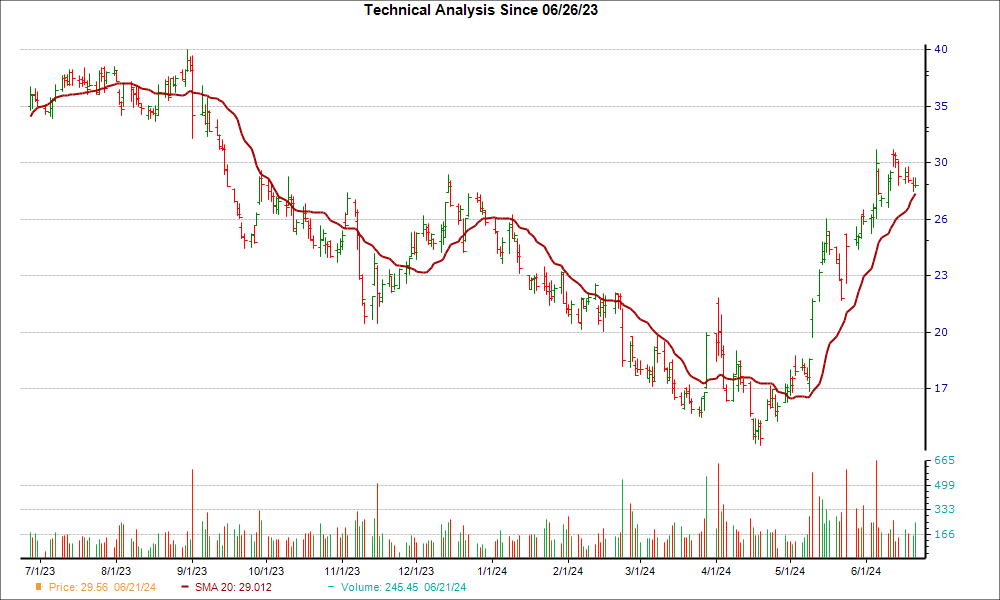

After reaching an important support level, Guardant Health GH could be a good stock pick from a technical perspective. GH surpassed resistance at the 20-day moving average, suggesting a short-term bullish trend.

The 20-day simple moving average is a popular trading tool. It provides a look back at a stock's price over a 20-day period, and is beneficial to short-term traders since it smooths out price fluctuations and provides more trend reversal signals than longer-term moving averages.

The 20-day moving average can show signals that are similar to other SMAs as well. If a stock's price is moving above the 20-day, the trend is considered positive. When the price falls below the moving average, it can signal a downward trend.

Over the past four weeks, GH has gained 23%. The company is currently ranked a Zacks Rank #3 (Hold), another strong indication the stock could move even higher.

The bullish case only gets stronger once investors take into account GH's positive earnings estimate revisions. There have been 1 revisions higher for the current fiscal year compared to none lower, and the consensus estimate has moved up as well.

Given this move in earnings estimate revisions and the positive technical factor, investors may want to keep their eye on GH for more gains in the near future.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.