CBRE Group, Inc. CBRE recently announced its plan to combine its Project Management business with Turner & Townsend. Subject to satisfaction of regulatory and other customary conditions, as well as completion of required consultations with employee Works Councils in certain jurisdictions, the transaction is expected to close at the end of 2024.

The integration of these two businesses is anticipated to yield net synergies, resulting in an incremental run-rate core earnings per share of approximately 15 cents by the end of 2027. This amount is expected to increase over time. The cost of incremental investment in Turner & Townsend/CBRE Project Management is approximately $70 million, excluding deal costs.

In November 2021, CBRE acquired a 60% ownership interest in Turner & Townsend. Since the acquisition, Turner & Townsend has achieved a compounded revenue growth rate of more than 20%.

Turner & Townsend offers program management, cost consultancy and project management services around the world. It operates across three distinct business segments, namely, Real Estate, Infrastructure, and Energy and Natural Resources.

Per Bob Sulentic, chair and CEO of CBRE, "Unifying our Project Management business will create an offering that is unmatched for its scale and breadth of capabilities, with more than 20,000 employees serving clients in over 60 countries. Powerful secular trends, particularly increased spending on infrastructure, green energy, and employee experience, are growth catalysts for this business, and we are well positioned to capitalize on this significant opportunity."

Following the transaction closure, CBRE will have a 70% ownership stake in the combined Turner & Townsend/CBRE Project Management business, leaving the Turner & Townsend partners with the remaining 30%.

In 2023, CBRE's Project Management business, including Turner & Townsend, generated net revenues of approximately $3 billion. Since 2021, the combined net revenue has grown at a double-digit annual rate, with a net profit margin of approximately 15%.

Starting from 2025, CBRE plans to present Project Management results in a new segment. This new segment will be separate from Global Workplace Solutions and will aim to enhance transparency for investors.

CBRE Group is well-poised to gain from its wide range of real estate products and services. The outsourcing business remains healthy and its pipeline is likely to remain elevated, offering it scope for growth. Strategic buyouts and technology investments are expected to drive its performance. However, persistent macroeconomic uncertainties and a high interest rate environment adds to the company's woes.

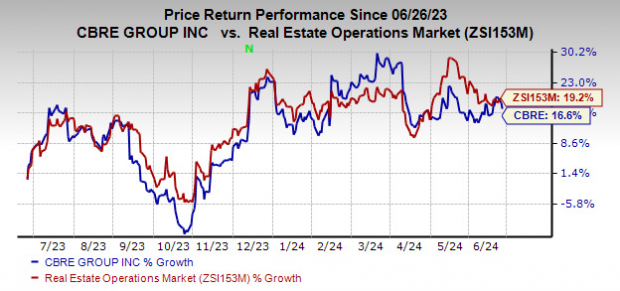

Over the past year, shares of this Zacks Rank #3 (Hold) company have gained 16.6% compared with the industry's upside of 19.2%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the real estate operations sector are Kennedy-Wilson KW and Jones Lang LaSalle JLL.

The Zacks Consensus Estimate for KW's current-year EPS has moved significantly northward in the past two months to 1 cent. Currently, it sports a Zacks Rank #1 (Strong Buy).

The Zacks Consensus Estimate for JLL's 2024 EPS has increased marginally upward over the past month to $12.22. The company currently carries a Zacks Rank #2 (Buy).

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.