JFrog Ltd. FROG reported worse-than-expected second-quarter revenue results and issued FY24 guidance below estimates on Wednesday.

JFrog reported quarterly earnings of 15 cents per share which beat the analyst consensus estimate of 14 cents per share. The company reported quarterly sales of $103.04 million which missed the analyst consensus estimate of $103.58 million.

“We are on a mission to revolutionize the software industry with a unified platform that encompasses EveryOps and streamlines the software supply chain flow,” said Shlomi Ben Haim, Co-founder and CEO of JFrog. “With the innovative power of our Qwak AI acquisition, JFrog proudly stands as the first to support DevOps, Security, and MLOps in a single platform. We are committed to providing a solution that fosters seamless collaboration among machines, developers, and data scientists,” Ben Haim added.

The company said it sees FY24 earnings of 54 cents to 56 cents per share, versus market estimates of 60 cents per share. The company sees revenue of $422 million to $424 million, versus expectations of $428.27 million.

JFrog shares fell 0.3% to close at $34.05 on Wednesday.

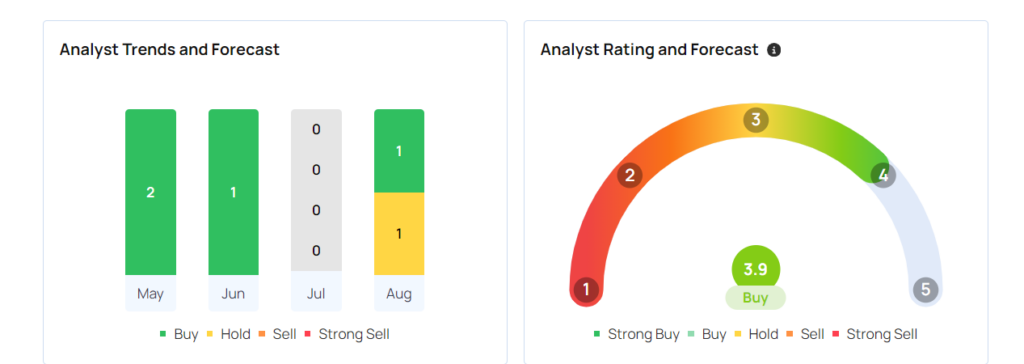

These analysts made changes to their price targets on JFrog following earnings announcement.

- Morgan Stanley analyst Sanjit Singh maintained JFrog with an Overweight and lowered the price target from $47 to $33.

- Piper Sandler analyst Rob Owens maintained the stock with a Neutral and cut the price target from $40 to $32.

- Canaccord Genuity analyst Kingsley Crane maintained JFrog with a Buy and lowered the price target from $48 to $38.

- Oppenheimer analyst Ittai Kidron downgraded JFrog from Outperform to Perform.

- Truist Securities analyst Miller Jump maintained with a Buy and cut the price target from $50 to $30.

Considering buying FROG stock? Here’s what analysts think:

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.