Bloomin’ Brands, Inc. BLMN reported downbeat results for the second quarter on Tuesday.

The company reported second-quarter adjusted EPS of 51 cents, missing the analyst consensus of 58 cents. Quarterly sales of $1.12 billion marginally missed the street view of $1.13 billion, decreasing 2.9% Y/Y.

David Deno, CEO said, "While our comparable sales growth outpaced the industry in Q2, we did not meet our expectations. We are very focused on developing a path to sustainable growth at Outback and are making progress in improving the guest experience, providing meaningful value, and enhancing customer and digital capabilities."

Bloomin’ Brands lowered the FY24 adjusted EPS outlook to $2.10-$2.30 (from $2.51-$2.66) vs. the estimate of $2.41 and projects U.S. Comparable Restaurant sales declining 1% to flat (prior view: flat to +2%). The company expects third-quarter U.S. comparable restaurant sales to be down 2% to flat, with adjusted EPS of $0.17-$0.25 (from $0.55-$0.60 prior) versus the estimate of $0.39.

Bloomin’ Brands shares rose 1.4% to trade at $17.21 on Wednesday.

These analysts made changes to their price targets on Bloomin’ Brands following earnings announcement.

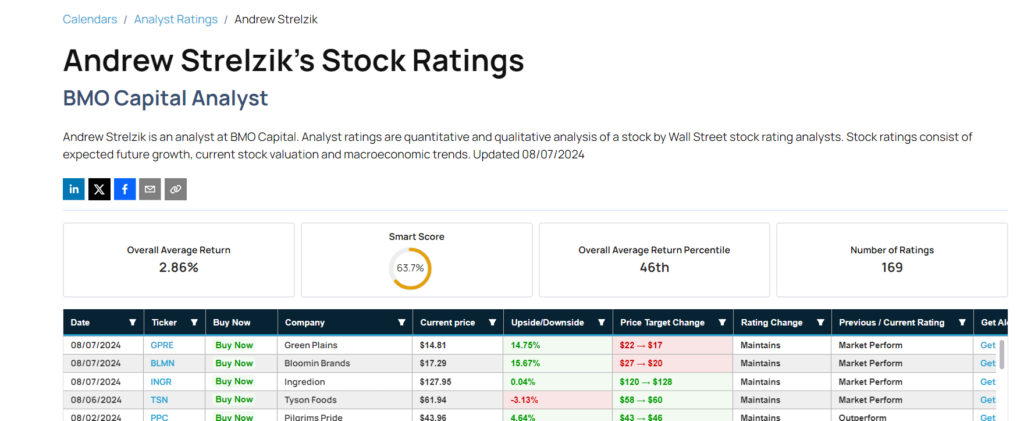

BMO Capital analyst Andrew Strelzik maintained Bloomin Brands with a Market Perform and lowered the price target from $27 to $20.

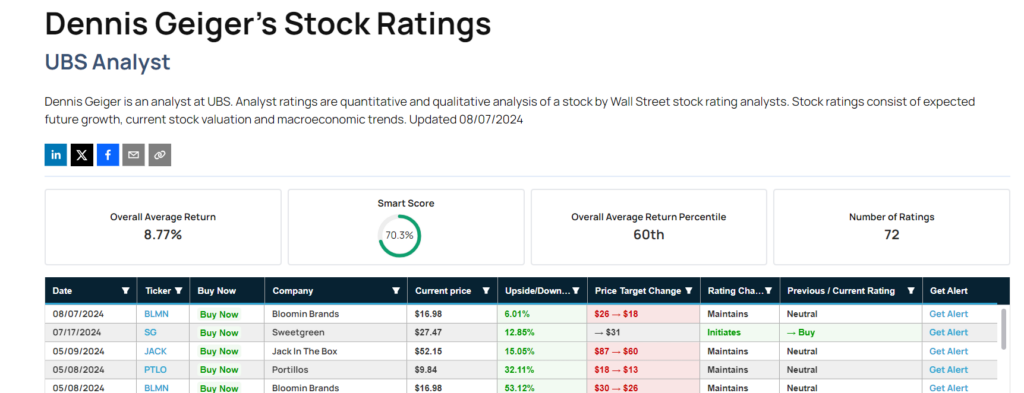

UBS analyst Dennis Geiger maintained Bloomin Brands with a Neutral and cut the price target from $26 to $18.

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.