Realty Income O has announced an increase in its 2024 earnings and investment guidance. The retail REIT now projects its 2024 adjusted funds from operations (AFFO) in the range of $4.15-$4.21 per share compared with the prior guidance range of $4.13-$4.21 per share.

Realty Income also expects its 2024 investment volume to reach $3 billion, up from $2 billion guided earlier. Per management, these raises reflect the company's confidence in its business outlook as it nears the midpoint of the year.

Specifically, management noted that these increases stem from an improving investment environment, mainly in Europe. Also, management pointed out the company's stable operating performance in its high-quality, diversified global real estate portfolio.

Realty Income's accretive buyouts, backed by a healthy balance sheet, bode well for long-term growth. The solid property acquisitions volume at decent investment spreads has aided the company's performance so far. Further, it has a healthy operating platform.

Realty Income's first-quarter 2024 AFFO per share of $1.03 was in line with the Zacks Consensus Estimate. The reported figure also compared favorably with the prior-year quarter's 93 cents per share.

Results display better-than-anticipated top-line growth. The company benefited from expansionary effects and a healthy pipeline of opportunities globally.

Total revenues were $1.26 billion, which outpaced the Zacks Consensus Estimate of $1.19 billion. The top line rose 33.5% year over year.

Realty Income's portfolio comprises a significant portion of top industries selling essential goods and services. It enjoys a well-diversified tenant base and derives the majority of its annualized contractual rents from tenants with a service, non-discretionary and/or a low-price-point component to their business, assuring stable revenue generation. However, a high interest rate environment raises concerns.

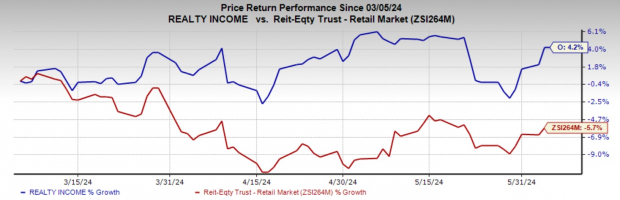

Shares of this Zacks Rank #3 (Hold) company have risen 4.2% in the past three months against the industry's decline of 5.7%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Kite Realty Group Trust KRG and Acadia Realty Trust AKR, each currently carrying a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for KRG's 2024 funds from operations (FFO) per share has been revised a cent northward over the past month to $2.05.

The consensus estimate for AKR's current-year FFO per share has been revised a cent upward over the past two months to $1.28.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.