Deere & Co DE reported better-than-expected third-quarter results and reaffirmed its net income 2024 outlook on Thursday.

The company's net sales and revenue declined 17% year-over-year to $13.152 billion, beating the consensus of $10.944 billion. Deere clocked an EPS of $6.29, down from $10.20 YoY, beating the consensus of $5.85.

During the quarter, the company initiated involuntary employee-separation programs across several regions, aiming to streamline operations. The programs incurred $124 million in pretax expenses, with an estimated total of $150 million.

Deere reaffirmed its 2024 net income outlook of $7.00 billion. Deere expects 2024 Production & Precision Ag net sales to decline by ~20% -25% and price realization of +2%; Small Ag & Turf net sales to fall by 20%- 25% and price realization of +2%; and Construction & Forestry net sales to decrease by 10%- 15% and price realization of +0.5%. The company expects Financial services net income of $720 million for the fiscal.

Deere shares gained 6.3% to close at $373.26 on Thursday.

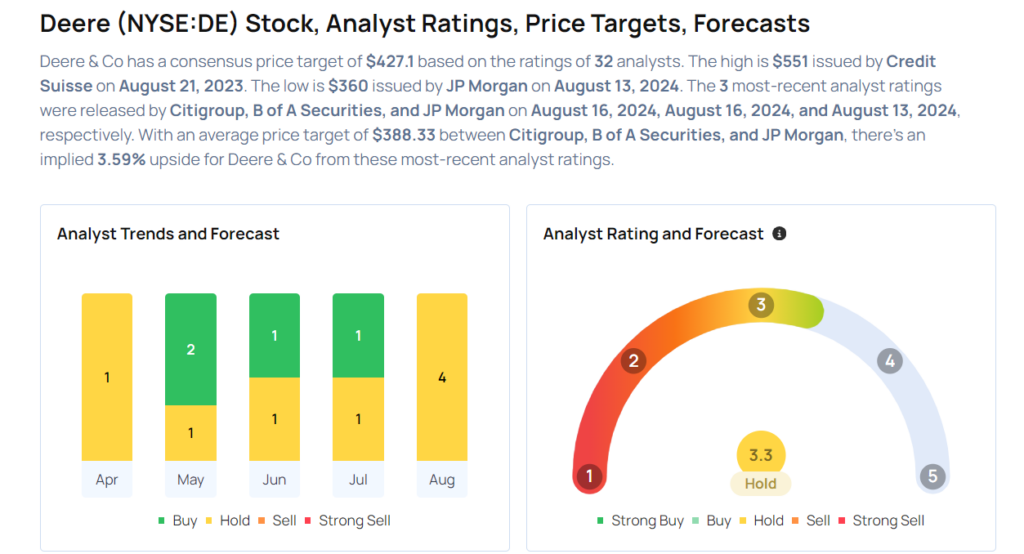

These analysts made changes to their price targets on Deere following earnings announcement.

- B of A Securities analyst Ross Gilardi maintained Deere with a Neutral and raised the price target from $400 to $410.

- Citigroup analyst Kyle Menges maintained Deere with a Neutral and raised the price target from $370 to $395.

Considering buying DE stock? Here’s what analysts think:

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.