Chart Industries, Inc. GTLS recently secured a contract from Argent LNG to provide its mid-scale modular liquefaction solution, IPSMR (Integrated Pre-Cooled Single Mixed Refrigerant) process technology, for the latter's Port Fourchon,LA-based 20 MTPA LNG facility.

Based in Louisiana, Argent is engaged in offering LNG and LNG-related services to its customers. With a focus on innovation, efficiency and care for the environment, Argent aims to play a crucial role in the future of U.S. energy exports.

Chart Industries' IPSMR technology helps in enhancing efficiency and performance in liquefaction systems. It helps LNG facilities to optimize resource utilization and reduce operational costs. Its modular design facilitates customization, thereby improving adaptability to various site conditions and gas turbine power specifications.

The IPSMR technology will enable Ardent to offer an optimal solution to the market, thus catering to the increasing demand for LNG-related services. Also, Chart Industries is expected to book another IPSMR technology and equipment order in 2025.

Zacks Rank

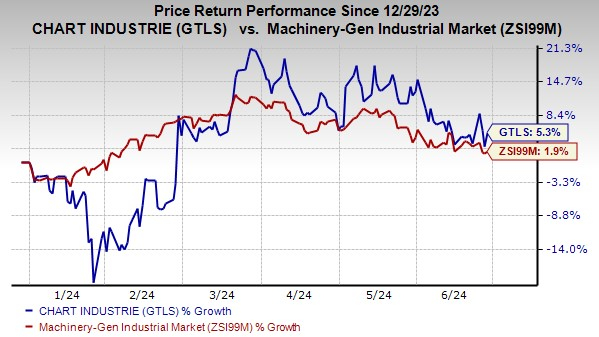

Chart Industries currently carries a Zacks Rank #3 (Hold). In the year-to-date period, GTLS stock has gained 5.3% compared with the industry's 1.9% rise.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

Applied Industrial Technologies, Inc. presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 8.2%.

The Zacks Consensus Estimate for AIT's fiscal 2024 earnings has improved 0.9% in the past 60 days. The stock has risen 11.8% in the year-to-date period.

Belden Inc. BDC presently carries a Zacks Rank of 2 and has a trailing four-quarter earnings surprise of 14.7%, on average.

The consensus estimate for BDC's 2024 earnings has increased 8.3% in the past 60 days. Shares of Belden have gained 19.2% in the year-to-date period.

Crane Company CR presently carries a Zacks Rank of 2. CR delivered a trailing four-quarter earnings surprise of 15.2%, on average.

The Zacks Consensus Estimate for CR's 2024 earnings has increased 0.8% in the past 60 days. Its shares have gained 22.5% in the year-to-date period.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.