Dr. Reddy's Laboratories RDY has announced a definitive agreement with Haleon plc HLN to acquire its global portfolio of consumer healthcare brands in the Nicotine Replacement Therapy category, excluding the United States.

The impending acquisition will add Nicotinell, Haleon's leading NRT brand with a presence in more than 30 countries across the EU, Asia (including Japan) and Latin America, to RDY's portfolio of global consumer healthcare over-the-counter (OTC) drugs. It also encompasses local market-leading brands, such as Nicabate in Australia, Thrive in Canada and Habitrol in New Zealand and Canada. The acquisition will cover all product formats, including lozenge, patch, gum and pipeline products, in all applicable global markets outside the United States.

The strategic move is set to further strengthen Dr. Reddy's OTC business. Please note that Haleon's Nicotinell is the world's second-largest brand in the NRT category, excluding the United States. It holds either the first or second position in 14 out of the top 17 global markets, with its lozenge/mini lozenge format being the top choice globally. Additionally, Nicotinell is among the top 15 OTC brands in Europe (excluding Russia and Italy) and ranks 32nd among all OTC brands globally (excluding the United States). In 2023, Nicotinell generated approximately GBP 217 million in revenues.

The proposed acquisition of Nicotinell and its related portfolio will provide a strong presence in the EU and other global markets, complementing and expanding Dr. Reddy's existing global footprint and capabilities.

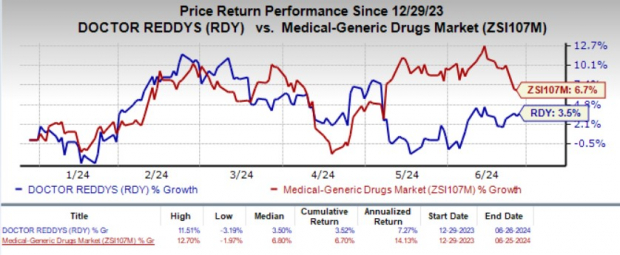

Year to date, shares of RDY have gained 3.5% compared with the industry's 6.7% growth.

Image Source: Zacks Investment Research

In consideration of the transaction, Dr. Reddy's is liable to make an upfront cash payment of GBP 458 million and performance-based contingent payments of up to GBP 42 million, payable in 2025 and 2026, to Haleon. This brings the total deal value to GBP 500 million.

Subject to the fulfillment of certain customary conditions, including regulatory approvals, the transaction is expected to close early in the fourth quarter of 2024. Consequently, Dr. Reddy's will acquire Haleon's NRT business in all countries outside of the United States. However, operations will transition to Dr. Reddy's in a phased approach to ensure successful integration of the business.

Tobacco use causes eight million deaths annually from health issues like cardiovascular diseases, lung disorders, cancers and diabetes. The World Health Organization (WHO) reports that 60% of the 1.3 billion tobacco users globally want to quit, but only 30% have access to the necessary tools. Although safe and effective medical treatments are available, they are not always accessible or sufficiently provided.

Please note that NRT is recommended by the WHO's Model List of Essential Medicines for treating nicotine use disorders. NRT also played a crucial role in the WHO's Access Initiative for Quitting Tobacco, which was launched in 2020 and aimed at helping tobacco users quit to reduce the risk of severe outcomes from COVID-19 infection.

Dr. Reddy's focuses on generics, branded generics, Active Pharmaceutical Ingredients, OTC products and biosimilars while investing in growth areas like novel molecules (NCEs, NBEs, CAR-T), digital therapeutics and consumer healthcare. In the United States, it has acquired brands like Habitrol, Doan's, Premama and the MenoLabs portfolio. In India, its portfolio includes hydration, cough-cold-allergy and skincare products, with a joint venture with Nestlé India for nutritional health solutions.

Dr. Reddy's also has a strong OTC presence in emerging markets. It recently entered into the U.K. market with Histallay. The company is enhancing its brand-building, marketing, digital and e-commerce capabilities.

Zacks Rank and Stocks to Consider

Dr. Reddy's currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the drug/biotech industry are ALX Oncology Holdings and Annovis Bio, each carrying a Zacks Rank #2 (Buy) at present.

In the past 30 days, the Zacks Consensus Estimate for ALX Oncology's 2024 loss per share has remained constant at $2.89. During the same period, the consensus estimate for 2025 loss per share has remained constant at $2.73. Year to date, shares of ALXO have plunged 60.5%.

ALX Oncology beat estimates in two of the trailing four quarters and missed twice, delivering an average negative surprise of 8.83%.

In the past 30 days, the Zacks Consensus Estimate for Annovis' 2024 loss per share has remained constant at $2.46. During the same period, the consensus estimate for 2025 loss per share has remained constant at $1.95. Year to date, shares of ANVS have plunged 69.4%.

ANVS beat estimates in three of the trailing four quarters and missed once, delivering an average negative surprise of 1.39%.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.