trounced the Zacks Consensus Estimate of $1.41. Revenues of $2,310 million for the quarter also beat the Zacks Consensus Estimate of $2,259.2 million. The company benefited from a return to primary demand for many of its specialty products in the Advanced Materials and Additives & Functional Products segments.

Eastman is benefiting from its innovation-driven growth model and actions to manage costs. It is expected to benefit from lower operating costs from its operational transformation program.

EMN is taking actions to keep its manufacturing and administrative costs in control. It achieved cost savings of around $200 million in 2023, net of inflation. Pricing initiatives and lower raw material and energy costs are also expected to support the company's bottom line. The company plans to maintain pricing discipline and improve asset utilization throughout the year.

Moreover, Eastman's goal is to increase new business revenues by utilizing its innovation-driven growth strategy. Its sales volumes are expected to be supported by the innovation and market development initiatives.

The company is also expected to gain from the revenues and earnings generated by its Kingsport methanolysis facility in 2024, mostly in the second half of the year. The facility is expected to deliver roughly $75 million of incremental EBITDA growth in 2024.

Eastman Chemical also remains focused on maintaining a disciplined approach to capital allocation with an emphasis on debt reduction. It returned $526 million to shareholders in 2023 through dividends and share repurchases. It also raised its dividend for the 14th consecutive year. Eastman expects to generate cash flow from operating activities of roughly $1.4 billion for 2024. It expects to repurchase shares worth $200-$300 million in 2024.

Stocks to Consider

Better-ranked stocks in the basic materials space include Axalta Coating Systems Ltd. AXTA, Carpenter Technology Corporation CRS and ATI Inc. ATI.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company's shares have soared roughly 127% in the past year.

Axalta Coating Systems, carrying a Zacks Rank #1, has a projected earnings growth rate of 26.8% for the current year. In the past 60 days, the consensus estimate for AXTA's current-year earnings has been revised upward by 5.9%. The company's shares have gained roughly 15% in the past year.

ATI currently carries a Zacks Rank #2 (Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company's shares have rallied around 62% in the past year.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.