NIO Inc. NIO, the Chinese electric vehicle maker, hosted its highly anticipated Power Up 2024 event in Wuhan yesterday. The event showcased the company's ambitious plans to expand its charging and battery swap infrastructure across China.

Despite the positive news from the Power Up event, NIO's stock suffered (declining more than 5% yesterday) due to broader market challenges in China. The central bank's decision to keep interest rates unchanged despite the need for additional stimulus has cast a shadow over Chinese stocks, including NIO, as investors worry about the lack of economic support in the face of slowing growth.

Adding to the pessimism, Chinese exchanges have discontinued the daily release of real-time data on foreign fund flows, diminishing overseas demand for Chinese equities. The absence of this key data has left investors without a crucial tool to gauge sentiment in the world's second-largest economy, exacerbating concerns about the near-term outlook for Chinese stocks.

These broader developments are making it difficult for NIO to capitalize on its infrastructure expansion plans. With shares of the company trading near their 52-week low, potential investors are left wondering if NIO is a bargain or a value trap. Before discussing how you should play the stock now, let's take a look at the key highlights from the NIO Power Up Event.

Key Takeaways From Power Up 2024

At the Power Up 2024 event, NIO revealed its extensive "Power Up Counties" initiative, aiming to install battery swap stations in more than 2,300 counties across 27 provincial-level regions in China by the end of 2025. The company plans to cover all 1,200 counties in 14 provincial administrative regions by June 2025 and expand further to reach more than 2,800 county-level regions by 2026. NIO's current infrastructure includes 2,480 battery swap stations, 2,322 supercharging stations with 10,577 charging piles and 1,627 destination charging stations with 12,432 charging piles.

Moreover, NIO announced the construction of a new battery swap station manufacturing facility in Wuhan, targeting an annual capacity of more than 1,000 stations. The company also introduced its "Power Up Partner Plan," inviting partners to collaborate on building and sharing the profits of charging and swapping stations. In a bid to enhance its technological prowess, NIO unveiled a portable car-to-car charger with a conversion efficiency of 95% and a maximum output voltage of 1,000V.

Why We Are Still Bearish on the Stock

While these initiatives underscore NIO's commitment to establishing a robust EV infrastructure, the company faces significant challenges that raise concerns.

NIO's first-quarter 2024 results revealed a 3.2% year-over-year decline in deliveries, with revenues falling 12.2%. This performance is in sharp contrast to the broader Chinese EV market, which grew by 14.7% year over year in the same period. This indicates a loss of market share to competitors like BYD Co Ltd BYDDY, Li Auto LI and XPeng XPEV. While second-quarter deliveries saw a 144% year-over-year surge, the company continues to struggle with profitability, raising doubts about its ability to sustain its business in the face of rising losses.

The highly competitive Chinese EV market has forced companies like NIO to cut prices and offer substantial incentives to drive sales, leading to eroded profit margins. NIO reported a wider-than-expected loss for first-quarter 2024, marking the eleventh consecutive quarter of earnings miss. Its cash/cash equivalents declined from $4.6 billion at the end of 2023 to $3.3 billion at the end of March 2024. This cash burn and profitability issues raise the likelihood that NIO will need to raise new funds, leading to increased leverage and shareholder dilution.

Price Performance & Valuation

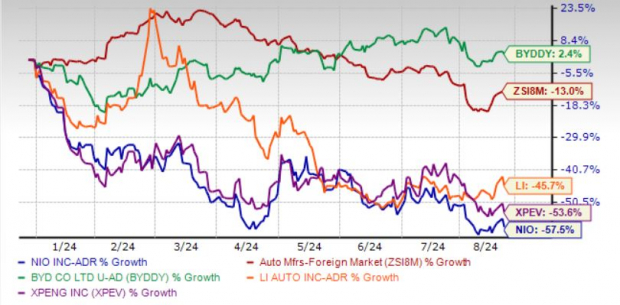

Year to date, NIO's shares have plummeted 57.5%, significantly underperforming the broader industry and its key competitors BYDDY, LI and XPEV.

YTD Price Performance Comparision

Image Source: Zacks Investment Research

The company's price-to-sales (P/S) ratio, currently at 0.51, is well below its historical highs and industry averages. Although this might make the stock appear undervalued, the discount seems justified, given the numerous red flags. The company's Value Score of D underscores the risks associated with investing in NIO at this juncture.

Image Source: Zacks Investment Research

Technical Indicators & Deteriorating Estimate Revisions

From a technical perspective, NIO's stock is in a bearish trend, trading below both the 50-day and 200-day moving averages.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for 2024 and 2025 loss per share has widened by 1 cent each over the past 30 days to $1.42 and $1.01, respectively, reflecting deteriorating market sentiment.

Conclusion: A Risky Bet

NIO's ambitious plans unveiled at the Power Up 2024 event highlight the company's commitment to expanding its EV infrastructure and securing a leading position in the Chinese market. However, with the stock under pressure from declining profit margins, eroding market share and a weakening balance sheet, NIO's prospects appear bleak. The company's reliance on raising new funds to sustain its operations could lead to further dilution of shareholder value, adding to the risks for current and potential investors.

Additionally, the broader economic challenges in China and bearish technical indicators for NIO suggest that the stock isn't a wise investment at this time. So, until NIO can demonstrate sustained profitability and its fundamentals improve, investors may be better off avoiding this stock despite its apparent undervaluation.

NIO currently carries a Zacks Rank #4 (Sell).

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.