Markel Group Inc. MKL has been gaining momentum on the back of new business volume, strong retention levels, an improving rate environment, higher interest income on cash equivalents, strategic buyouts and favorable growth estimates.

Growth Projections

The Zacks Consensus Estimate for Markel Group's 2024 revenues is pegged at $14.95 billion, implying a year-over-year improvement of 4.6%.

The consensus estimate for 2025 earnings per share and revenues indicates an increase of 21% and 5.6%, respectively, from the corresponding 2024 estimates.

Earnings have grown 46.2% in the past five years, better than the industry average of 14.4%.

Earnings Surprise History

Markel Group has a decent earnings surprise history. It beat estimates in two of the last four quarters and missed twice, the average being 33.41%.

Northbound Estimate Revision

The Zacks Consensus Estimate for 2024 and 2025 has moved 2% and 1.9% north, respectively, in the past 60 days, reflecting analyst optimism.

Zacks Rank & Price Performance

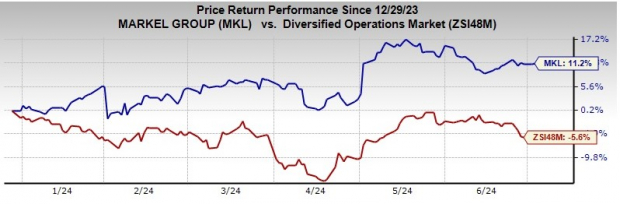

MKL currently carries a Zacks Rank #3 (Hold). The stock has gained 11.2% against the industry's decline of 5.6% year to date.

Image Source: Zacks Investment Research

Return on Equity (ROE)

Markel Group's trailing 12-month ROE was 11.2%, up 310 basis points year over year. ROE reflects its efficiency in using its shareholders' funds.

Business Tailwinds

MKL has been generating improved premiums. An improvement in new business volume, strong retention levels, continued increases in rates and expanded product offerings should help the insurer retain the momentum.

Investment income should continue to benefit from an improving rate environment, higher interest income on cash equivalents, fixed maturity securities and short-term investments due to higher yields.

Markel Group considers strategic buyouts a prudent approach to ramp up its growth profile. Acquisitions have helped the company enhance its surety capabilities, ramp up Markel Ventures' revenues and expand its reinsurance product offerings. The insurer has been pursuing acquisitions to achieve profitable growth in insurance operations and create additional value on a diversified basis in Markel Ventures' operations.

Higher revenues at construction services and transportation-related businesses due to a combination of increased demand, higher prices and growth, as well as a rise in production at one of the equipment manufacturing businesses are expected to boost operating revenues. The increase also reflected a full-year contribution from Metromont.

Banking on a strong capital position, the insurer has engaged in share buybacks. In the first quarter of 2024, MKL doubled its share buyback to $161 million, as its shares traded at a discount. The company has a share repurchase program authorized by the board to buy back up to $750 million of shares. As of Mar 31, 2024, $553.5 million remained available for repurchases under the program. In 2023, the company repurchased shares for $445 million.

However, Markel Group is exposed to catastrophe loss, inducing volatility in underwriting results. Exposure to cat loss always remains a concern, given its unprecedented nature. Also, the company has been experiencing an increase in operating expenses due to higher losses and loss adjustment expenses, underwriting, acquisition and insurance expenses. MKL should strive to ensure that growth in total revenues outpaces the rise in expenses. Otherwise, the operating margin is likely to suffer.

Stocks to Consider

Some better-ranked stocks from the Diversified Operations industry are Griffon Corporation GFF, Carlisle Companies Incorporated CSL and ITT Inc. ITT. While Griffon sports a Zacks Rank #1 (Strong Buy), Carlisle and ITT carry a Zacks Rank #2 (Buy) each at present.

Griffon delivered a four-quarter average earnings surprise of 33.45%. Year to date, GFF has rallied 6.2%.

The Zacks Consensus Estimate for GFF's 2024 and 2025 earnings implies year-over-year growth of 10.1% and 20.6%, respectively.

Carlisle delivered a four-quarter average earnings surprise of 16.97%. Year to date, CSL has gained 29.8%.

The Zacks Consensus Estimate for CSL's 2024 and 2025 earnings implies year-over-year growth of 28.4% and 8.9%, respectively.

ITT beat earnings estimates in three of the last four quarters and matched in the one, the average being 6.49%. Shares of ITT have risen 6.3% year to date.

The Zacks Consensus Estimate for ITT's 2024 and 2025 earnings implies year-over-year growth of 12.2% and 13.7%, respectively.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.