Cardinal Health Inc. CAH is a global pharmaceutical and medical products distributor serving over 100,000 hospitals. It's also the largest distributor of medical supplies and surgical products in the United States. Cardinal Health provides medical supplies and specialty therapeutics to 90% of the hospitals in the United States, as well as 60,000 pharmacies and over 10,000 specialty physician offices.

The rising trend in acute care utilization from emergency rooms, ambulatory and surgical care centers, and inpatient hospital visits has helped drive record results for the company. The stock is also a dividend aristocrat, having raised its dividend for nearly 40 consecutive years.

Cardinal Health operates in the medical sector with major healthcare services companies like McKesson Co. MCK, Stryker Co. SYK, and Cencora Inc. COR.

Cardinal Health's Massive Portfolio and Reach

The company's professional products range from durable medical equipment to anesthesia supplies, personal protective equipment (PPE), lab supplies, and surgical equipment. It carries over 46,000 home healthcare products to over 3.4 million patients. Its digital ecosystem supports medication adherence to over 23 million patients and over 60 payers. The company offers numerous tailored services, including data and analytics, to improve cost efficiencies, workflows, and waste reduction for ambulatory surgery centers, hospitals, pharmacies, and labs. They even provide customer packaging solutions to pharmaceuticals through its 60,000-square-foot facility with automated and semi-automated equipment accommodating small and large-volume batches and projects in compliance with all FDA standards.

Cardinal Health: Expanding Its Specialty Business

Cardinal continues to expand its specialty business, which focuses on distributing and servicing specialty pharmaceuticals, pharmacies, and physician practices. It offers technology platforms that help manage inventory, track patient outcomes, manage reimbursement cycles, and improve efficiency for pharmacies and practices. Specialty therapeutics include a wide array of high-cost, complex medications that often require special storage, handling, and patient support programs. In January 2024, the company agreed to acquire Specialty Networks for $1.2 billion in cash to accelerate growth in its Specialty business.

CAH Stocks Forms a Cup and Handle Breakout Pattern

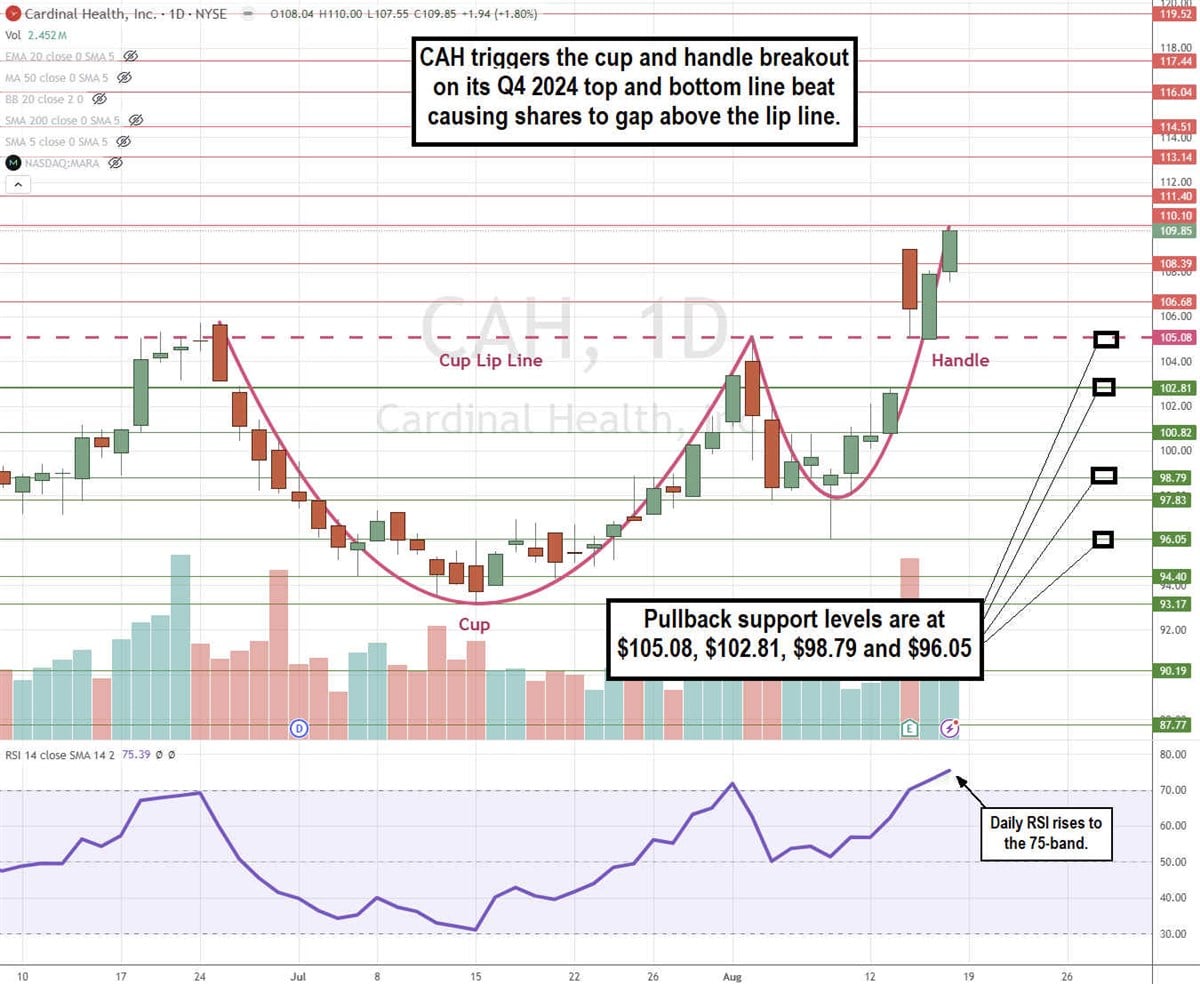

The daily candlestick chart for CAH illustrates a cup and handle breakout pattern. The cup lip line at $105.08 was tested on Aug. 8, 2024. The pullback formed the handle staging the rally into its earnings release. CAH gapped to the cup lip line and proceeded to break out higher after testing the support for two days. The daily relative strength index (RSI) has bounced to the 75-band. Pullback support levels are at $105.08, $102.81, $98.79, and $96.05.

Cardinal Health Beats Top and Bottom Line Estimates

The fiscal fourth-quarter 2024 earnings report indicated strong top- and bottom-line acceleration. Cardinal Health reported EPS of $1.84, which beat the consensus analyst estimates for $1.74 by 10 cents. Its non-GAAP operating earnings rose 14% to $605 million. Segment profit increases in the Global Medical Products and Distribution and Pharmaceuticals and Specialty Solutions segments primarily drove the growth. Revenues grew 12.1% YoY to $59.87 billion, which also beat the consensus analyst estimate of $58.74 billion.

Fiscal 2024 operating cash flow and adjusted free cash flow reached all-time highs of $3.8 billion and $3.9 billion, respectively. Fiscal full-year 2024 revenues rose 11% YoY to $226.8 billion. Full-year non-GAAP diluted EPS rose 29% to $7.53.

Cardinal Health Raises Its Guidance

The company issued upside fiscal full-year 2025 non-GAAP EPS of $7.55 to $7.70 versus $7.53 consensus estimates, raising it from previous guidance of $7.50. Full-year revenue is expected to grow 10% to 12% YoY. Its Pharmaceutical and Specialty Solutions segment is expected to see revenues decline 4% to 6% YoY. Its Global Medical Products and Distribution (GMPD) segment is expected to see 3% to 5% revenue growth. Other revenue is expected to grow 10% to 12% YoY.

Cardinal Health CEO Jason Hollar commented, "We delivered robust cash flow generation, continued profit growth in the Pharmaceutical and Specialty Solutions segment and significant improvement driven by our GMPD Improvement Plan. We enter the new fiscal year with momentum and confidence, evidenced by our raised fiscal year 2025 guidance."

CAH analyst ratings and price targets are at MarketBeat. There are 12 analyst ratings on CAH stock, comprised of seven Buys, two Holds, and one Sell. Consensus analyst price targets point to a 7% upside at $117.45.

The article "Cardinal Health Soars as America's Leading Acute Care Supplier" first appeared on MarketBeat.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.