Hyatt Hotels Corporation H reported mixed results for its second quarter on Tuesday.

The company posted second-quarter 2024 sales of $1.703 billion, missing the consensus estimate of $1.705 billion. Net room growth was approximately 4.6% year-over-year.Comparable system-wide hotels' RevPAR increased by 4.7%, and comparable system-wide all-inclusive resorts' Net Package RevPAR increased by 3% YoY.

Adjusted EPS of $1.53 beats the analyst consensus of $1.17.

"System-wide RevPAR grew by 4.7% and net rooms growth was 4.6%, generating record gross fee revenue of $275 million in the quarter. Our pipeline reached a new record of 130,000 rooms, up 9% year-over-year, reflecting strong developer interest in our brands. We saw continued growth of the World of Hyatt loyalty program, with membership increasing by 21% year-over-year to a record 48 million members," commented Mark S. Hoplamazian, President and Chief Executive Officer of Hyatt.

The company expects to grow net rooms by 5.5% – 6%. It expects comparable system-wide hotels RevPAR to increase 3% to 4% on a constant currency basis. The company's full-year Adjusted EBITDA is projected between $1.135 billion and $1.175 billion; it expects net income of $1.055 billion -$1.115 billion and Free cash flow of $560 million-$610 million.

Hyatt shares fell 1.4% to close at $132.02 on Tuesday.

These analysts made changes to their price targets on Hyatt following earnings announcement.

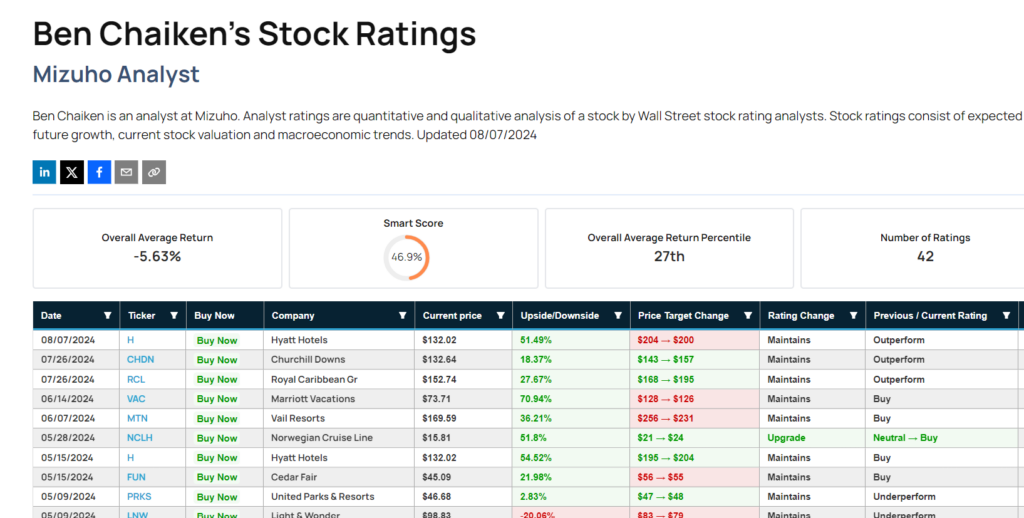

Mizuho analyst Ben Chaiken maintained Hyatt Hotels with an Outperform and lowered the price target from $204 to $200.

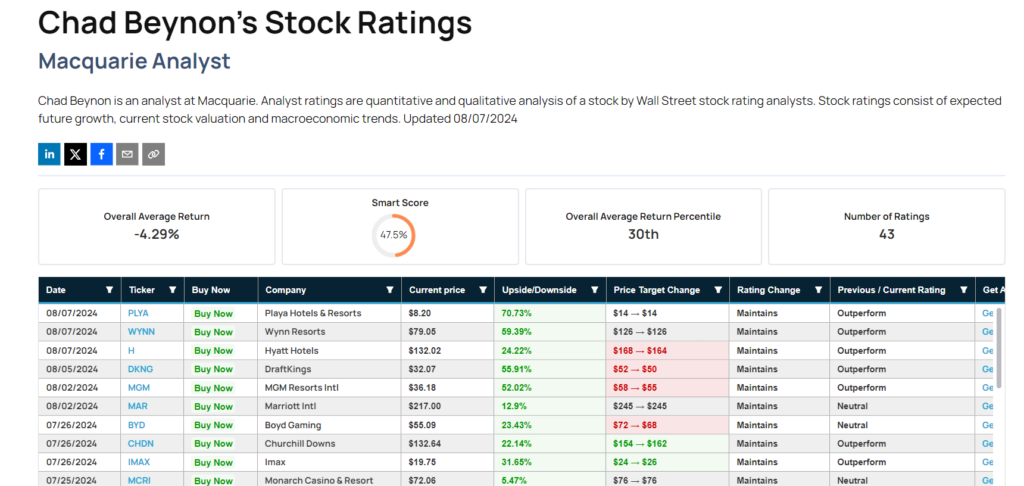

Macquarie analyst Chad Beynon maintained Hyatt with an Outperform and cut the price target from $168 to $164.

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.