Keurig Dr Pepper Inc. KDP has been working well to stay ahead of the curve, thanks to its sturdy business strategies. It is gaining from the brand strength and pricing actions. The company's expansion initiatives and efforts to bring innovation to its products are tailwinds. Continued momentum in the Refreshment Beverages segment has been contributing to its results. Let's delve deeper.

Detailing Further

Keurig Dr Pepper's evolving enterprise strategy focuses on five pillars to deliver sustainable growth. These comprise a road map to guide KDP's employees' actions every day with directives to champion consumer-obsessed brand building, shape its now and next beverage portfolio, amplify the route-to-market advantage, produce fuel for growth and dynamically allocate capital. Consistent strength in the company's brand portfolio and in-market execution, along with elasticity across most categories, has been bolstering revenues. These factors are expected to benefit the company in maneuvering a challenging operating landscape.

The company has been seeing strong market share gains across categories for a while now. In first-quarter 2024, across its Canadian coffee business, market share grew for Keurig brewers and the owned and licensed pod portfolio led by the Van Houtte brand. Management is investing in the route-to-market capabilities, including the on-premise expansion in Canada, and is focused on strengthening its DSD network in Mexico. In addition, management looks forward to strengthen the company's international route to market capabilities. This will continue driving the company's overall performance ahead.

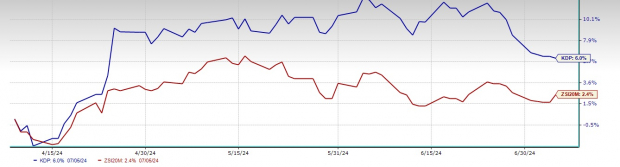

Image Source: Zacks Investment Research

The company's Refreshment Beverages unit has been gaining from higher net price realization. The segment's results were driven by higher pricing, persistent elasticities across most categories and contribution from KDP's commenced distribution partnership with Nutrabolt for C4 Energy. In first-quarter 2024, sales in the U.S. Refreshment Beverages segment rose 4.3% year over year to $2.1 billion. Continuation of this trend will continue to aid the company's top line in the near term.

Last month, the company agreed to acquire the entire production, sales and distribution assets of independent bottler Kalil Bottling Co. (Kalil). The acquisition is likely to conclude in third-quarter 2024. The terms of the agreement have been kept under cover. This acquisition will encompass bottling and distribution rights in Arizona for major KDP brands, including Canada Dry, 7UP, A&W, Snapple and Core Hydration. After the completion of the transaction, Keurig Dr Pepper will operate a production facility in Tucson and sales and distribution centers in Tucson and Tempe.

Bottlenecks to Growth

On the flip side, Keurig Dr Pepper is reeling under persistent cost pressures in transportation, warehousing and labor. These, along with the adverse impacts of higher marketing investment, have been acting as deterrents. The company is also witnessing sluggishness in the coffee segment. In first-quarter 2024, sales in the U.S. Coffee segment dropped 2.1% year over year, reflecting a net price drop of 1.8% and a marginally lower volume/mix of 0.3%. The company witnessed a 1.1% year-over-year fall in K-pod shipments. Management expects a relatively muted growth contribution from the U.S. Coffee unit in 2024.

Conclusion

Shares of this energy drinks and alternative beverages marketer have risen 6% versus the industry's 2.4% increase in the past three months.

Analysts seem quite optimistic about this current Zacks Rank #3 (Hold) stock. The Zacks Consensus Estimate for 2024 sales and earnings per share is currently pegged at $15.43 billion and $1.92, respectively. These estimates show corresponding growth of 4.1% and 7.3% year over year. The consensus mark for 2025 sales and EPS currently stands at $15.99 billion and $2.06, respectively, suggesting increases of 3.7% and 7.2% year over year.

Stocks to Consider in Consumer Staples Space

Freshpet FRPT, which is a pet food company, currently flaunts a Zacks Rank #1 (Strong Buy). FRPT has a trailing four-quarter earnings surprise of 118.2%, on average.

The Zacks Consensus Estimate for Freshpet's current financial-year sales and EPS suggests growth of 24.8% and 177.1%, respectively, from year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It sports carries a Zacks Rank of 1. VITL has a trailing four-quarter average earnings surprise of 102.1%.

The Zacks Consensus Estimate for Vital Farms' current financial-year sales and EPS suggests growth of 22.6% and 62.7%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ, which manufactures a diverse portfolio of salty snacks, currently carries a Zacks Rank of 2 (Buy). UTZ has a trailing four-quarter earnings surprise of 2%, on average.

The Zacks Consensus Estimate for Utz Brands' current financial-year EPS suggests growth of 26.3% from the year-ago reported numbers.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.