The Home Depot, Inc. HD reported mixed results for its second quarter on Tuesday.

HD reported second-quarter 2024 sales growth of 0.6% year-over-year to $43.175 billion, marginally missing the consensus estimate of $43.376 billion. Adjusted EPS was $4.67 (-0.2% year over year), beating the consensus of $4.50.

"The underlying long-term fundamentals supporting home improvement demand are strong. During the quarter, higher interest rates and greater macro-economic uncertainty pressured consumer demand more broadly, resulting in weaker spend across home improvement projects," commented Ted Decker, chair, president, and CEO.

Home Depot raised its sales guidance from $154.20 billion to $156.49 billion – $158.01 billion versus the consensus of $158.88 billion. It expects Comparable sales to decline between 3% and 4% (prior ~1%). HD expects Adjusted EPS of $14.66-$14.96 versus the consensus of $15.14.

Home Depot shares gained 1.2% to close at $350.07 on Tuesday.

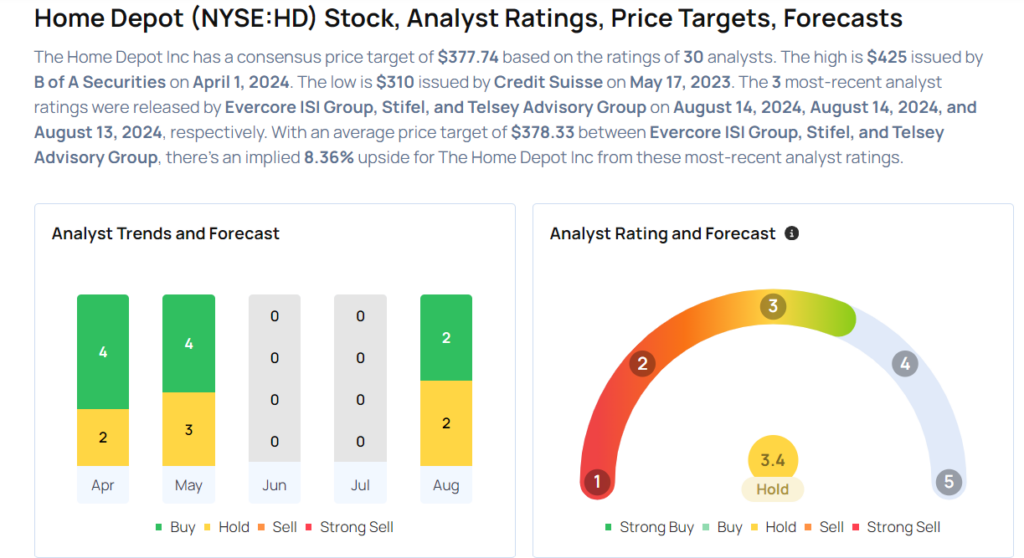

These analysts made changes to their price targets on Home Depot following earnings announcement.

- Stifel analyst W. Andrew Carter maintained Home Depot with a Hold and lowered the price target from $380 to $375.

- Evercore ISI Group analyst Greg Melich maintained Home Depot with an Outperform rating, while cutting the price target from $415 to $400.

Read More:

Considering buying HD stock? Here’s what analysts think:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.