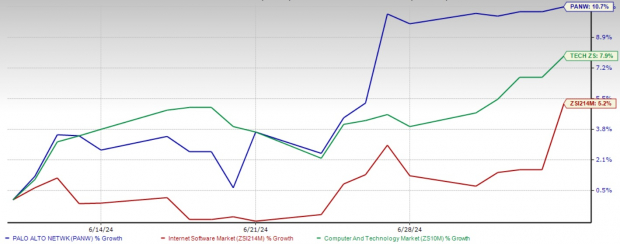

Palo Alto Networks, Inc. PANW shares have risen 10.7% over the past month, outperforming the Zacks Internet - Software industry's growth of 5.2% and the broader Zacks Computer & Technology sector's return of 7.9%.

The upswing was primarily driven by positive demand signals from other cybersecurity companies, including Zscaler Inc. and CrowdStrike Holdings, Inc. CRWD. As reported on May 30, Zscaler's third-quarter fiscal 2024 revenues increased 32% year over year, while non-GAAP earnings soared 83%. CrowdStrike reported its first-quarter fiscal 2025 results on Jun 4, wherein revenues jumped 33%, while non-GAAP earnings rose 63%.

The latest quarterly results from Zscaler and CrowdStrike suggest that the demand environment for cybersecurity players is still strong. However, Palo Alto's slowing sales and earnings growth remains a major concern.

One-Month Price Performance

Image Source: Zacks Investment Research

What's Hurting PANW's Top-Line Growth?

Over the past year, Palo Alto has reported decelerated growth in revenues, billings and adjusted earnings. It has blamed uncertain macroeconomic conditions as the main reason behind this deceleration.

However, the cybersecurity industry is highly competitive, with each player continuously innovating and vying for market share. To address these threats, Palo Alto is aiming to consolidate its customer base into a unified security platform, reducing reliance on smaller cybersecurity firms for specific services.

The strategy would have long-term benefits, including a more stable, predictable revenue stream and stronger market positioning. However, the company is offering free trials and deferred billing options to accelerate the adoption of this unified platform among customers, which is hurting Palo Alto's revenues, billings and adjusted earnings growth.

Palo Alto expects fiscal 2024 revenues between $7.99 billion and $8.01 billion, indicating approximately 16% year-over-year growth, much lower than the 25% year-over-year rise it reported in fiscal 2023.

The Zacks Consensus Estimate for fiscal 2024 earnings is currently pegged at $5.57 per share, up by a penny over the past 30 days and indicating a 25.5% year-over-year increase. In fiscal 2023, non-GAAP earnings soared 76% on a year-over-year basis.

Image Source: Zacks Investment Research

Strong Long-Term Prospects

Despite having near-term challenges, long-term prospects for Palo Alto seem to be bright. It is a market leader in cybersecurity, offering solutions that address network security, cloud security and endpoint protection. The company's next-generation firewall and advanced threat detection technologies are widely recognized and adopted by enterprises globally.

The global cybersecurity market is poised for substantial growth, with projections indicating an increase from $172.2 billion in 2023 to $424.97 billion by 2030, as per a report by Fortune Business Insights. Palo Alto Networks, with its comprehensive and innovative solutions, is well-positioned to capture a significant share of this expanding market.

An expanding portfolio is critical to Palo Alto's long-term prospects, enhancing its competitive edge in the rapidly evolving cybersecurity market. It is strategically expanding beyond its core firewall business and trying to capture market share in adjacent areas like Secure Access Service Edge.

An expanded portfolio generates multiple revenue streams, mitigating the impact of market fluctuations on any single product. This diversification ensures more stable and predictable financial performance, appealing to investors seeking long-term growth.

Additionally, Palo Alto has partnered with NVIDIA Corporation and other tech companies, including Celona, Druid, Ataya, NetScout Systems and NTT Data, to offer robust private 5G security solutions and services. Together, these companies aim to deliver a secure, high-performance private 5G environment that supports critical applications and services across various industries.

Under this partnership, NVIDIA brings advanced AI and machine learning capabilities, enhancing threat detection and response. This alliance not only strengthens Palo Alto's position in the emerging private 5G market but also boosts its ability to provide end-to-end security solutions tailored to the needs of modern enterprises.

Final Thoughts

Considering the robust demand environment, portfolio strength and a strong partner base, Palo Alto's long-term prospects seem to be bright. However, the company's strategy of consolidating its customer base into a unified security platform is likely to continue hurting revenue and earnings growth in the near term.

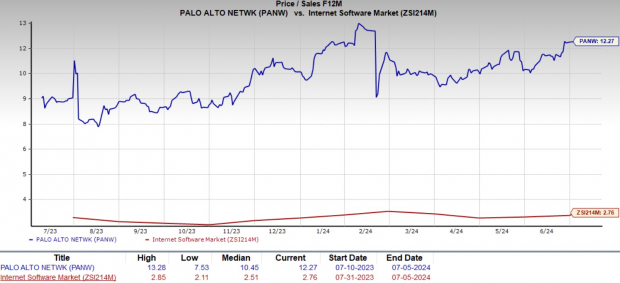

Additionally, PANW stock is trading at a significant premium compared to the Zacks Internet Software industry. Its forward 12-month P/S of 12.27X is higher than the industry's 2.76X.

Image Source: Zacks Investment Research

We believe investors should wait for a better entry point for Palo Alto, which currently carries a Zacks Rank #3 (Hold), given the modest growth prospect and a stretched valuation in the near term.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.