Airbnb, Inc. ABNB reported worse-than-expected second-quarter EPS results and issued third-quarter revenue guidance below estimates on Tuesday.

Airbnb's second-quarter sales of $2.748 billion exceeded the analyst consensus estimate of $2.738 billion, marking a 10.63% increase from the same period last year. However, the company's quarterly GAAP earnings of 86 cents per share fell short of the analyst consensus estimate of 92 cents, missing the mark by 6.52%.

"Q2 marked another strong quarter for Airbnb. Revenue increased 11% year-over-year to $2.75 billion. Net income was $555 million, representing a net income margin of 20%. Adjusted EBITDA of $894 million increased 9% year-over-year and represented an Adjusted EBITDA Margin of 33%. We generated $1 billion of FCF during Q2 and $4.3 billion of FCF over the trailing 12 months — our highest ever," the company wrote in a letter to shareholders.

Airbnb shares gained 4.1% to close at $130.47 on Tuesday.

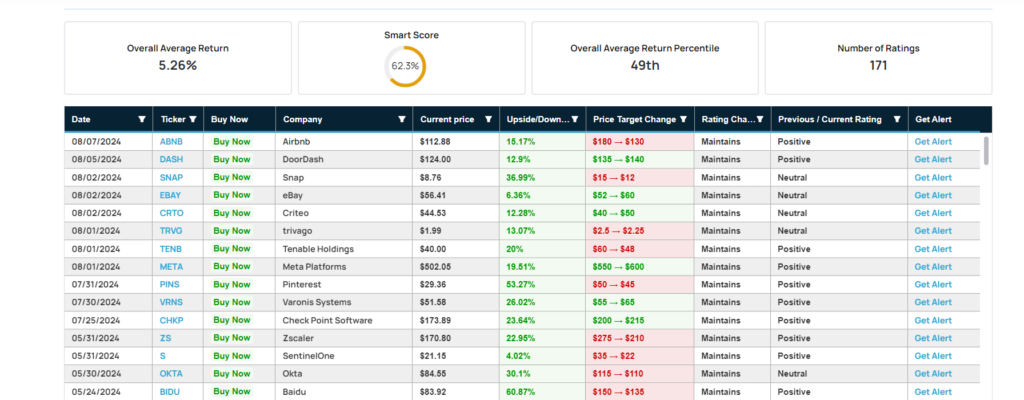

These analysts made changes to their price targets on Airbnb following earnings announcement.

- Piper Sandler analyst Thomas Champion maintained Airbnb with a Neutral and lowered the price target from $155 to $125.

- Susquehanna analyst Shyam Patil maintained Airbnb with a Positive and cut the price target from $180 to $130.

Considering buying ABNB stock? Here’s what analysts think:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.