Atmos Energy Corporation's ATO continuous capital investments to increase the safety and reliability of its natural gas pipelines help enhance its performance. The company's expansion into renewable natural gas will boost its performance even further.

Currently, the company carries a Zacks Rank #2 (Buy). Let's look at the factors that are driving the stock.

Growth Projections

The Zacks Consensus Estimate for ATO's fiscal 2024 and 2025 earnings per share increased 1.82% and 0.99%, respectively, in the last 60 days.

The consensus estimate for 2024 and 2025 sales indicates year-over-year growth of 9.39% and 11.32%, respectively.

The long-term (three to five years) earnings growth of the company is pinned at 7%.

Surprise History & Dividend Details

Atmos Energy has a positive earnings surprise history. Its trailing four-quarter earnings surprise is 3.3%, on average.

The company has been rewarding its shareholders through consistent increases in annual dividend rates for 40 consecutive years. It has consistently paid shareholders a cash dividend on its common stock since 1995. The current dividend yield of the company is 2.8%, which is better than the Zacks S&P 500 Composite's yield of 1.61%.

Leverage

Atmos Energy's debt to capital at the end of second-quarter fiscal 2024 was 39.31%, which compared favorably with its industry average of 44.91%. The reduced leverage signifies that the interest costs are lower and the company is using a smaller percentage of borrowed capital than its peers to run its operation.

Liquidity

ATO's current ratio is 1.36, better than the industry average of 0.69. The current ratio, being greater than one, indicates the company has enough short-term assets to meet its short-term obligations.

Investments & Customer Additions

The company plans to invest $3.1 billion during fiscal 2024 and approximately $17 billion till fiscal 2028, majorly to increase its safety and reliability. It aims to replace miles of old transmission and distribution lines over the next five years to make its systems more reliable and reduce methane emissions by 50% by 2035 from the 2017 levels. These investments will help deliver natural gas to consumers safely, improve customers' experience, and provide environmental and operational benefits to the company.

Atmos Energy's regulated and reliable operations generate a relatively stable and growing income. The company expects strong industrial and commercial customer growth. Commercial customer growth remained solid with more than 2,000 commercial customers connecting to the system during the first half of the fiscal 2024.

Price Performance

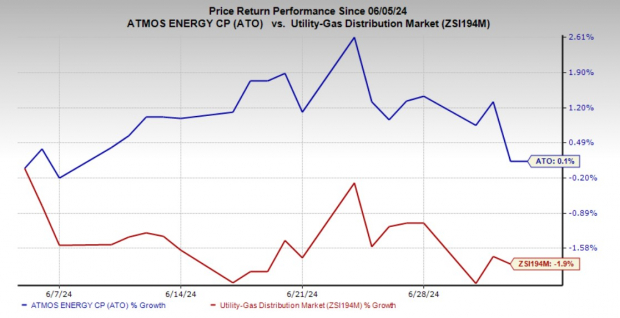

Shares of Atmos Energy have gained 0.1% in the past month against the industry's 1.9% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the industry are NewJersey Resources Corporation NJR, UGI Corporation UGI, and Fortis Inc. FTS. Each of these stocks currently carries a Zacks Rank of 2.

NewJersey Resources has delivered an average earnings surprise of 107.41% in the last four quarters. The Zacks Consensus Estimate for earnings for fiscal 2024 indicates year-over-year growth of 9.7%.

UGI has delivered an average earnings surprise of 19.13% in the last four quarters. The consensus estimate for earnings for 2024 and 2025 has gone up 0.69% and 0.32%, respectively, in the last 90 days.

Fortis has delivered an average earnings surprise of 4.17% in the last four quarters. The Zacks Consensus Estimate for earnings for 2024 and 2025 indicates year-over-year growth of 2.19% and 2.66%, respectively.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.