HubSpot, Inc. HUBS posted better-than-expected second-quarter earnings on Wednesday.

HubSpot reported quarterly earnings of $2.03 per share, which beat the analyst consensus estimate of $1.63 by 24.54%. Quarterly sales clocked in at $637.2 million, which beat the analyst consensus estimate by 2.87% and represents a 20.42% increase from the same period last year.

"Q2 was another solid quarter of revenue growth and profitability driven by our rapid pace of innovation and consistent execution," said Yamini Rangan, CEO of HubSpot. "I am thrilled to see customers consolidating on HubSpot and the momentum we have in becoming the customer platform of choice for scaling companies."

HubSpot sees third-quarter revenue in a range of $646 million to $647 million, versus the $646.69 million estimate, and earnings of between $1.89 and $1.91 per share, versus the $1.89 estimate. The company sees full-year revenue in a range of $2.567 billion to $2.573 billion, versus the $2.56 billion estimate, and earnings of between $7.64 and $7.70 per share, versus the $7.36 estimate.

HubSpot shares rose 2.4% to close at $460.74 on Wednesday.

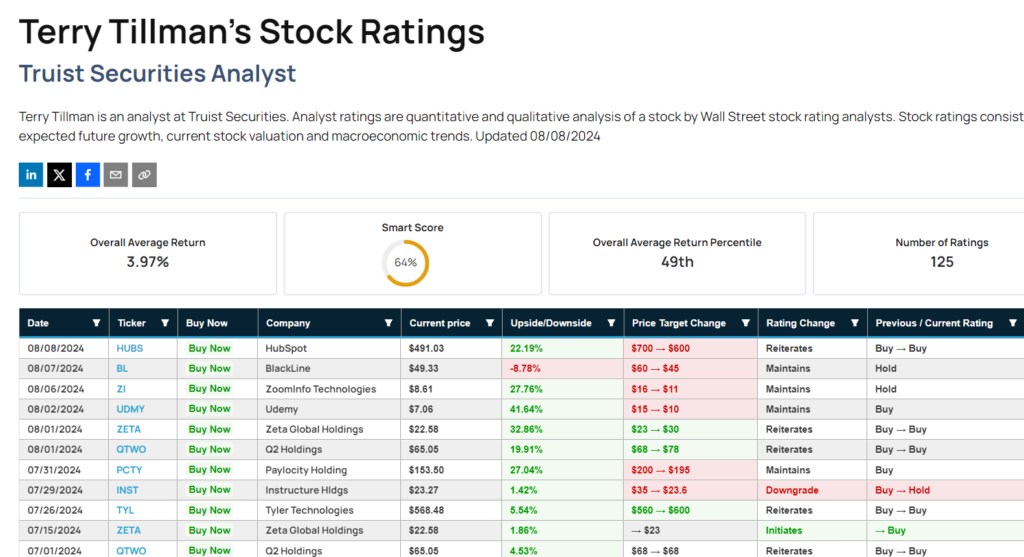

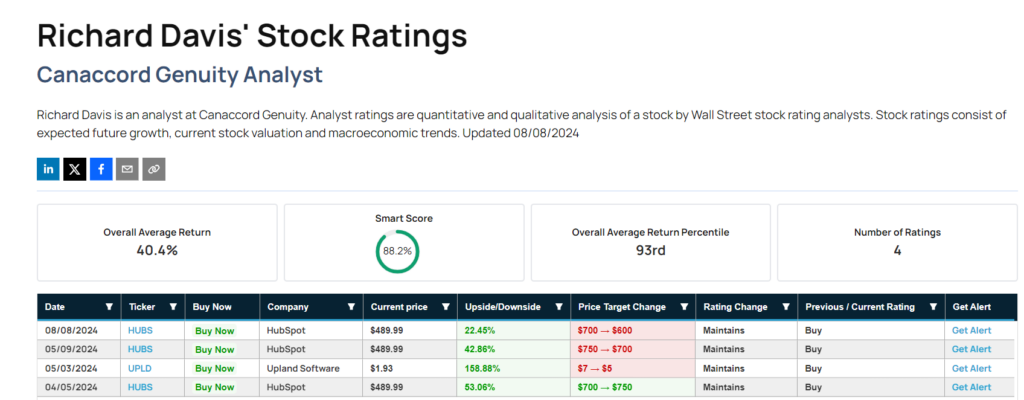

These analysts made changes to their price targets on HubSpot following earnings announcement.

Truist Securities analyst Terry Tillman reiterated HubSpot with a Buy rating and cut the price target from $700 to $600.

Canaccord Genuity analyst Richard Davis maintained HubSpot with a Buy rating and lowered the price target from $700 to $600.

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.