International Business Machines Corporation IBM, in collaboration with Jones Lang LaSalle Inc. JLL, recently launched a new sustainability solution, aimed at bolstering Environmental, Social, and Governance (ESG) reporting within the commercial real estate (CRE) sector. This initiative is set to address the rising demand for transparent and accurate ESG data, which has become increasingly crucial for investors and stakeholders.

Leveraging IBM's cutting-edge Envizi technology in data analytics and management, along with its deep expertise in real estate services, JLL will likely help organizations capture and manage data across real estate portfolios for swift decision-making process and public reporting.

Additionally, this collaboration will also likely give CRE organizations a thorough understanding of ESG metrics such as energy consumption, carbon footprint and waste management practices. This is expected to empower JLL's sustainability experts' efficiency, enabling them to deliver robust reporting and enhanced data management to their clients for decarbonization strategies.

As sustainability continues to play a pivotal role in global business practices, collaborations like this are poised to play a crucial role in shaping the future of ESG reporting across the real estate sector. Per a report by IBM Institute for Business Value, organizations that integrate sustainability practices are 52% more likely to outperform their peers in profitability and experience a 16% higher rate of revenue growth.

With this collaboration, IBM aims to equip JLL's customer base with IBM's AI-infused, specialized software to meet their evolving business needs. This is also likely to improve the profitability of IBM and strengthen its leadership in delivering innovative solutions across the hybrid cloud, AI and consulting services.

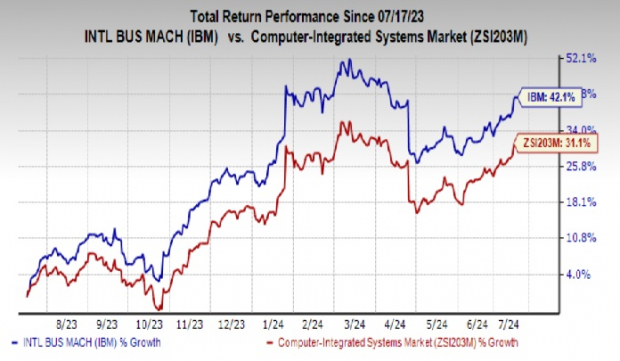

Shares of IBM have gained 42.1% over the past year compared with the industry's growth of 31.1%.

Image Source: Zacks Investment Research

Zacks Rank and Key Picks

IBM currently carries a Zacks Rank #4 (Sell).

A couple of better-ranked stocks in the industry have been discussed below.

Ooma, Inc. OOMA offers cloud-based communications solutions, smart security and other connected services. The company's smart software-as-a-service and unified-communications-as-a-service platforms serve as a hub for seamless communications and networking infrastructure applications. It currently sports a Zacks Rank of 1 (Strong Buy).

It delivered a trailing four-quarter average earnings surprise of 8.90%. In the last reported quarter, Ooma delivered an earnings surprise of 27.27%.

Telephone and Data Systems, Inc. TDS, presently sporting a Zacks Rank of 1, provides wireless products and services, cable and wireline broadband, TV and voice services to approximately 6 million customers in Chicago.

In the last reported quarter, TDS delivered an earnings surprise of 145.45%.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.