Bumble Inc. BMBL reported worse-than-expected second-quarter revenue results on Wednesday.

Bumble reported quarterly earnings of 22 cents per share on $273.12 million of quarterly revenue which came in just under analyst estimates.

"Our first chapter of the Bumble App launch delivered better women's experiences and improved engagement," said Lidiane Jones, CEO of Bumble. "We are pleased with these early wins but it's evident that to reignite the user growth engine for Bumble Inc. in the long term, we need to take a firm stance towards delivering customer value that goes beyond this launch. We are confident that the steps we are taking to strengthen our ecosystem, customer experience, and revenue strategy will revitalize our growth by making Bumble the best place for people to find successful and healthy connections in their lives," Jones added.

Bumble projects third-quarter revenue in a range of $269 million to $275 million, versus the $273 million estimate, with Bumble App Revenue of between $217 million and $221 million. Bumble sees adjusted EBITDA of between $77 million and $80 million and full-year revenue growth of 1% to 2%.

Bumble shares rose 1.9% to close at $8.06 on Wednesday.

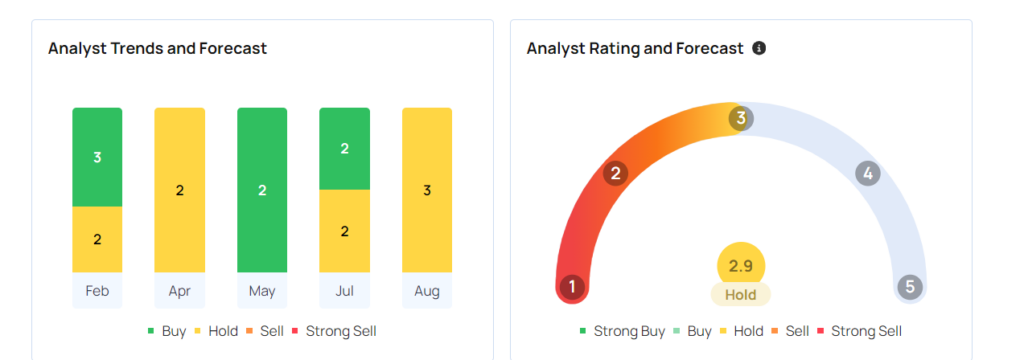

These analysts made changes to their price targets on Bumble following earnings announcement.

- Stifel analyst John Egbert downgraded the rating for Bumble from Buy to Hold and lowered the price target from $13 to $6.5.

- Evercore ISI Group analyst Shweta Khajuria downgraded the rating for Bumble from Outperform to In-Line and cut the price target from $18 to $8.

- JP Morgan analyst Cory Carpenter downgraded the stock from Overweight to Neutral and lowered the price target from $17 to $7.

- Morgan Stanley analyst Nathan Feather maintained the stock with an Equal-Weight and lowered the price target from $12 to $6.

- Piper Sandler analyst Matt Farrell maintained Bumble with a Neutral and lowered the price target from $13 to $7.

Read More:

Considering buying BMBL stock? Here’s what analysts think:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.