Zinger Key Points

- AT&T's Q2 revenue was $29.8 billion, down 0.4% YoY, missing estimates.

- Adjusted EPS of $0.57 met expectations; stock price rose post-report.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

AT&T Inc T reported fiscal second-quarter 2024 operating revenues of $29.8 billion, down 0.4% year over year and missing the analyst consensus estimate of $29.9 billion.

Adjusted EPS of $0.57 is in line with the analyst consensus estimate. The stock price gained after the print.

Also Read: AT&T and Snowflake Hit by Cyberattack, Millions of Customers Affected

In the Mobility segment, AT&T clocked 997 thousand wireless net adds, including 419 thousand postpaid phone net adds, beating analyst estimates of 279 thousand, Bloomberg reports.

Verizon Communications Inc VZ reported postpaid phone net additions of 148 thousand, surpassing forecasts of 118 thousand for the quarter.

AT&T has attracted budget-conscious customers with its lower-priced unlimited plans, standing out amid fierce competition, CNBC reports.

AT&T’s mobility segment saw a postpaid churn of 0.85% versus 0.95% a year ago. The Consumer Wireline segment had 239 thousand AT&T Fiber net adds, implying fiber broadband net additions lagging behind analyst estimates of 253 thousand. Verizon reported 391 thousand total broadband net additions.

The company reported 139 thousand AT&T Internet Air net adds.

AT&T’s adjusted EBITDA of $11.3 billion was up from $11.1 billion a year ago. It spent $4.4 billion on Capex.

The company generated $9.1 billion in operating cash flow (down from $9.9 billion in the year-ago quarter) and $4.6 billion in free cash flow (up from $4.2 billion last year).

Currently, AT&T’s dividend yield stands at 6.10%. Higher free cash flows allow the company to raise shareholder returns through higher stock buybacks and dividends.

Prepaid churn was 2.57% compared to 2.50% in the year-ago quarter. Postpaid phone-only ARPU was $56.42, up 1.4% compared to the year-ago quarter.

Operating Income: Operating income was $5.8 billion versus $6.4 billion a year ago.

Mobility segment operating income was up 1.6% year over year to $6.72 billion, with a margin of 32.8% compared to 32.6% in the year-ago quarter.

The Business Wireline segment operating margin was 2.1% compared to 7.5% in the year-ago quarter. The Consumer Wireline segment operating margin was 5.5% compared to 5.2% in the year-ago quarter.

FY24 Outlook: AT&T reiterated Wireless service revenue growth in the 3% range, Broadband revenue growth of 7%+, and adjusted EPS of $2.15 – $2.25 versus the $2.22 consensus.

It maintained full-year adjusted EBITDA growth in the 3% range and a full-year free cash flow of $17 billion-$18 billion.

For 2025, the company affirmed the adjusted EPS growth guidance.

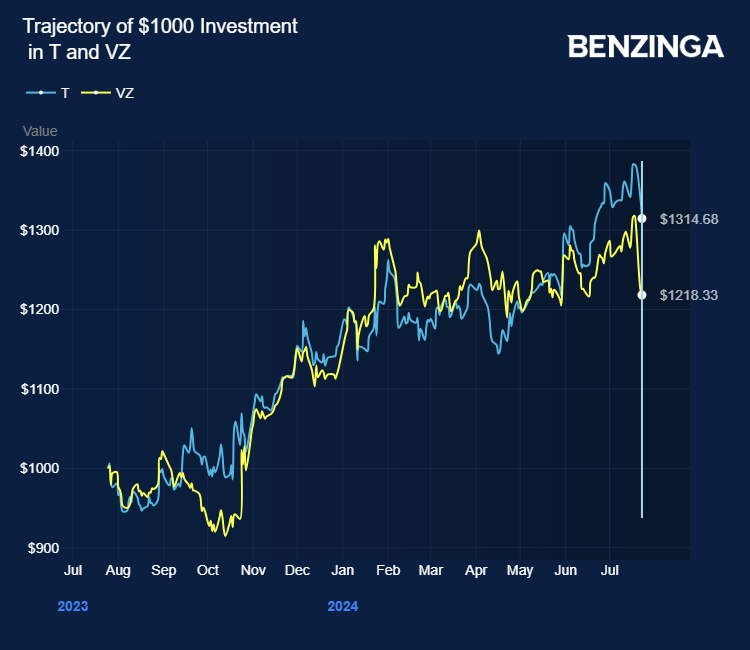

Price Action: T shares traded higher by 2.86% at $18.74 in the premarket at the last check on Wednesday.

Also Read:

Photo by 2p2play via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.